It’s hard to go hunting in a Prius, so I use a pick up.I guess if Sleepy Joe gets the credit, I owe him a big thank you.

As a retired oil refinery worker, my holdings in company stock have risen sharply. Nearly forty years ago when first going to work for them, I told my wife, we would not complain about the price of gasoline. So, we don't.

No one is forced to buy a rig that gets poor milage, myself included. It is a choice. There should be no sense of entitlement that the price of oil products will never rise.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What are you guys paying for gas?

- Thread starter Nick87

- Start date

I thought the buck stops with him.Then one has no idea how the world works and should be gifted with an eye roll

$3.39 reg in Boston

406dn

Well-known member

- Joined

- Dec 12, 2019

- Messages

- 2,805

It’s hard to go hunting in a Prius, so I use a pick up.

I hauled an elk home in a Subaru wagon, years ago. So maybe not a Prius, but there are many ways to skin a cat.

This should be fun.I thought the buck stops with him.

You should educate that wllm fella.

BigHornRam

Well-known member

Come on man. He's working on it.I thought the buck stops with him.

Joe Biden 'Asleep' at Climate Summit Sparks Wave of Criticism and Sympathy

"America is in crisis, and Joe Biden is asleep at the wheel," House Republicans tweeted after a video showing Biden with his eyes closed during a speech at COP26 went viral.

No need to educate, so settle down. If gas was $1.50 do you joe would be taking credit for it? Do you think he would be telling the world about how his influence and progressive deal making drove down the price of fuel. You know damn well he would.This should be fun.

You should educate that wllm fella.

The Subaru wagons are not anything to sleep on. They will probably go hell of a lot more places then a Ram power wagon or Ford raptor.I hauled an elk home in a Subaru wagon, years ago. So maybe not a Prius, but there are many ways to skin a cat.

Doublecluck

Well-known member

I guess if Sleepy Joe gets the credit, I owe him a big thank you.

As a retired oil refinery worker, my holdings in company stock have risen sharply. Nearly forty years ago when first going to work for them, I told my wife, we would not complain about the price of gasoline. So, we don't.

No one is forced to buy a rig that gets poor milage, myself included. It is a choice. There should be no sense of entitlement that the price of oil products will never rise.

Kinda a wash though no? Considering literally every product and service anyone consumes requires fuel to get it to them? Actually lots of people are forced to buy rigs that get poor mileage, like most of the people who provide those products and services. My largest cost outside labor is fuel, we drive 2 vehicles over 100,000 miles a year providing products and services to Montana consumers, not like I’m gonna eat it, just raised my prices for the second time this year. Just because I’m billing more don’t mean I’m making more, just because your making more don’t mean your not paying more, someone’s getting richer, just not sure it’s you or I.

3.79 for diesel today in Missoula on my way to post falls

D

Deleted member 28227

Guest

Broad strokes.I thought the buck stops with him.

