TDAmeritrade is a fantastic platform! I would banter, the best trading platform for my trading interest which includes day, swing and mid/long term activities. It's very user friendly for the basic joe/jane to complex trades with a vast array of research options. I've had frequent discussions with representatives and have been very pleased with their service.Also worthy to consider is TDAmeritrade. I find their platform really easy to use and customer service is terrific (US).

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

BigHornRam

Well-known member

Right before the last housing bubble every tom dick and harry was a real estate expert. Sharks are swimming right now. I'm staying the hell out of the water.

noharleyyet

Well-known member

Right before the last housing bubble every tom dick and harry was a real estate expert. Sharks are swimming right now. I'm staying the hell out of the water.

Agreed. I can’t lie, part of me is going to enjoy watching what I’m almost certain is about to happen.

grizzly_

Well-known member

- Joined

- Feb 18, 2013

- Messages

- 1,276

Right before the last housing bubble every tom dick and harry was a real estate expert. Sharks are swimming right now. I'm staying the hell out of the water.

Agreed. I can’t lie, part of me is going to enjoy watching what I’m almost certain is about to happen.

I'm in real estate and from what I see everybody is scared of the stock market and getting back into real estate.

I'm in real estate and from what I see everybody is scared of the stock market and getting back into real estate.

They’re both really expensive right now though, that’s what gives me pause. Although it goes against my investing philosophy in general, I have more cash on hand right now than I would normally feel comfortable with.

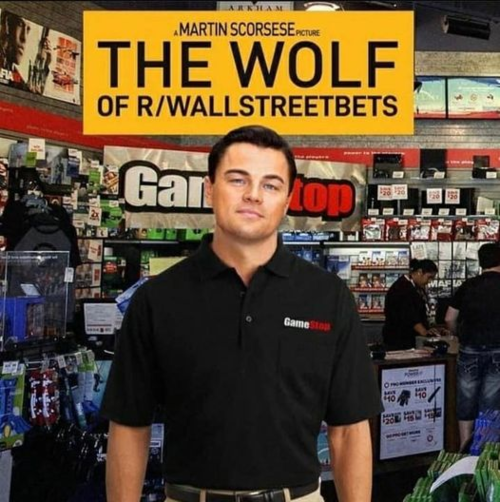

Something is telling me now is the time to keep some powder dry for future buying opportunities (smart/disciplined ones, not the casino moves like shorts, GME etc...).

Last edited:

hogcarpy

Well-known member

AgreedThey’re both really expensive right now though, that’s what gives me pause. Although it goes against my investing philosophy in general, I have more cash on hand right now than I would normally feel comfortable with.

Something is telling me now is the time to keep some powder dry for future buying opportunities (smart/disciplined ones, not the casino moves like shorts, GME etc...).

BigHornRam

Well-known member

Everyone is piling into real estate right now, particularly in the west, because of low interest rates. So you pay 50% more than you should so you can borrow money at 2.5%. Smart! This bubble is going to make the last one look insignificant.I'm in real estate and from what I see everybody is scared of the stock market and getting back into real estate.

What is going to be the trigger?Everyone is piling into real estate right now, particularly in the west, because of low interest rates. So you pay 50% more than you should so you can borrow money at 2.5%. Smart! This bubble is going to make the last one look insignificant.

BigHornRam

Well-known member

No job, no make payments. Boom!What is going to be the trigger?

What's going to cause the mass unemployment at this point?No job, no make payments. Boom!

BigHornRam

Well-known member

Really?What's going to cause the mass unemployment at this point?

Yes. Isn't unemployment decreasing? What will cause such a significant turn around at this point? So much so to collapse the housing market that has survived this much so far?Really?

T

tjones

Guest

Ya that’s not going to happen anytime soon.No job, no make payments. Boom!

I deal with a whole lot of companies across the country every day and also trades.

There is not a single one not looking to hire. These are good paying jobs.

BigHornRam

Well-known member

I can imagine the lumber mills are struggling to find skilled help right now. Plumbers, electricians, framers, ect, too. Key word is skilled.Ya that’s not going to happen anytime soon.

I deal with a whole lot of companies across the country every day and also trades.

There is not a single one not looking to hire. These are good paying jobs.

T

tjones

Guest

Nope not just skilled.I can imagine the lumber mills are struggling to find skilled help right now. Plumbers, electricians, framers, ect, too. Key word is skilled.

Entry level mill workers, pallet manufacturers, truss manufacturers, any retailer, most banks, any office. If you can fog a mirror there is a job for you.

BigHornRam

Well-known member

Weird.Nope not just skilled.

Entry level mill workers, pallet manufacturers, truss manufacturers, any retailer, most banks, any office. If you can fog a mirror there is a job for you.

US payrolls post surprise drop of 140,000 in December, the first decline since April as America's labor-market struggles continue

The Friday report ends a seven-month streak of payroll additions for the US labor market and reflects a slowdown in the US economic recovery.

"The country's unemployment rate stayed steady at 6.7% in December, the agency said. That's slightly lower than the median economist estimate of 6.8%. The rate's pace of decline moderated through the end of the year after tumbling from its 14.7% peak at the start of the pandemic."Weird.

US payrolls post surprise drop of 140,000 in December, the first decline since April as America's labor-market struggles continue

The Friday report ends a seven-month streak of payroll additions for the US labor market and reflects a slowdown in the US economic recovery.www.businessinsider.com

Isn't that part important too? Why do you insist on calling for doomsday? It's ok to be prepared and also optimistic.

BigHornRam

Well-known member

6.7% unemployment rate and job postings everywhere. That's what I found weird.

Not to take this off topic too much farther (although this does relate directly to the market)...

Imagine what the 2020 unemployment and payroll figures would look like had the US government not spent over $1 Trillion on the PPP program (paying companies not to lay people off or cut pay). Would not be a pretty picture.

At some point, I would expect for business fundamentals once again become relevant to a company’s stock price. I’ve been waiting for that to happen for a while now and it hasn’t happened though, maybe time has just passed me by...

Imagine what the 2020 unemployment and payroll figures would look like had the US government not spent over $1 Trillion on the PPP program (paying companies not to lay people off or cut pay). Would not be a pretty picture.

At some point, I would expect for business fundamentals once again become relevant to a company’s stock price. I’ve been waiting for that to happen for a while now and it hasn’t happened though, maybe time has just passed me by...

Similar threads

- Replies

- 41

- Views

- 4K

- Replies

- 0

- Views

- 359

- Replies

- 43

- Views

- 4K