SAJ-99

Well-known member

You have been talking the past year about China reopening like it’s a Six Flags.It’s not the way you feel !

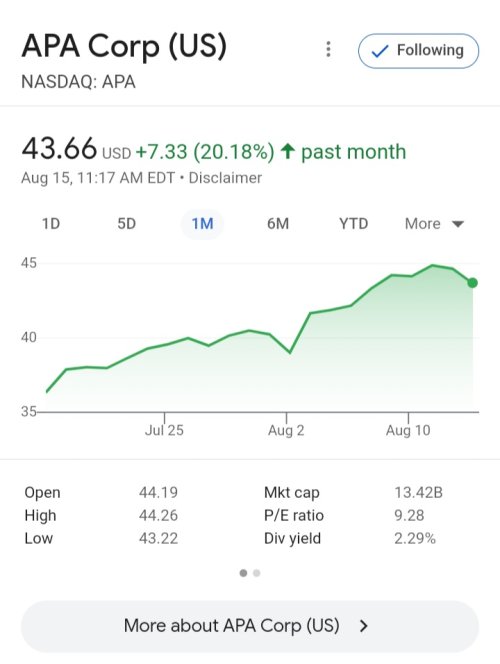

It’s the global demand/ it’s the current Biden Administration policy on fossil fuel / it’s the reopening of China and India oil demand/ it’s the OPEC attitude toward Biden to keep prices up/ it’s the Fall and Winter demand and 4th quarter rebound ! Listen to the CEO of Exxon and Chevron of future guidance…….. up up up and away.