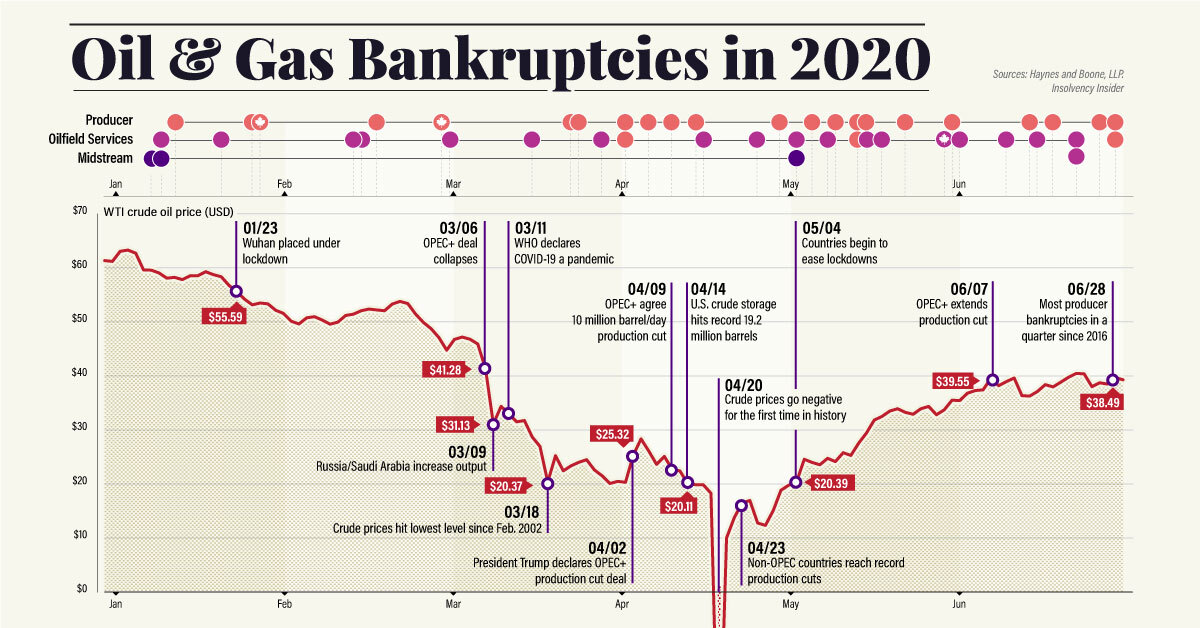

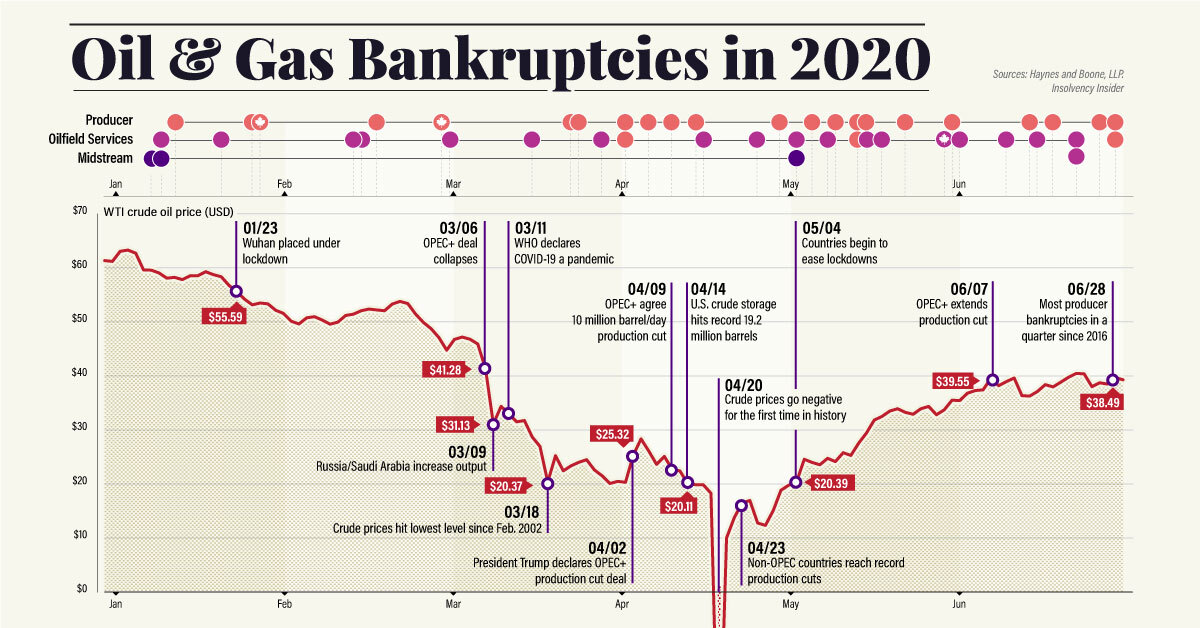

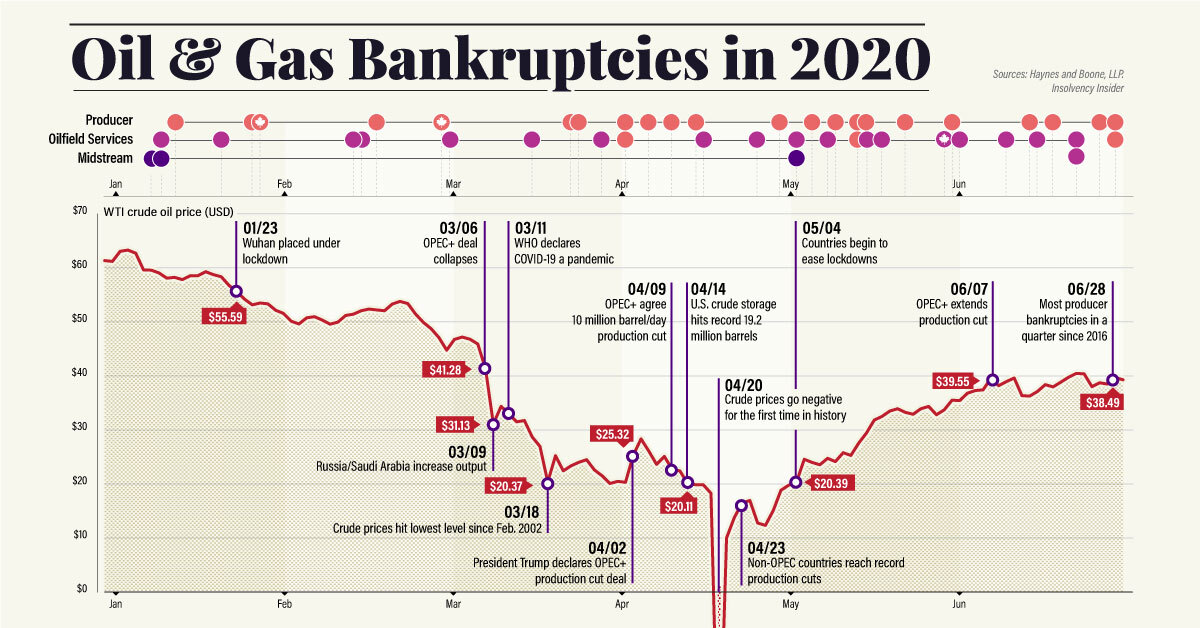

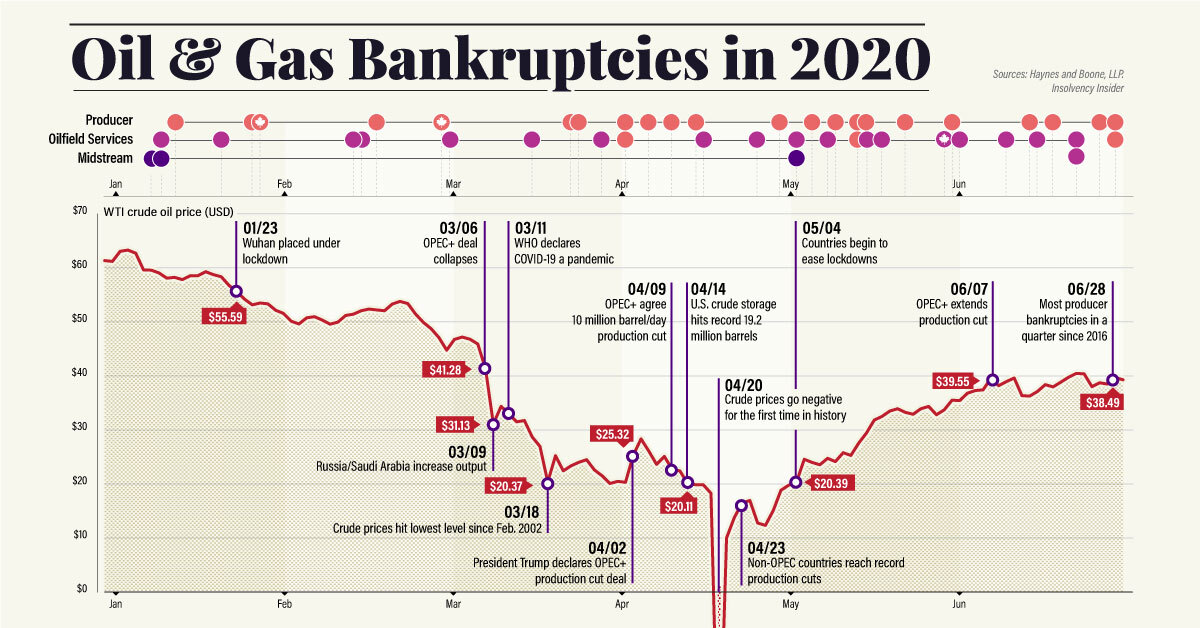

2008-2016 -> Market rewarded growth of OG at all costs, returns didn't matter as much as increased production

2016 - Down turn over 100 OG company Bankruptcies

2017-2020-> Investment came back OPEC + Russia were losing massive amounts of money as US production soared. Glut of commodity on market.

2020- Black Swan event, because of covid market collapsed + OPEC/Russia drove price down artificially by dumping oil, massive number of bankruptcies

2021- Demand increased, US production was way down therefore price has dramatically increased, OPEC + Russia haven't increased production as they are realizing huge profits

