SAJ-99

Well-known member

Sitting in hotel waiting out a storm before continuing my unicorn hunt.what are these "measurement adjustments" you speak of?

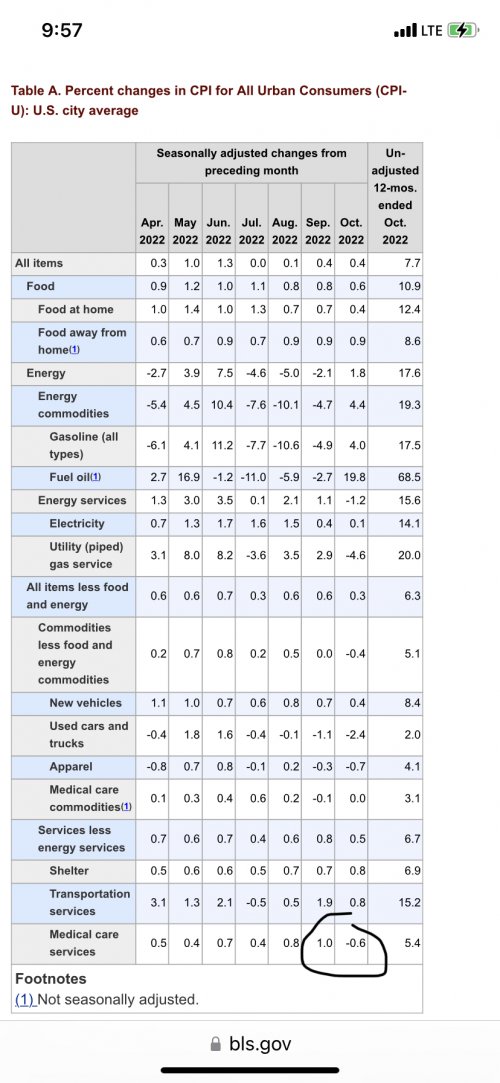

Here is the adjustment (circled at bottom). It should continue to be a negative contributor for the next 12 months, and at 8% it is a sizable contributor to the total CPI, especially Core.