Nah. I wasn’t talking about our exchange on here. More the other one I’d initially responded to that said there were unfilled entry level apprenticeships in the trades starting at $80k a year out there but that no one would do the job. If if that did exist at one place or time it’s certainly not the reality in any job market I’ve ever been alive to see.I assume you're referring to an article or another? My comments have always shared entry is entry. Get in and work ass off. Time in = experience = $.

I think that narrative may be sought by some that don't want to put in the effort - and complain about it any way possible to rationalize the "challenges" faced trying to make it in today's job market.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

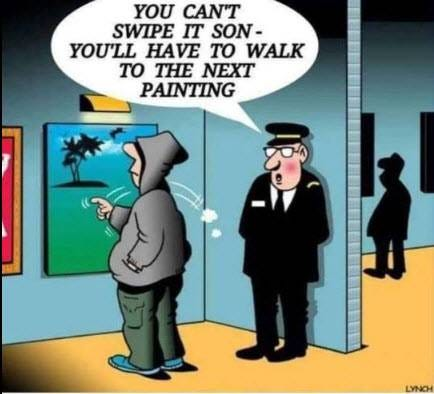

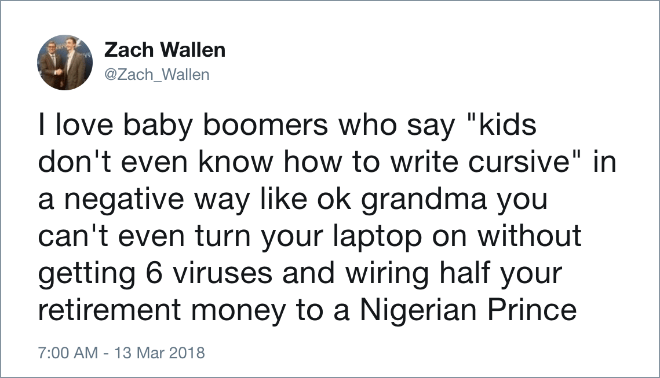

The Gen Z Law Regarding Boomers For Off Season Sake.

- Thread starter Sytes

- Start date

44hunter45

Well-known member

A fun thought exercise for Boomers claiming inflation isn't a big deal-- let's pay social security benefits in 1972 dollars rather than 2024 dollars.

You do understand that inflation hits everyone, right?It seems like one side of this discourse believes inflation relative to earnings doesn’t have a significant impact on millennials or Gen Zers. My point (although probably inarticulately made) is asking those folks to think through trying to survive today on a dollar that has 650% less purchasing power.

SAJ-99

Well-known member

You are comparing apples and cockroaches. How the hell does a dollar have 650% less purchasing power? You are not earning a 1972 $, you are earning a 2024 $. This is a Fox news blurb that is a poor comparison of inflation and statistics. The equivalent of $1 in 1972 might be $7.50 today, but the comparison is completely irrelevant to anyone except those that bury cash in coffee cans in 1972. That same 1972 $1 invested in the S&P is worth $180 today. Boomers are not typically the ones who are downplaying inflation. On the contrary, they are the ones that say inflation is measured wrong or manipulated and the main target of all those gold-bug ads played in the middle of the afternoon....asking those folks to think through trying to survive today on a dollar that has 650% less purchasing power.

Sheltowee

Well-known member

For sure, of course it does. But wages have not kept pace with inflation and that has a much heavier impact on the generations that make up most of the workforce, as opposed to generations that are primarily retired, have already built up their nest egg, or both.You do understand that inflation hits everyone, right?

BigHornRam

Well-known member

Hits the poor the hardest.You do understand that inflation hits everyone, right?

Gerald Martin

Well-known member

- Joined

- Jul 3, 2009

- Messages

- 9,479

Some of you guys have entirely too much time on your hands….aren’t there some hills to walk uphill both ways or something?

RobG

Well-known member

It turns out that wages have gone up by more than 650% so it's easier to survive if you are willing to work.It seems like one side of this discourse believes inflation relative to earnings doesn’t have a significant impact on millennials or Gen Zers. My point (although probably inarticulately made) is asking those folks to think through trying to survive today on a dollar that has 650% less purchasing power.

If you want to dive into it I found a study from 2017 here. They say wages have exceeded inflation except at the very bottom, where they have lost about 1%. In other words, a person with a decent job is slightly better off than the same person in the 80s. And that doesn't even include the obscene interest rates on a mortgage back then. Things could be better for you, but every generation has had its barriers.

SAJ-99

Well-known member

250+ years of taking advantage of the poor. It’s an American tradition. Let’s not pretend to start caring now.Hits the poor the hardest.

FIFY"xyz" years of taking advantage of the poor. It’s a human trait. Let’s not pretend to start caring now.

It's too bad us boomers don't understand how hard inflation hits a young person stating out in life. When I graduated high school in 1972 the inflation rate was 3.76%. rose to 6.22% in 73, 12.34% in 74, down to 9.3% in 75, only 5.76% in 76, 6.5% in 77, 7.6% in 78, up to11.35% in 79, 13.5% in 80, 10.32% in 81, and finally back down to a low 6.2% in 82. Glad I didn't have to deal with two years of 7% inflation like the last couple of years. Oh, that's right, I did have to deal with it.

Of course, mortgage rates weren't too bad back then, only 7.5% when I graduated high school. Two years later they were 10.3%. By the end of the 80s they were up to 13% then back down to 8% by the end of the 90s. So, we don't know anything about high interest rates.