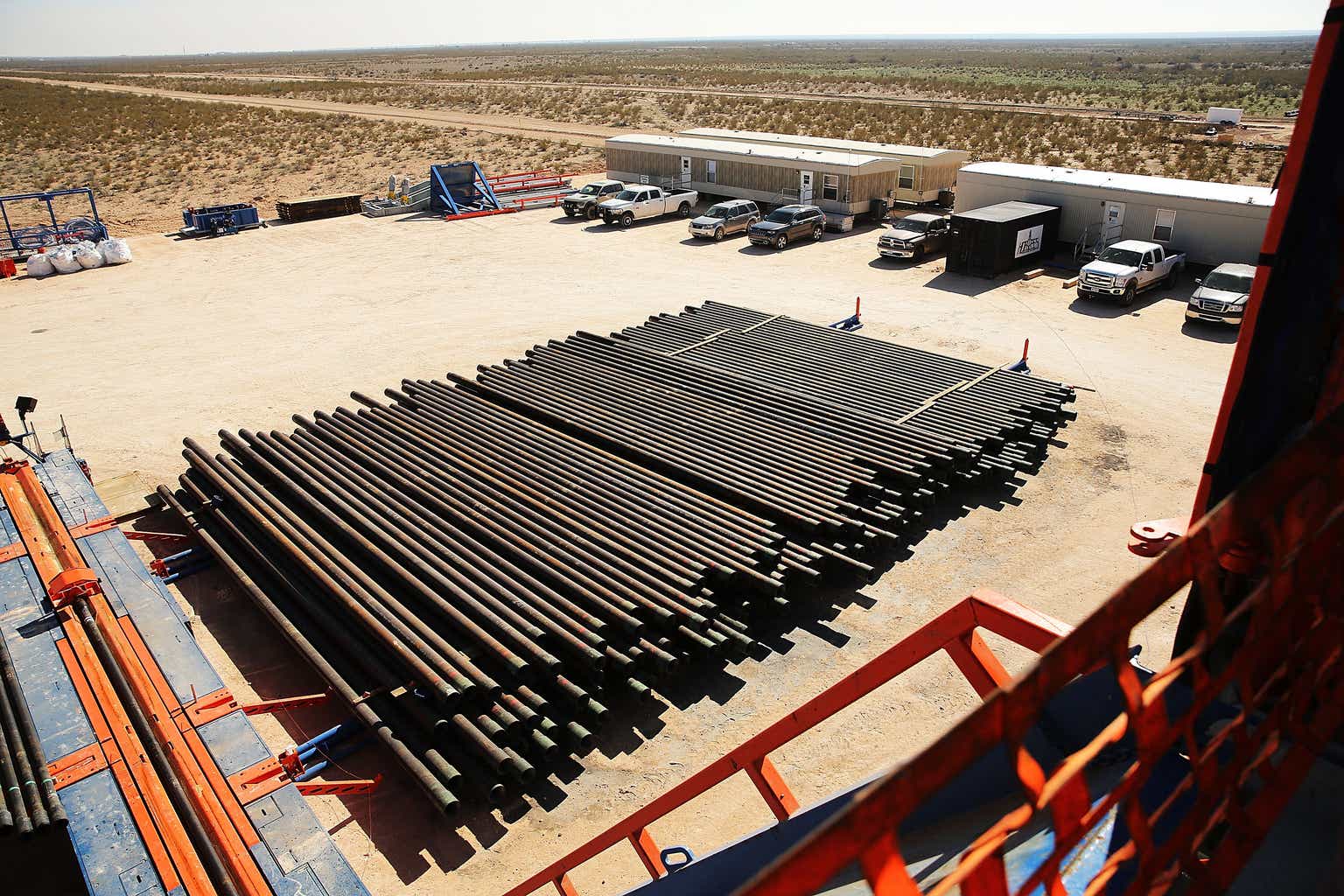

Huge moves by activist investors, ESG has become a buzz word, market is demanding dividends not growth. Publics aren't adding rigs as one would expect with $80+ oil.

Increase in rig count is primarily coming from privates, but even privates are switching to dividend models and aren't adding many rigs. Investment in PE is tepid, IPOs like Vine were weak despite commodity pricing, which was not a good signal to investors. Further institutional investors, are pulling out of OG all together.

We would be in a similar place with any president. There are some levers the president can pull but it's capitalism not a state owned industry and it's an international market. We would be at a similar price point with a president of either party. Analysts were predicting current commodity prices when oil went negative in April 2020.

It's a volatile industry, but I think the big players will do their best to keep us averaging in the $70-90 range. Too high and money returns and supply increases or people start using less.

"U.S. energy firms this week cut oil and natural gas rigs for the first time in seven weeks even as oil prices rose to fresh seven year highs"

U.S. oil & gas rig count falls for first week in seven -Baker Hughes

U.S. energy firms this week cut oil and natural gas rigs for the first time in seven weeks even as oil prices rose to fresh seven year highs.

Tracking the Growing Wave of Oil & Gas Bankruptcies in 2020

Dropping crude prices and a worsening pandemic have led to a growing wave of energy bankruptcies. Here’s what that fallout looks like.

www.visualcapitalist.com

www.visualcapitalist.com

Last edited by a moderator:

noharleyyet

Well-known member

I spoke too soon....diesel was 3.55 yesterdayAbout 3.20 for diesel. 3.60 for 91 octane gasoline.

noharleyyet

Well-known member

No one's going to rebut a fusillade of glossies wllm...I believe the gentleman was quoting the Big Guy's own personal teleprompter.Broad strokes.

2008-2016 -> Market rewarded growth of OG at all costs, returns didn't matter as much as increased production

2016 - Down turn over 100 OG company Bankruptcies

2017-2020-> Investment came back OPEC + Russia were losing massive amounts of money as US production soared. Glut of commodity on market.

2020- Black Swan event, because of covid market collapsed + OPEC/Russia drove price down artificially by dumping oil, massive number of bankruptcies

2021- Demand increased, US production was way down therefore price has dramatically increased, OPEC + Russia haven't increased production as they are realizing huge profits

Huge moves by activist investors, ESG has become a buzz word, market is demanding dividends not growth. Publics aren't adding rigs as one would expect with $80+ oil.

