Bam Bam

Well-known member

"I find it difficult to have a meaningful discussion when you question the validity of CPI."

You are right about Friedman though... people treat him as an economics god, rather than a smart man. However, I find that I wholeheartedly agree with most of his ideas. He had a gift for explaining complex subjects, and he had a wonderful understanding of human nature to boot.

Ok, as far as inflation being uniform, I'm not sure what that proves...Inflation is never uniform- ever. Necessities tend to go up in price the most, and as times get more difficult, people spend more and more of their money on the things that they need. The things that people don't need (TV's, new windows, tuxedo rentals...ect.) tend to rise in price more slowly.

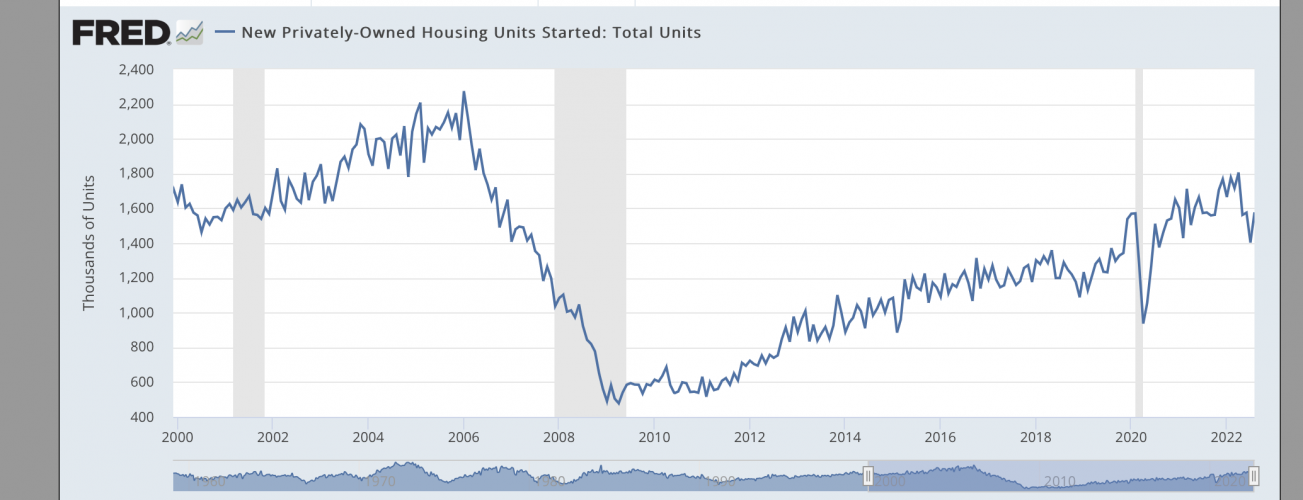

So, as far as the bottom being in the market, you are thinking that the market bottom is in, and you are buying stocks again, "99"? I am not, as you could probably tell. These FED rate hikes will hurt the economy, and begin to hurt inflation as designed-but that will also hurt the stock market. I think stocks have much further to fall, so I am holding off.

You are right about Friedman though... people treat him as an economics god, rather than a smart man. However, I find that I wholeheartedly agree with most of his ideas. He had a gift for explaining complex subjects, and he had a wonderful understanding of human nature to boot.

Ok, as far as inflation being uniform, I'm not sure what that proves...Inflation is never uniform- ever. Necessities tend to go up in price the most, and as times get more difficult, people spend more and more of their money on the things that they need. The things that people don't need (TV's, new windows, tuxedo rentals...ect.) tend to rise in price more slowly.

So, as far as the bottom being in the market, you are thinking that the market bottom is in, and you are buying stocks again, "99"? I am not, as you could probably tell. These FED rate hikes will hurt the economy, and begin to hurt inflation as designed-but that will also hurt the stock market. I think stocks have much further to fall, so I am holding off.