elkantlers

Well-known member

I wonder what it would take to Titrate that red out of dyed diesel.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I don't want gas prices the way they are, for the last what 2 years I've been posting that our current situation was going to happen because of Trumps policies/Russia-Saudi battle/Covid19/ESG. You can't beat down producers then expect them to be able to slam on production in 3 weeks, that's insanity.Nice try wise ass. Some reasonable control would be good. But hey, your making $.

Glad I'm not trying to get to work on the average income. Been there done that in the 70's.

Try it on $1.25 minimum wage and gas hits $1.99. I did. 12% inflation.

UAE said they favor OPEC production increases. So it's a drop speculating that OPEC might relent.Looks like oil is down 12% on news that OPEC may increase production. @wllm1313 is this some real relief?

| FOOD | SIZE | PRICE |

| Bean Burrito | $1.29 | |

| Beefy 5-Layer Burrito | $1.69 | |

| Chicken Burrito | $1.79 |

This is really how it feels when you try to order bigger items thereTaco Bell Menu Prices, March 2023

FOOD SIZE PRICE Chalupa Supreme $14.97 Crunchwrap Supreme $23.98 Chicken Quesadilla $34.99

Does OPEC have enough spare capacity to stabilize the market?UAE said they favor OPEC production increases. So it's a drop speculating that OPEC might relent.

Does OPEC have enough spare capacity to stabilize the market?

This looks professionalI don't want gas prices the way they are, for the last what 2 years I've been posting that our current situation was going to happen because of Trumps policies/Russia-Saudi battle/Covid19/ESG. You can't beat down producers then expect them to be able to slam on production in 3 weeks, that's insanity.

What were you saying when gas prices were at $1.80, on now those poor folks losing their jobs?

"The “financial bloodbath” analysts predicted last month overflowed as hundreds of U.S. oil producers limped toward bankruptcy and the industry laid off more than 6,000 workers in a single day" 1.

----------------------------------------------------------------------------------------------------

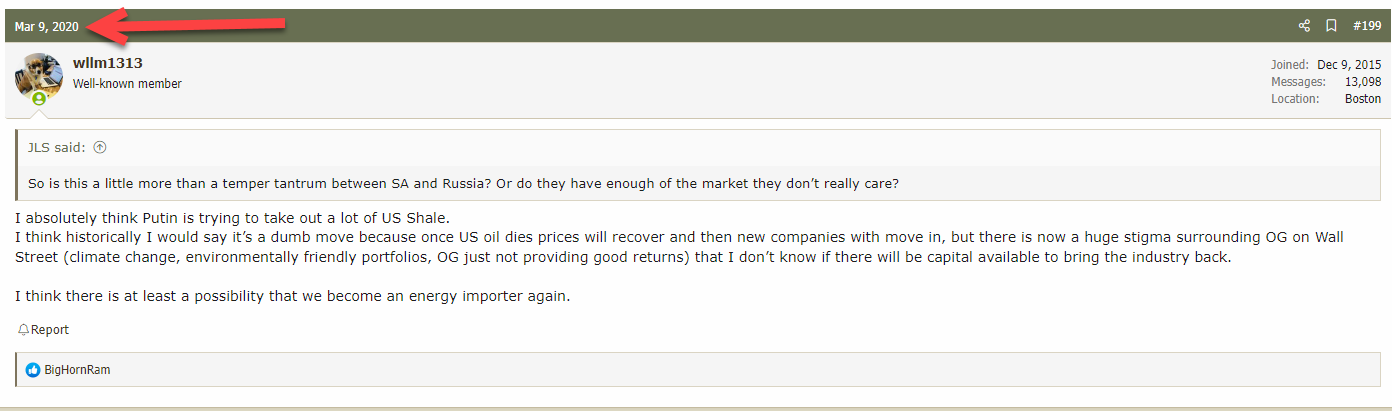

It's crazy to me the hyper pollicization of what everyone uses to heat their homes and drive to work. The flip the script below is just nuts... in not even 2 years we went from let's destroy them to their are evil profit mongers.

2020

View attachment 214796

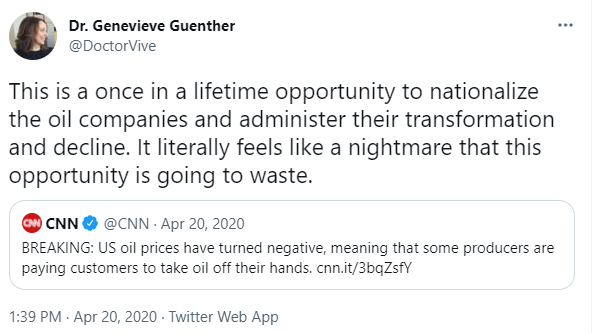

2022

View attachment 214797

---------------------------------------------------------------------------------------------------------------------------------------

"Reasonable Control"

For a number of decades oil was controlled, the Texas RRC (governing body of OG in the state) prorationed Oil, they tried a couple of different tactics but ultimately it didn't work and we scrapped it.

