Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

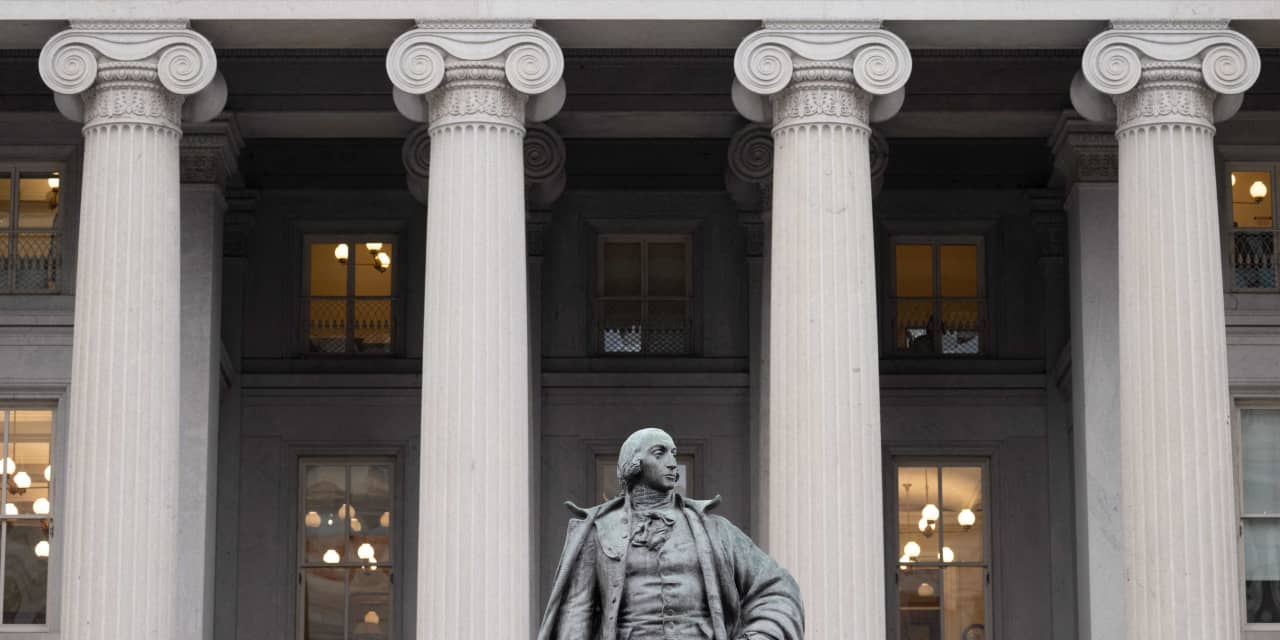

U.S. Debt Ceiling. 31.4 Trillion!

- Thread starter Sytes

- Start date

VikingsGuy

Well-known member

First, I don’t have a handy link, but if I run across one I will post.So they have a magic way to make it disappear without taxpayers paying for it?

Seriously though, if there's a good spot for me to learn more about what you're saying, i'd like to get more educated.

Second, I am not saying unlimited govt debt is OK or that there is not a “piper paying moment” if we keep writing dumb checks. But rather, what is good/bad debt, acceptable amounts of debt, and consequences for too much/little debt are just different for govt bonds than personal credit cards. The reduction of govt debt to a “per person owes” sound bite does not really reflect how these govt debt works in practice.

There are all types of circumstances and sleight of hand that tend to reduce the actual amount tax payers will ever be paid back. For example - a fair amount of our prior debt recently shrunk in real dollar terms due to inflation - it’s getting paid back but with “less valuable dollars” - thereby on a relative basis it is a “smaller debt” against GDP. Of course when we borrow again it is then at a higher rate - but if rates rise again, same story. Or the Federal Reserve can buy essentially unlimited long term treasuries to fund govt largess - effectively printing money - if done at the right times can reduce amount govt will ever actually pay back - if done at the wrong times or in wrong way can further drive inflation (but that again reduces in real dollar terms the existing debt).

Like personal debt, the more important question is what is the debt paying for. If it is roads, fiber optic, semi-conductor industry infrastructure, improved competitiveness of US mfg, advanced educations, etc then it will pay for itself in spades when these assets support economic growth. Unfortunately too much of our spending is on bureaucracy, and non-productive items like industry subsidies, green economy boondoggles (different than important infrastructure like power lines), prisons, foreign wars, interest on past debt, and major social programs that are not viably funded but can’t be reformed due to political pressure.

