D

Deleted member 28227

Guest

Indeed 40 years ago he was noting the failure of the American dream and the two realities of our society... that of the wealthy and that of the poor.Hard to believe a boomer wrote this almost 40 years ago.

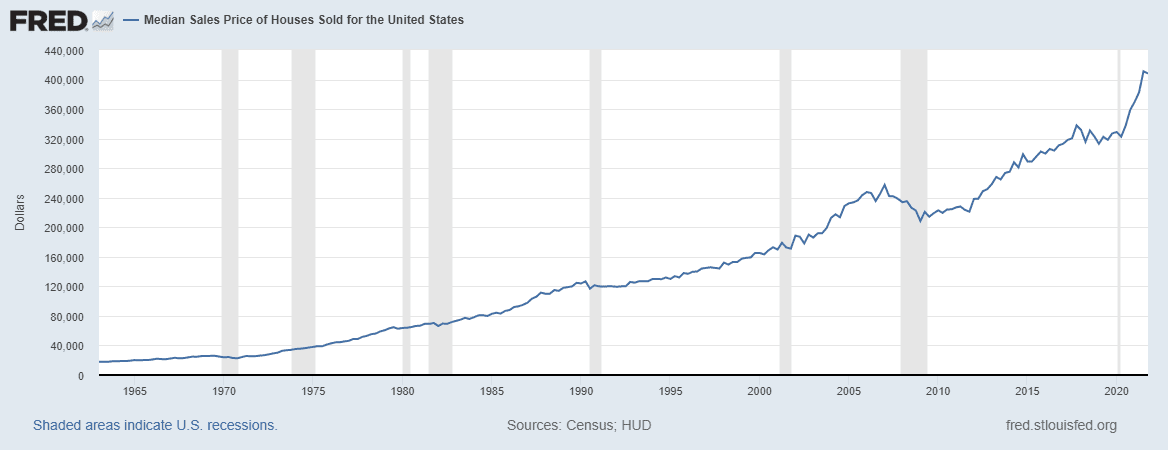

Lot of factors demonstrate that gap has expanded.