huntandfly

Well-known member

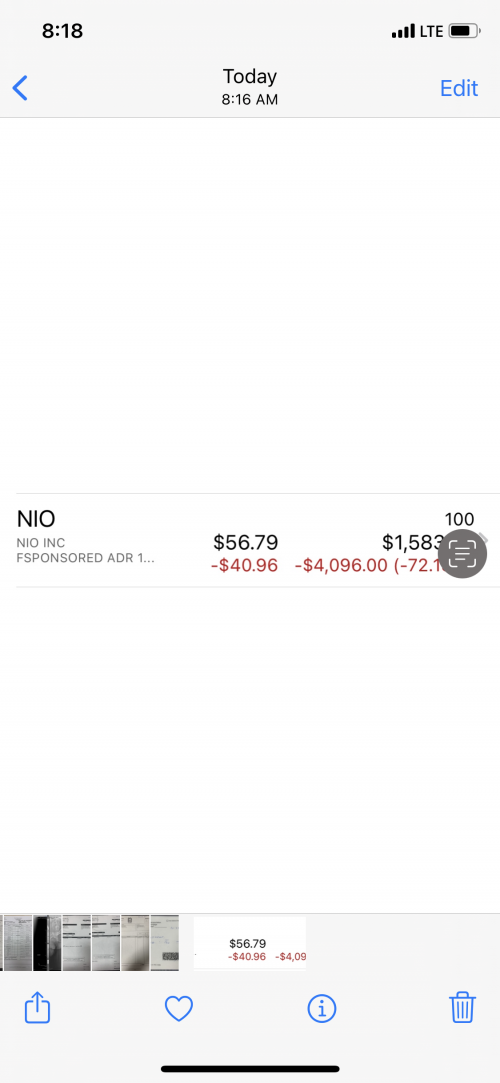

I am hoping you are the correct one haha. I exited a few positions about 2 weeks ago that weren’t yet red and I had held over a year, but I have a fair amount still in. Don’t really want to see it keep dragging down, but am positioned to take bites on the way down to improve the position long termi didn't say it's necessarily a typo, just surely it's a typo

i'm not gonna bet that it won't. it's just a lot further than i'd bet it would personally.