In 2020 it was brought up by the industry... "MOTION FOR COMMISSION CALLED HEARING ON THE VERIFIED COMPLAINT OF PIONEER NATURAL RESOURCES U.S.A. INC. AND PARSLEY ENERGY INC. TO DETERMINE REASONABLE MARKET DEMAND FOR OIL IN THE STATE OF TEXAS"

Petro-Canada was formed as a gov owned company, and was until 91'.

So the point of these 2 controls was to limit production so that we didn't over produce and drive the prices down to the point that companies failed.

Decline and bosting production

So the basic premises with OG is that you have to spend money to make money, spend money to stay flat.

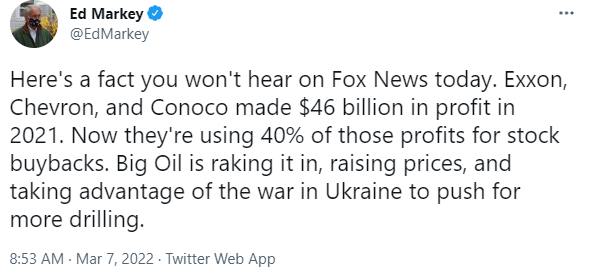

This is a example of what a shale well's production looks like.

View attachment 214798

So essentially production dropped in the US during the pandemic, 1 because some wells were shut in but mostly because we just stopped drilling. Some like a company with 50,000 BOED has to run 2 rigs continuously to stay at that number. If you drop 1 rig you're down to 35k, add one you go up to maybe 60k.

On private lands, in a Oil friendly state it takes time to turn on production drilling and fracking a well isn't a simple process. On federal lands with one of the "9,000" permits the White house is talking about it's even more complicated. It takes months to get the BLM to give the ok to build and occupy a drilling site, even with a permit in hand, and in states like WY you can't drill for good portions of the year due to wildlife stipulations (winter range, sage grouse Leks, etc).

-------------------------------------------------------------------------------------------------------------------------------------

View attachment 214799

This is a 4th quarter 2021 Bloomberg graph, that illustrates what companies were thinking for 2022. Essentially they were planning maybe $74 and contracted service companies, but supplies, hired folks with that price in mind. Thinking ok we drill too much we drop the price and go bankrupt... again.

This is what folks were thinking when they made their budgets.

View attachment 214801

Jan 1 = $75

Feb 1 = $88

Mar 1= $103

Mar 8 = $130

as I type this $107...

So given that it takes ~6 months to add a rig, drill wells, and produce what can the industry do and should they do in your opinion? There isn't a 'real' oil shortage demand is going to be less because of current prices and there will be a lot of Russian oil out there on the market... what's to say that if the industry ramps up to 13 million barrels per day we don't take it in the shorts, in April 2023.

Some companies are fully integrated like Chevron and produce oil and sell gas, they have some control over what they charge. Man other companies, even really big ones are not and have no real control over what you pay at the pump they are just taking it to market and selling it for the going rate.

Conclusion of term paper... @hank4elk I really feel for people, I'm not sure what we do about gas prices currently short term, strategic petroleum reserve? Defense production act and set gas prices + ration gas? Provide a tax incentive to have companies let their works work from home?

The capitalistic approach would to be to let high prices cause demand to fall, people drive and fly less.

Near term is really hard to predict. Longer term I think we need to be more honest about the fact that OG is a national security issue, we need to lower our usage with higher MPG vehicles, and we need to invest in Nuclear so that we aren't as dependent on oil. I think EV cars are an important piece of the puzzle.

I don't think reasonable control is really a thing though.

1. https://grist.org/energy/falling-oi...fe-into-an-old-idea-nationalize-the-industry/

This is a lot of candy for a nickel...well doneI don't want gas prices the way they are, for the last what 2 years I've been posting that our current situation was going to happen because of Trumps policies/Russia-Saudi battle/Covid19/ESG. You can't beat down producers then expect them to be able to slam on production in 3 weeks, that's insanity.

What were you saying when gas prices were at $1.80, on now those poor folks losing their jobs?