Increase in rig count is primarily coming from privates, but even privates are switching to dividend models and aren't adding many rigs. Investment in PE is tepid, IPOs like Vine were weak despite commodity pricing, which was not a good signal to investors.

We would be in a similar place with any president. There are some levers the president can pull but it's capitalism not a state owned industry and it's an international market. We would be at a similar price point with a president of either party. Analysts were predicting current commodity prices when oil went negative in April 2020.

It's a volatile industry, but I think the big players will do their best to keep us averaging in the $70-90 range. Too high and money returns and supply increases or people start using less.

View attachment 200410

"U.S. energy firms this week cut oil and natural gas rigs for the first time in seven weeks even as oil prices rose to fresh seven year highs"

U.S. oil & gas rig count falls for first week in seven -Baker Hughes

U.S. energy firms this week cut oil and natural gas rigs for the first time in seven weeks even as oil prices rose to fresh seven year highs.www.reuters.com

Tracking the Growing Wave of Oil & Gas Bankruptcies in 2020

Dropping crude prices and a worsening pandemic have led to a growing wave of energy bankruptcies. Here’s what that fallout looks like.www.visualcapitalist.com

Last edited:

D

Deleted member 28227

Guest

I just think folks give way to much credit to presidents who are essentially screaming into the wind...No one's going to rebut a fusillade if glossies wllm...I believe the gentleman was quoting the Big Guy's own personal teleprompter.

100% yes, as would any president... I'm an equally opportunity eye roller.If gas was $1.50 do you joe would be taking credit for it?

Good summary.Broad strokes.

2008-2016 -> Market rewarded growth of OG at all costs, returns didn't matter as much as increased production

2016 - Down turn over 100 OG company Bankruptcies

2017-2020-> Investment came back OPEC + Russia were losing massive amounts of money as US production soared. Glut of commodity on market.

2020- Black Swan event, because of covid market collapsed + OPEC/Russia drove price down artificially by dumping oil, massive number of bankruptcies

2021- Demand increased, US production was way down therefore price has dramatically increased, OPEC + Russia haven't increased production as they are realizing huge profits

Huge moves by activist investors, ESG has become a buzz word, market is demanding dividends not growth. Publics aren't adding rigs as one would expect with $80+ oil.

Increase in rig count is primarily coming from privates, but even privates are switching to dividend models and aren't adding many rigs. Investment in PE is tepid, IPOs like Vine were weak despite commodity pricing, which was not a good signal to investors. Further institutional investors, are pulling out of OG all together.

We would be in a similar place with any president. There are some levers the president can pull but it's capitalism not a state owned industry and it's an international market. We would be at a similar price point with a president of either party. Analysts were predicting current commodity prices when oil went negative in April 2020.

It's a volatile industry, but I think the big players will do their best to keep us averaging in the $70-90 range. Too high and money returns and supply increases or people start using less.

View attachment 200410

"U.S. energy firms this week cut oil and natural gas rigs for the first time in seven weeks even as oil prices rose to fresh seven year highs"

U.S. oil & gas rig count falls for first week in seven -Baker Hughes

U.S. energy firms this week cut oil and natural gas rigs for the first time in seven weeks even as oil prices rose to fresh seven year highs.www.reuters.com

Tracking the Growing Wave of Oil & Gas Bankruptcies in 2020

Dropping crude prices and a worsening pandemic have led to a growing wave of energy bankruptcies. Here’s what that fallout looks like.www.visualcapitalist.com

That was my sarcastic point which I think was missed. All presidents want to take credit for low fuel and energy prices. When US production is in the downside of the swing and OPEC and Russia are cashing in they want to stand back with their hands up and tell us they can’t really do a whole lot. Which is technically true but, maybe he can call OPEC+ when he gets up from his nap and ask nicely to start moving some more oil.

noharleyyet

Well-known member

yep...I just think media folks give way to much credit to presidents who are essentially screaming into the wind...

