noharleyyet

Well-known member

The situation is obvious...the stock market must be impeached.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I agree with the sentiment though don't agree with the Robinhood thought.I think it is a Robinhood rally.

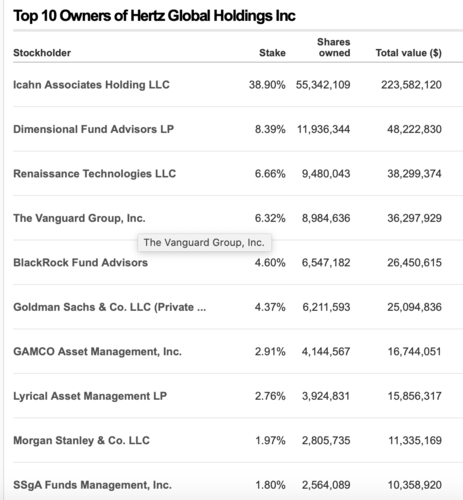

Let's use HTZ. HTZ top 10 owners account for about 80% of total shares outstanding. Icahn can't sell anything, Vanguard is index, Blackrock is index, SSGA is index, DFA is enhanced index, Ren Tech is a HF so it is impossible to know what is on the other side of that trade. My point is most institutional holders can't sell or won't until the index drops the stock. Consequently, it doesn't take a Whale to swing the price. Second screen shot is a order book. Look at size column and remember this is $5 stock. It looks a lot like AAPL's which is $330/shr. In HTZ, even a 1000 lot is only $5000. and the company is bankrupt and shares are going to zero. No institutional investor is buying.I agree with the sentiment though don't agree with the Robinhood thought.

That's chump change compared to the financial institutions using $ to initiate the wave Robinhood-ers jump on to ride.

Meh, wish I was selling green though my "Robinhood activity" for, "lunch $" is a bit pinched though recovering... Slowly. Coin flip... Wrong side for my play.

Be it $20k for turnarounds or $5k... It's a drop in the bucket in comparison.

This market is an altered reality. While my TSP is doing great having placed my $ in the G fund prior to the plunge and hopped back in reservedly so, in the F fund early May... I'm not rebuilding what I would have lost, I'm capitalizing on the gains I've made. Close to slotting it back into the G fund...

We're about to find the enlarged hole covered by institution fabricated carpet, imo.

Bah! I *should have placed a strangle. Kicking myself as I pondered what legs to place... Should have, could have... But didn't. Haha!

Time will tell.

Interesting "correction" for a Thursday... Would have thought had this been set to occur, it would have been a Friday due to uncertain weekend activity both politically and, well... Seems politically x's 2... Haha!

Think tomorrow may be a second dump, more mild though w/ increase of covid #'s so early in phase two... Who knows what this weekend holds and I think that should place fear however I'm on the losing side of this right now well, I should say today I'm doing great! However the past two weeks I've been biting the bullet. so I wouldn't take my hobby advice to mean anything though it sure seems from my massive expansive experience... I'd be surprised if Friday was a big rebound from today.

Then again this market is on its own little spinning world.

Thoughts?

Aint that the truth. Fed says the money spigot will remain open for as far as the eye can see and we sell off by 6%. I had become pretty defensive over the last 200 S&P points, but turned a little of that cash into equities today. Too much money out there. All dips will get bought.Then again this market is on its own little spinning world.

CNBC's Jim Cramer said Thursday that the stock market's recent rip higher was not reflective of actual conditions in the U.S. during the coronavirus pandemic.

"There's just been a happiness trade that has been out of sync with everything, whether it be hot spots in Arizona, or whether it be unemployment, or whether it be the higher price of food," Cramer said on "Squawk on the Street."

If you want to compare what I feel are several seasoned investors in this thread to what seems to be newbies viewing the stock market as a casino then go check out a similar thread about the current stock market over at Rokslide.