antelopedundee

Well-known member

Here we go again. Ride em cowboy.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I am not a big risk taker at my age, (65) but Is Anybody into Metals.....as in Physical, (not certificates)

Silver broke 50 & Gold broke 4000 the other day.......is it too late to get in??

A buddy thinks silver will hit 100 by the end of the year.

Any advice/comments appreciated, thank you.

If you buy gold get gold buffaloes or gold eagles as they don't fall under any sort of reporting. Neither do others depending upon volume and venue sold. Also eagles and buffs are easier to sell. Make sure that you have a plan for how to sell BEFORE you buy. If you want to try paper metals go with SLV or GLD.I am not a big risk taker at my age, (65) but Is Anybody into Metals.....as in Physical, (not certificates)

Silver broke 50 & Gold broke 4000 the other day.......is it too late to get in??

A buddy thinks silver will hit 100 by the end of the year.

Any advice/comments appreciated, thank you.

I stand by my statement from post #3456 in Feb 2023, when the stock was $13. DFLI is a complete POS.Laughing at myself this morning, this has been the biggest dog (loss percentage) in my portfolio the past few years.......now it's got momentum again.....I might save my $550 investment LOL.

View attachment 389037

I believe it has to get to $40 before I'm at break even. Crazier shit has happen in the market before. Never say never!Laughing at myself this morning, this has been the biggest dog (loss percentage) in my portfolio the past few years.......now it's got momentum again.....I might save my $550 investment LOL.

View attachment 389037

100%....now it's just a POS with a little bit of steam rising from it.I stand by my statement from post #3456 in Feb 2023, when the stock was $13. DFLI is a complete POS.

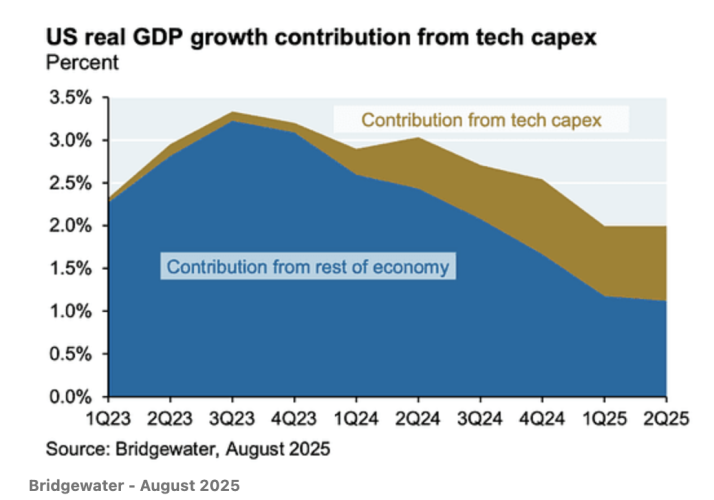

I'm sitting on cash and waiting to see if this A.I bubble pops

There will be a significant downturn, there always is. The trick is identifying when the actual bottom is reached and things begin to go back up, which is very difficult in real time. In the meantime, you’re sacrificing gains.

For storage, everything is sold out for the next year. My guess is that as soon as some earnings calls start mentioning controlling spend and others flatten/lower guidance it's gonna get pretty stormy.

View attachment 389353

Why control spend when the deals are circular though!?

Bad news is earnings growth is single digits and analysts have turned negative on it over the last 6 months. The good news is the price direction seems to look like someone is accumulating shares into the earnings on 10/23.Pick this one apart.

Iridium Communications (IRDM). It's well below it's 200 day, down 34% this year, but has a PE of 18, pays a solid 3% dividend. They have government contracts and just announced an additional partnership with Qualcomm. Forecasts are indicating earnings growth.

The good news is the price direction seems to look like someone is accumulating shares into the earnings on 10/23.

Yep, I’ve been building cash since SPY broke $630 and it hasn’t gone below since… lolThere will be a significant downturn, there always is. The trick is identifying when the actual bottom is reached and things begin to go back up, which is very difficult in real time. In the meantime, you’re sacrificing gains.