Irrelevant

Well-known member

So what I'm hearing is that O&G isn't a bad play right now? Looks to be +~70% in the last year. Will it last?Broad strokes.

2008-2016 -> Market rewarded growth of OG at all costs, returns didn't matter as much as increased production

2016 - Down turn over 100 OG company Bankruptcies

2017-2020-> Investment came back OPEC + Russia were losing massive amounts of money as US production soared. Glut of commodity on market.

2020- Black Swan event, because of covid market collapsed + OPEC/Russia drove price down artificially by dumping oil, massive number of bankruptcies

2021- Demand increased, US production was way down therefore price has dramatically increased, OPEC + Russia haven't increased production as they are realizing huge profits

Huge moves by activist investors, ESG has become a buzz word, market is demanding dividends not growth. Publics aren't adding rigs as one would expect with $80+ oil.

Increase in rig count is primarily coming from privates, but even privates are switching to dividend models and aren't adding many rigs. Investment in PE is tepid, IPOs like Vine were weak despite commodity pricing, which was not a good signal to investors. Further institutional investors, are pulling out of OG all together.

We would be in a similar place with any president. There are some levers the president can pull but it's capitalism not a state owned industry and it's an international market. We would be at a similar price point with a president of either party. Analysts were predicting current commodity prices when oil went negative in April 2020.

It's a volatile industry, but I think the big players will do their best to keep us averaging in the $70-90 range. Too high and money returns and supply increases or people start using less.

View attachment 200410

"U.S. energy firms this week cut oil and natural gas rigs for the first time in seven weeks even as oil prices rose to fresh seven year highs"

U.S. oil & gas rig count falls for first week in seven -Baker Hughes

U.S. energy firms this week cut oil and natural gas rigs for the first time in seven weeks even as oil prices rose to fresh seven year highs.www.reuters.com

Tracking the Growing Wave of Oil & Gas Bankruptcies in 2020

Dropping crude prices and a worsening pandemic have led to a growing wave of energy bankruptcies. Here’s what that fallout looks like.www.visualcapitalist.com

BigHornRam

Well-known member

Already tried asking OPEC for more oil.Good summary.

That was my sarcastic point which I think was missed. All presidents want to take credit for low fuel and energy prices. When US production is in the downside of the swing and OPEC and Russia are cashing in they want to stand back with their hands up and tell us they can’t really do a whole lot. Which is technically true but, maybe he can call OPEC+ when he gets up from his nap and ask nicely to start moving some more oil.

White House calls on OPEC to boost oil production as gasoline prices rise

The White House is calling on OPEC+ to take action as surging gas prices prompt fears that rising inflation will derail the economic recovery.

D

Deleted member 28227

Guest

I invest in index fundsSo what I'm hearing is that O&G isn't a bad play right now? Looks to be +~70% in the last year. Will it last?

BigHornRam

Well-known member

Depends on the price of O&G and the debt the companies are carrying. This one is up well over 70% in the last year. Good investment or bad? Im holding my shares.. Time will tell if it was the smart thing to do.So what I'm hearing is that O&G isn't a bad play right now? Looks to be +~70% in the last year. Will it last?

Apache Corp. Stock: ~$10 Billion Valuation Has Potential (NASDAQ:APA)

Apache Corporation has an impressive portfolio of assets and it's focused on aggressively improving its financial position. Learn more about APA stock here.

BigHornRam

Well-known member

That's what Venezuela did. I'll pass.If youse guys really want cheap gas, nationalize the oil industry & keep all domestic production home.

but that's socialism.

Similar threads

- Replies

- 0

- Views

- 655

- Replies

- 15

- Views

- 3K

- Replies

- 0

- Views

- 1K