VikingsGuy

Well-known member

We've tried all four at various times - none seemed an improvementWell we tried the whole first horseman of the apocalypse route and that in an insane turn of events made odds worse.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

We've tried all four at various times - none seemed an improvementWell we tried the whole first horseman of the apocalypse route and that in an insane turn of events made odds worse.

So I guess cyber bullying it isWe've tried all four at various times - none seemed an improvement

So I guess cyber bullying it is

Your example is sort of like waiting for Boomers to die so draw odds get better.

Someone was looking into this apparently.It’s possible that while most of that wealth will be transferred, some may actually disappear in the form of declining home/property pricing (mass supply entering the market at roughly the same time).

I’ve been waiting for that shoe to drop for years though, and it just doesn’t. Who knows?

Reminds me of the old joke NYTimes headline: Meteor to Devastate Earth: Women, Minorities Hardest HitSomeone was looking into this apparently.

The Greatest Wealth Transfer in History Is Here, With Familiar (Rich) Winners (Published 2023)

In an era of surging home and stock values, U.S. family wealth has soared. The trillions of dollars going to heirs will largely reinforce inequality.www.nytimes.com

That is the question I have been asking, and not getting an answer to. The MM will hold government debt, and if a default happens it has to market that debt down in price. That would "break the buck", the $1/shr price, for many of these funds. It would probably be short term, but I wonder if stocks tank and I decide to buy some, will I have to sell the MM at $0.94 to get the cash to buy the stocks. Good news is that everyone seems to agree not paying the debt payments would be last on the list...sorry Boomers on SS.Is a money market a safe place to be with your cash if the Government goes into default?

Read it. You might learn something and be able to provide an informed opinion. I could also post it on the "Mortgage vs Cash from Retirement" thread because there are some nuggets on how to avoid paying taxes.Reminds me of the old joke NYTimes headline: Meteor to Devastate Earth: Women, Minorities Hardest Hit

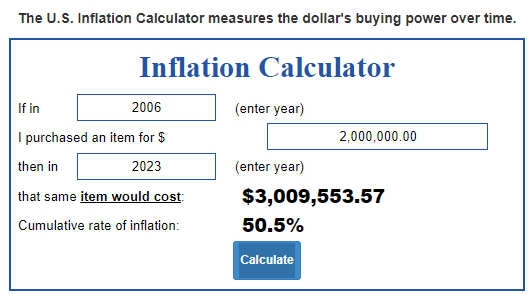

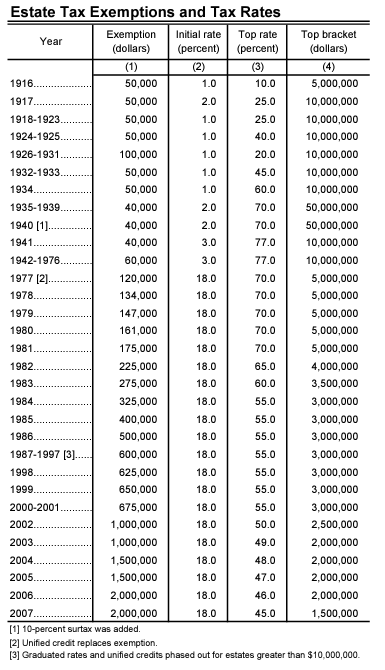

Inheritance tax, the only tax I like. It serves an important role in a meritocracy and a democracy, lest we stumble into "feudalism". If I were calling the shots there would be a first $10 million exclusion followed by 50% from $10m-$50m and then 90% from $50m up. I don't even care about the federal budget/revenue benefits, I would do it just for the societal benefits. I don't begrudge Bill Gates or Elon Musk a single dollar of their personal wealth. They earned it and made our lives better in the process. But their kids, grandkids, great grandkids, great great grandkids, etc did nothing to earn it. 99% of Americans wouldn't be effected and the 1% would still be able to pass 10's of millions to their kids. A simple solution to a lot of problems, but it will never happen -- cuz those with empire-type wealth have the votes and the average person still somehow thinks wealth at the level is the same as the humble earnings they have.Someone was looking into this apparently.

The Greatest Wealth Transfer in History Is Here, With Familiar (Rich) Winners (Published 2023)

In an era of surging home and stock values, U.S. family wealth has soared. The trillions of dollars going to heirs will largely reinforce inequality.www.nytimes.com

Behind a paywall.Read it. You might learn something and be able to provide an informed opinion. I could also post it on the "Mortgage vs Cash from Retirement" thread because there are some nuggets on how to avoid paying taxes.

Behind a paywall.

Changed the link on the post. Hopefully you can access it now.Behind a paywall.

Great post VG, hit the nail on the head with that take imo.

Nope, none of those confiscaing self enriching vote buying sunza's business what I or anyone does with net dough.Inheritance tax, the only tax I like. It serves an important role in a meritocracy and a democracy, lest we stumble into "feudalism". If I were calling the shots there would be a first $10 million exclusion followed by 50% from $10m-$50m and then 90% from $50m up. I don't even care about the federal budget/revenue benefits, I would do it just for the societal benefits. I don't begrudge Bill Gates or Elon Musk a single dollar of their personal wealth. They earned it and made our lives better in the process. But their kids, grandkids, great grandkids, great great grandkids, etc did nothing to earn it. 99% of Americans wouldn't be effected and the 1% would still be able to pass 10's of millions to their kids. A simple solution to a lot of problems, but it will never happen -- cuz those with empire-type wealth have the votes and the average person still somehow thinks wealth at the level is the same as the humble earnings they have.

Inheritance tax, the only tax I like. It serves an important role in a meritocracy and a democracy, lest we stumble into "feudalism". If I were calling the shots there would be a first $10 million exclusion followed by 50% from $10m-$50m and then 90% from $50m up. I don't even care about the federal budget/revenue benefits, I would do it just for the societal benefits. I don't begrudge Bill Gates or Elon Musk a single dollar of their personal wealth. They earned it and made our lives better in the process. But their kids, grandkids, great grandkids, great great grandkids, etc did nothing to earn it. 99% of Americans wouldn't be effected and the 1% would still be able to pass 10's of millions to their kids. A simple solution to a lot of problems, but it will never happen -- cuz those with empire-type wealth have the votes and the average person still somehow thinks wealth at the level is the same as the humble earnings they have.

Gotta smokem while you gottemNope, none of those confiscaing self enriching vote buying sunza's business what I or anyone does with their net dough.