SAJ-99

Well-known member

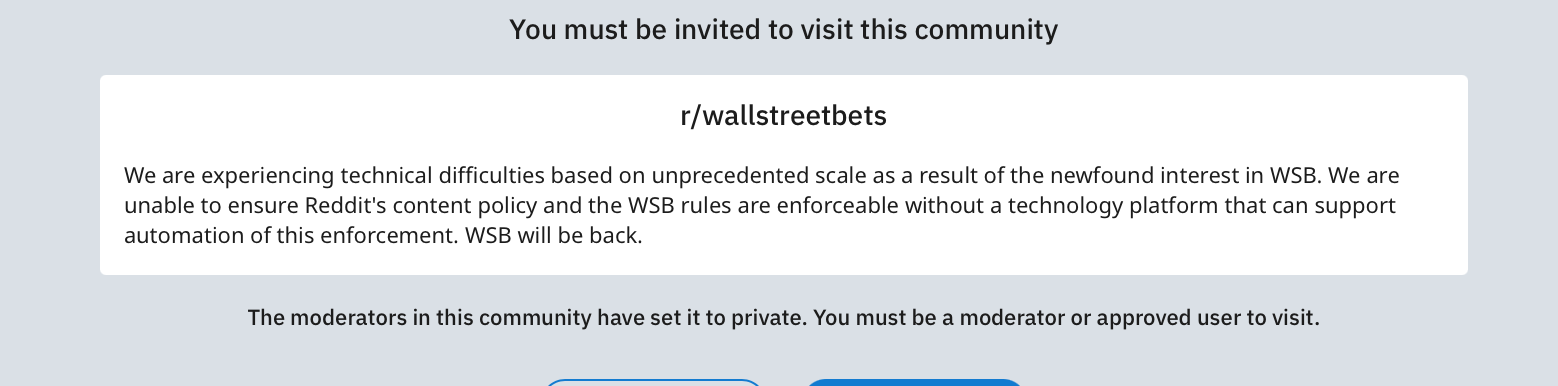

Calling something manipulation is disingenuous. It's an excuse for not understanding. Every transaction affects the market price. That is what markets are for. Look about 30 pages back on this thread about negative oil. Lots of points there ring similar. I see the comparison as betting on a sporting event and blaming the referees for the loss. In this case WSB seem to be winning, just still complaining because they are being "disrespected". GME is back to $150 today. Two weeks ago it was under $20. The interesting part is that the more press WSB gets, the more others jump on the bandwagon which further drives the price higher. Buying begets buying (and selling begets more selling, but that is for later). I find it fascinating but mostly from a psychological angle.Agreed, I'm not trying to argue. My only point initially was that people are blaming a relatively small group of people in WSB for this; while the same sources calling for SEC involvement and sanctions have been manipulating markets for decades. Hypocritical is the word I'm looking for.