"The “financial bloodbath” analysts predicted last month overflowed as hundreds of U.S. oil producers limped toward bankruptcy and the industry laid off more than 6,000 workers in a single day" 1.

----------------------------------------------------------------------------------------------------

It's crazy to me the hyper pollicization of what everyone uses to heat their homes and drive to work. The flip the script below is just nuts... in not even 2 years we went from let's destroy them to their are evil profit mongers.

2020

View attachment 214796

2022

View attachment 214797

---------------------------------------------------------------------------------------------------------------------------------------

"Reasonable Control"

For a number of decades oil was controlled, the Texas RRC (governing body of OG in the state) prorationed Oil, they tried a couple of different tactics but ultimately it didn't work and we scrapped it.

In 2020 it was brought up by the industry... "MOTION FOR COMMISSION CALLED HEARING ON THE VERIFIED COMPLAINT OF PIONEER NATURAL RESOURCES U.S.A. INC. AND PARSLEY ENERGY INC. TO DETERMINE REASONABLE MARKET DEMAND FOR OIL IN THE STATE OF TEXAS" The idea was to avert another price collapse, but it was voted down.

Petro-Canada was formed as a gov owned company, and was until 91'.

So the point of these 2 controls was to limit production so that we didn't over produce and drive the prices down to the point that companies failed.

Decline and bosting production

So the basic premises with OG is that you have to spend money to make money, spend money to stay flat.

This is a example of what a shale well's production looks like.

View attachment 214798

So essentially production dropped in the US during the pandemic, 1 because some wells were shut in but mostly because we just stopped drilling. For instance a company with 50,000 BOED has to run 2 rigs continuously (at least) to stay at that number. If you drop 1 rig you're down to 35k, add one you go up to maybe 60k.

On private lands, in a Oil friendly state it takes time to turn on production drilling and fracking a well isn't a simple process. On federal lands with one of the "9,000" permits the White house is talking about it's even more complicated. It takes months to get the BLM to give the ok to build and occupy a drilling site, even with a permit in hand, and in states like WY you can't drill for good portions of the year due to wildlife stipulations (winter range, sage grouse Leks, etc).

-------------------------------------------------------------------------------------------------------------------------------------

View attachment 214799

This is a 4th quarter 2021 Bloomberg graph, that illustrates what companies were thinking for 2022. Essentially they were planning maybe $74 and contracted service companies, but supplies, hired folks with that price in mind. Thinking ok we drill too much we drop the price and go bankrupt... again.

This is what folks were thinking when they made their budgets.

View attachment 214801

Jan 1 = $75

Feb 1 = $88

Mar 1= $103

Mar 8 = $130

as I type this $107...

So given that it takes ~6 months to add a rig, drill wells, and produce what can the industry do and should they do in your opinion? There isn't a 'real' oil shortage demand is going to be less because of current prices and there will be a lot of Russian oil out there on the market... what's to say that if the industry ramps up to 13 million barrels per day we don't take it in the shorts, in April 2023.

Some companies are fully integrated like Chevron and produce oil and sell gas, they have some control over what they charge. Many other companies, even really big ones are not and have no real control over what you pay at the pump they are just taking it to market and selling it for the going rate.

Conclusion of term paper... @hank4elk I really feel for people, I'm not sure what we do about gas prices currently short term, strategic petroleum reserve? Defense production act and set gas prices + ration gas? Provide a tax incentive to have companies let their works work from home?

The capitalistic approach would to be to let high prices cause demand to fall, people drive and fly less.

Near term is really hard to predict. Longer term I think we need to be more honest about the fact that OG is a national security issue, we need to lower our usage with higher MPG vehicles, and we need to invest in Nuclear so that we aren't as dependent on oil. I think EV cars are an important piece of the puzzle.

I don't think reasonable control is really a thing though.

1. https://grist.org/energy/falling-oi...fe-into-an-old-idea-nationalize-the-industry/

I'd like to formally request that you change your user name to C Cooter Angus.IDK, @wllm1313, C Cooter Angus over on Youtube says that it's Joe Biden gettin in bed with chinamen & the devil what's driving them prices up, and C Cooter has a picture of Jerry Falwell riding a dinosaur while slamming a tall boy of MGD and you don't, so I'm going with C Cooter.

How'd cooter do?IDK, @wllm1313, C Cooter Angus over on Youtube says that it's Joe Biden gettin in bed with chinamen & the devil what's driving them prices up, and C Cooter has a picture of Jerry Falwell riding a dinosaur while slamming a tall boy of MGD and you don't, so I'm going with C Cooter.