Irrelevant

Well-known member

That is right up my alley.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

That is right up my alley.

Hard to say what it will do.Seems like oil is still poised to go up with what's going on in the world.

Similar note:Hard to say what it will do.

A Sustained Oil Rally Seems Unlikely Amid Rampant Inflation | OilPrice.com

Stubbornly high inflation continues to pressure the Fed to hike interest rates even further, but lower supply from OPEC+ and dwindling diesel inventories could make for tighter supply in oil marketsoilprice.com

VZ suckered me back it. Kick me in the head now and get it over with.Good read for the week ahead, earnings and noted interests:

Bank Earnings, Credit Card Cap In Focus

Stay up to date with Wall Street Breakfast: Nvidia H200 export approval, Netflix-WBD bid talk, Q4 bank earnings.seekingalpha.com

Consumer confidence high, business confidence low. If you're not confused, you're not paying attention. The nice thing is that we can cherry pick whatever data suits our view. Election results good? bad? possible nuclear war- we got it! Inflation getting worse? better? Yes!Nice buying bite today. Now, whether to tighten the drag or let it swim. Day/swing, easy catch day. Longs...? At some point - yes(?).

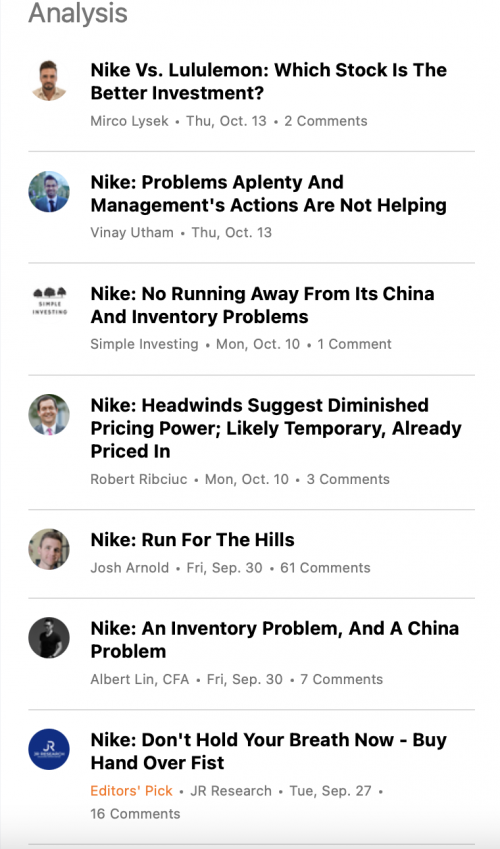

View attachment 244959

SA essentially publishes third-party write-up. You can find buy and sell articles on any major stock. To your point, it’s up the reader to sort through and make their own judgement. The best stuff is usually written by professional analysts, but not always.As with any article regarding the market, baise beware. IMO, over the years reading Seeking Alpha, I've come to learn their interests, when it's being pressed and when it seems a fairly reasonable assessment. They are, by far, my favorite - as a hobbyist.

Just Biden reacting to earlier news. He wanted OPEC to wait one month to cut production. Saudi's wouldn't do that for him. Don't think this will help him any.You the oil/crude buyers - Worth the read, IMO.

Snapshot: The extension intends to offset any market volatility that is expected once a European oil embargo goes into effect on Dec. 5, and to ensure prices keep falling from the historic highs recorded earlier this year. It also comes after OPEC and its Russia-led allies agreed to slash output by a whopping 2M barrels per day from November. Don't forget that midterm elections are around the corner, and prices at the pump have been said to be a defining factor of any outcome, especially with voters worried about inflation and the economy.

Bank Earnings, Credit Card Cap In Focus

Stay up to date with Wall Street Breakfast: Nvidia H200 export approval, Netflix-WBD bid talk, Q4 bank earnings.seekingalpha.com

As with any article regarding the market, baise beware. IMO, over the years reading Seeking Alpha, I've come to learn their interests, when it's being pressed and when it seems a fairly reasonable assessment. They are, by far, my favorite - as a hobbyist.

247wallst.com

247wallst.com

Seeking Alpha or Zacks... Same difference though my point being, cherry picked articles along with their own analysts that fit their interest. I believe SA does a better job of performing this - a photo finish lead towards impartiality... Still a stretch to that neutral point.SA essentially publishes third-party write-up. You can find buy and sell articles on any major stock. To your point, it’s up the reader to sort through and make their own judgement. The best stuff is usually written by professional analysts, but not always.

I don't do Zacks. I knew the firm well in previous life, and it's probably a case of seeing how the sausage is made and never wanting to eat it.Seeking Alpha or Zacks... Same difference though my point being, cherry picked articles along with their own analysts that fit their interest. I believe SA does a better job of performing this - a photo finish lead towards impartiality... Still a stretch to that neutral point.

SA and Zacks (the leading two, IMO) both hold great earnings analysis. One of my key areas for stock picks.

See what happens. King crab legs, or beans and rice for dinner. It's only money!Lots of put open interest in tomorrow's expiry - about 70% more than calls. A little odd to see it on non-quarterly date. Heavy put gamma could mean a wild day. Prepare now and buckle in.