VikingsGuy

Well-known member

We managed 3 of the last 5 decades with rates between 6%-14%. And interest on debt as share of GDP much higher than today for 2 of those decades. 5% rate and interest owed per GDP of 2% is not ideal but hardly the end of the world. Today’s rates and ratios are much closer to the norm for post-WW2 than the last 20 yrs have been.With interest rates coming off of historic lows, the interest payment on the debt is now larger than what we spend on defense budget - both over $800B a year.

Our debt was significantly lower when rates were above 7% last time. Plus, at some point, people and governments won’t have enough trillions to purchase treasuries. It’s not hard for the fed to sell 100’s of Billions but Trillions is another matter.We managed 3 of the last 5 decades with rates between 6%-14%. And interest on debt as share of GDP much higher than today for 2 of those decades. 5% rate and interest owed per GDP of 2% is not ideal but hardly the end of the world. Today’s rates and ratios are much closer to the norm for post-WW2 than the last 20 yrs have been.

VikingsGuy

Well-known member

2024 is projected to have abou 2.6% interest vs GDP whereas the 80s-90s were 3+%. As for “enough” - Fed Reserve can buy them - think quantitative easing on steroids.Our debt was significantly lower when rates were above 7% last time. Plus, at some point, people and governments won’t have enough trillions to purchase treasuries. It’s not hard for the fed to sell 100’s of Billions but Trillions is another matter.

Again, I don‘t like piling on stupid debt - but this is not even close to an existential crisis yet. But I have no doubt American voters will keep demanding free stuff and lower taxes until it is.

But hey - if we cap social security payments at amounts paid in by the individual, eliminate the mortgage interest deduction, eliminate all agriculture subsidies, quit funding higher education, turned all our roads into toll roads, reduce military force funding level to German rate, allow widespread immigration, tax petroleum/gas sufficient to reflect externalities, make the middle class pay European tax rates, eliminate posh public employee pensions, let the elderly and terminally ill have only palliative care, tax held wealth, etc, etc, we can fix this short order. Funny, folks never sign up for real solutions.

(Note: for clarities sake, the above is not meant to be a serious proposal, but rather to show real cuts would have real consequences)

Last edited:

antelopedundee

Well-known member

If they cut SS and Medicare they'd just spend the (savings) somewhere else like giving the Goddamned rich another tax cut. We are in effect borrowing in order to give those tax cuts. Supposedly in the first year of the 2017 Tax Cut and Jobs Act, Berkshire Hathaway got a $24 billion tax reduction. So how did that result in sufficient economic activity to generate enough taxes replace that $24 billion? He really has more money now than he knows what to do with.

As a shareholder of Berkshire, I can only assume that when you say “he” you were referring to me.If they cut SS and Medicare they'd just spend the (savings) somewhere else like giving the Goddamned rich another tax cut. We are in effect borrowing in order to give those tax cuts. Supposedly in the first year of the 2017 Tax Cut and Jobs Act, Berkshire Hathaway got a $24 billion tax reduction. So how did that result in sufficient economic activity to generate enough taxes replace that $24 billion? He really has more money now than he knows what to do with.

antelopedundee

Well-known member

Warren/Berkshire as it seems in many articles about them the 2 are interchangeable. One is synonymous with the other. As a shareholder you share in the wealth. Congrats on being part owner of a huge chunk of money that you have no control over. Wish I'd bought a share when it was $265K.As a shareholder of Berkshire, I can only assume that when you say “he” you were referring to me.

What % of BH holdings is their cash?

Apple is another company with hordes of cash that they apparently have no clue about what to do with it.

Last edited:

antelopedundee

Well-known member

I wish every American could go over the national budget line by line just to see where they think the waste is.

I wish the Defense Department could do it to its budget to let us know where all the lost Defense budget money went.I wish every American could go over the national budget line by line just to see where they think the waste is.

antelopedundee

Well-known member

They likely have many billions that they can't account for.I wish the Defense Department could do it to its budget to let us know where all the lost Defense budget money went.