Unemployment rates varied between 5% and 11% during that period so we don't know anything about having trouble getting a job. like folks today at 3 and 4 % unemployment.

Parents of boomers never felt any reason to pay anything on a kid's education after high school nor any obligation to help support them after they left the house at age 18. Pretty smooth sailing right out of high school.

High tax bracket in 1972 was 70% and the average middle-class guy only had to pay 25- 40%, 50% or more if you were upper middle class and 20% if you were poor as a church mouse. We didn't have any of those fancy credits for kids and such either. So, we always had a lot of extra spending money.

Yeah, I guess us boomers have had a nice free ride for all our lives. It's good to be king.

Of course, mortgage rates weren't too bad back then, only 7.5% when I graduated high school. Two years later they were 10.3%. By the end of the 80s they were up to 13% then back down to 8% by the end of the 90s. So, we don't know anything about high interest rates.

Unemployment rates varied between 5% and 11% during that period so we don't know anything about having trouble getting a job. like folks today at 3 and 4 % unemployment.

Parents of boomers never felt any reason to pay anything on a kid's education after high school nor any obligation to help support them after they left the house at age 18. Pretty smooth sailing right out of high school.

High tax bracket in 1972 was 70% and the average middle-class guy only had to pay 25- 40%, 50% or more if you were upper middle class and 20% if you were poor as a church mouse. We didn't have any of those fancy credits for kids and such either. So, we always had a lot of extra spending money.

Yeah, I guess us boomers have had a nice free ride for all our lives. It's good to be king.

Blue Steel

Well-known member

- Joined

- Feb 26, 2023

- Messages

- 1,017

Quote found online:

"Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair."

"Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair."

rjthehunter

Well-known member

Well said. There's money to be made in a lot of jobs by putting your time in. A tradesmen is no different. No one is hiring someone with a pulse at 120k/year. Not a mason, electrician, or anyone in between.Gotcha. I think my buddy who’s working his way up through the ranks as an electrician will eventually get to where he needs to be financially, but they’re really putting him through the wringer to get there. The false narrative that there’s big money jobs easily and immediately to any low level employee willing to show up on time kinda of chaps my butt.

I don't know why it's become so normal for people to lie about how much money tradesmen are making.

rjthehunter

Well-known member

I lost faith in how they calculate "inflation" the past few years. Or maybe it's the market I'm in that's been hit harder. But shit, it seemed like everything was 30-50% more expensive than it was a few years ago.It's too bad us boomers don't understand how hard inflation hits a young person stating out in life. When I graduated high school in 1972 the inflation rate was 3.76%. rose to 6.22% in 73, 12.34% in 74, down to 9.3% in 75, only 5.76% in 76, 6.5% in 77, 7.6% in 78, up to11.35% in 79, 13.5% in 80, 10.32% in 81, and finally back down to a low 6.2% in 82. Glad I didn't have to deal with two years of 7% inflation like the last couple of years. Oh, that's right, I did have to deal with it.

Of course, mortgage rates weren't too bad back then, only 7.5% when I graduated high school. Two years later they were 10.3%. By the end of the 80s they were up to 13% then back down to 8% by the end of the 90s. So, we don't know anything about high interest rates.

Unemployment rates varied between 5% and 11% during that period so we don't know anything about having trouble getting a job. like folks today at 3 and 4 % unemployment.

Parents of boomers never felt any reason to pay anything on a kid's education after high school nor any obligation to help support them after they left the house at age 18. Pretty smooth sailing right out of high school.

High tax bracket in 1972 was 70% and the average middle-class guy only had to pay 25- 40%, 50% or more if you were upper middle class and 20% if you were poor as a church mouse. We didn't have any of those fancy credits for kids and such either. So, we always had a lot of extra spending money.

Yeah, I guess us boomers have had a nice free ride for all our lives. It's good to be king.

BigHornRam

Well-known member

If I had to pick what country to be poor in, it would be the USA.250+ years of taking advantage of the poor. It’s an American tradition. Let’s not pretend to start caring now.

Dougfirtree

Well-known member

Some arguments go on and on because both sides are right...

<iframe src="https://giphy.com/embed/SWN6nYgyodVKw" width="480" height="248" frameBorder="0" class="giphy-embed" allowFullScreen></iframe><p><a href="

">via GIPHY</a></p>

<iframe src="https://giphy.com/embed/SWN6nYgyodVKw" width="480" height="248" frameBorder="0" class="giphy-embed" allowFullScreen></iframe><p><a href="

What argument? Been mostly humorous with some interesting subjective factoids and personal experiences.Some arguments go on and on because both sides are right...

<iframe src="https://giphy.com/embed/SWN6nYgyodVKw" width="480" height="248" frameBorder="0" class="giphy-embed" allowFullScreen></iframe><p><a href="">via GIPHY</a></p>

Otherwise beats the hell out of other HT arrogant approach methods towards fellow conservationists/hunters that only hold cheers from their pom pom squad.

I’m not saying there isn’t one, but I don’t know if there’s a single blue collar job in Frenchtown Montana today that pays someone $130k, which is equivalent to what Smurfit stone paid hundreds of people in the 90s.Dual income is powerful, especially when there aren't kids in the picture.

A quick googling suggests a family should be making around 200k to afford that. I'll wager a guess that 200k is quite a bit above the median Montana income.

Similar threads

- Replies

- 156

- Views

- 25K

- Replies

- 22

- Views

- 4K

- Replies

- 8

- Views

- 2K

- Replies

- 23

- Views

- 4K