Irrelevant

Well-known member

Just to be fully transparent... I made a little profit on it, then purged it all... then it went +35% since then.Plug power has taken my summer profits and shat all over them...

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Just to be fully transparent... I made a little profit on it, then purged it all... then it went +35% since then.Plug power has taken my summer profits and shat all over them...

Or Carnival....?..anyone in Pfizer?

Not me, unfortunately. Technically it is Biontech's (BNTX) vaccine. They partnered with Pfizer for manufacturing and distribution. Both stocks up big today. The RNA method Biontech used to make this vaccine (similar to Moderna methods) may be the way we make vaccines going forward. Pretty amazing results. It helps that BNTX got a boat load of cash from Germany to fund the study. Pfizer keeps saying they didn't take Operation Warp Speed money, but they didn't have to. A technicality that annoys me for some reason...anyone in Pfizer?

View attachment 161312

I love +7% "tanks", I wish it always tanked like that.

10/30 was a good day to rig yourself of cash, at least it was for me. But I took @SAJ-99 advice a bit early on a few and didn't make as much as I could have.I went from 95% cash to 5% cash the past three weeks.

It's the vaccine news, hoping flying will burn fuel. But I will take it anyway since I'm heavy on petroView attachment 161312

I love +7% "tanks", I wish it always tanked like that.

Roll the dice.Anybody have any thoughts on taking some money off the table right now? With the way COVID is spiking up I have some concerns a new wave of shut downs will cause a pull back in the market. Would a new stimulus bill potentially counteract that?

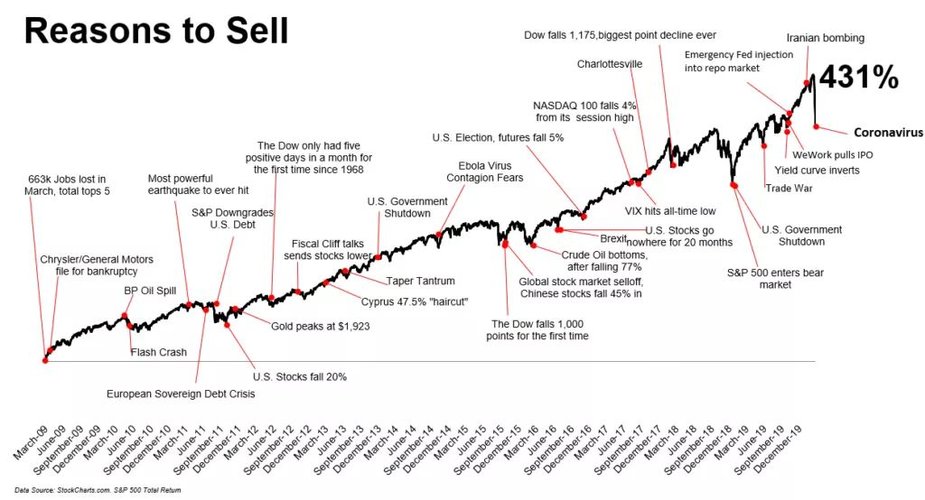

Anybody have any thoughts on taking some money off the table right now? With the way COVID is spiking up I have some concerns a new wave of shut downs will cause a pull back in the market. Would a new stimulus bill potentially counteract that?

He is a certified lunatic. The author of the article.The New York Times: Making the Most of the Coming Biden Boom.

Opinion | Making the Most of the Coming Biden Boom (Published 2020)

The economic outlook is probably brighter than you think.www.nytimes.com

Don't worry guys, progressive policies will result in a big boom for the economy once we get this virus under control.

Shutdowns are still being done at the local level and will be until at least Jan 20. I still don't think there is the political appetite on either side for a national shutdown. but To your question "Will there be a national shut down?", it doesn't matter. If the virus continues on this pace, people will make decisions individually that essentially shut down the economy. Some will argue that (personal decision) is as it should be, but the consequence is probably a lot of deaths. Hospitals in a lot of areas are over capacity. There is not a good answer now just like there wasn't a good answer in March. I'm starting to see some banks calling for Q1 2021 GDP to be negative. That is not a good sign for anyone. As evidence of the impact, elective surgeries are a big money maker for hospitals and there is heavy volume at EOY as people hit deductibles. Hospitals in areas with big covid outbreak will need to cut elective surgeries as a first step. Some people will need to endure that joint pain into 2021, and HC is a huge part of our economy.Do you think the incoming administration might try for a partial shit down of the country to better control this virus. Just asking ....please don't crucify me. Thanks.

I'm hoping that the vaccines give some hope.