They (we?) have about $147B cash on hand right now.Warren/Berkshire as it seems in many articles about them the 2 are interchangeable. One is synonymous with the other. As a shareholder you share in the wealth. Congrats on being part owner of a huge chunk of money that you have no control over. Wish I'd bought a share when it was $265K.

What % of BH holdings is their cash?

Apple is another company with hordes of cash that they apparently have no clue about what to do with it.

Buffet has a few more shares of Berkshire than I do.

SAJ-99

Well-known member

Take a full picture. Sure, lots of valid points that make this less rosy, but the numbers are the numbers. We aren't going bankrupt yet.

www.barrons.com

www.barrons.com

U.S. Net Wealth Is Over $135 Trillion. Here's Where That Money Resides.

The U.S. is poised to remain the world’s most influential economic force, write Paul J. Simko and Richard P. Smith.

antelopedundee

Well-known member

I just wonder why HB needs or should get a tax cut. Never heard that they've been giving them back.They (we?) have about $147B cash on hand right now.

Buffet has a few more shares of Berkshire than I do.

SAJ-99

Well-known member

He was against it, but it would be a dereliction of duty to not pay more that necessary. In the end WB can spend the money on things he thinks are worthy rather than normal government expenses.I just wonder why HB needs or should get a tax cut. Never heard that they've been giving them back.

Billionaire Warren Buffett: Current corporate tax rate is not hurting our businesses

https://www.cnbc.com/2017/10/03/war...are|com.apple.UIKit.activity.CopyToPasteboard

antelopedundee

Well-known member

I recall Warren saying that it wasn't necessary, but I was wondering why congress thought a cut was necessary. Economic activty isn't replacing the lost revenue so they have to borrow to make up the shortage. I understand that some lower on the totem pole folks were helped, but is it worth it? FWIW the current outlay for SS is simply paying back what was borrowed over the years.He was against it, but it would be a dereliction of duty to not pay more that necessary. In the end WB can spend the money on things he thinks are worthy rather than normal government expenses.

Billionaire Warren Buffett: Current corporate tax rate is not hurting our businesses

https://www.cnbc.com/2017/10/03/warren-buffett-corporate-tax-rate-is-not-hurting-our-businesses.html?__source=iosappshare|com.apple.UIKit.activity.CopyToPasteboard

SAJ-99

Well-known member

Lower taxes has been in the RNC platform for a long time. They had senate, house, and presidency so they did it. Of course economic activity doesn't replace the lost revenue, but that isn't the point. The point is to reward those who fund the party. People "lower on the totem pole" didn't benefit nearly as much as corporations and those that own them. The individual and estate cuts expire in 2025. The corporate stuff doesn't. That should tell you what you need to know.I recall Warren saying that it wasn't necessary, but I was wondering why congress thought a cut was necessary. Economic activty isn't replacing the lost revenue so they have to borrow to make up the shortage. I understand that some lower on the totem pole folks were helped, but is it worth it? FWIW the current outlay for SS is simply paying back what was borrowed over the years.

Debt is so normal anymore. But what I've never understood is why people argue that so much debt is fine...? If you have to borrow, you pay compound interest. If you have excess, you collect compound interest. Am I missing something?

Blue Steel

Well-known member

- Joined

- Feb 26, 2023

- Messages

- 991

And some of it was left in Afghanistan, now being used by othersI wish the Defense Department could do it to its budget to let us know where all the lost Defense budget money went.

VikingsGuy

Well-known member

As the govt prints the money, the kitchen table family budget analog doesn't work.Debt is so normal anymore. But what I've never understood is why people argue that so much debt is fine...? If you have to borrow, you pay compound interest. If you have excess, you collect compound interest. Am I missing something?

A country should use as much debt as it can to build infrastructure and other economic drivers as possible, up to the point where it starts to squeeze out private investment, fuels inflation, or reaches the limit of investors' willingness to buy debt at reasonable rates.

Every serious economist would agree a certain amount of debt is better than zero debt and all would also agree that too much debt is a problem. But , every economist will have their own individual number as to where the line is crossed.

Personally, I think we are getting very close to it, so support levelling off our debt growth rate, but am not freaked out by debt in general.

Similar threads

- Replies

- 98

- Views

- 8K

- Replies

- 16

- Views

- 2K

- Replies

- 36

- Views

- 3K

- Replies

- 199

- Views

- 13K