SAJ-99

Well-known member

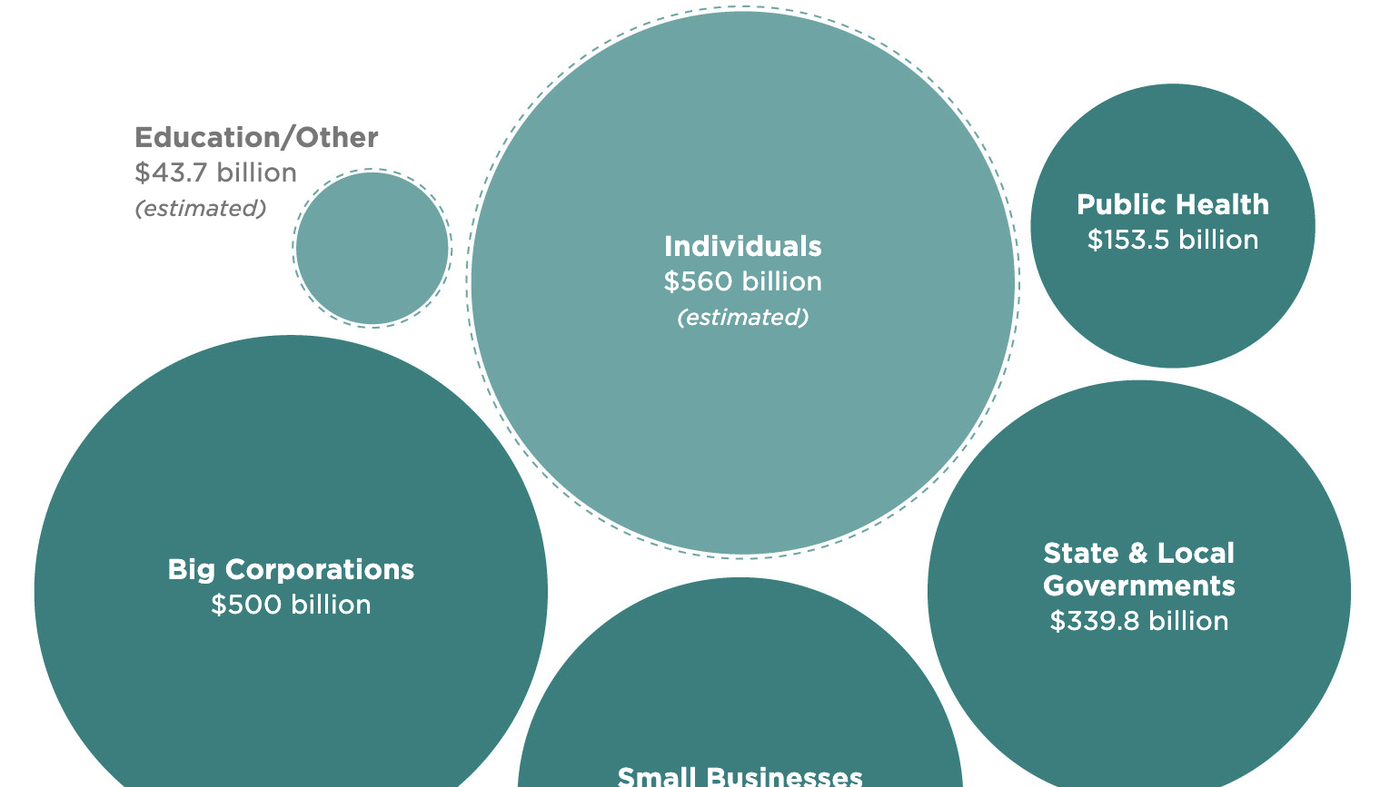

Data next week is going to be bad. We know this, but the scale of bad is going to be incredible. There were 5.8m unemployed in Feb report. We added 3.3m in new claims today (from last week) and expect a similar 3m number next week. That means 12m people will be unemployed and the UE rate will skyrocket.Dummy that down please?

Cash is a huge benefit to Mutual fund managers in a falling market. All the deposits from payrolls from the middle of the month were probably sat on as the market fell, but they can't sit on cash too long. They do what we call "window dressing" at the end of the month. They buy at lower prices and look like geniuses because they outperformed the market - at least that is the intent. We are already at levels from 3/15, so they probably should have bought. Fund managers are good at outsmarting themselves. They will still look good, but could have been better.