Rainer

Well-known member

- Joined

- Feb 4, 2016

- Messages

- 808

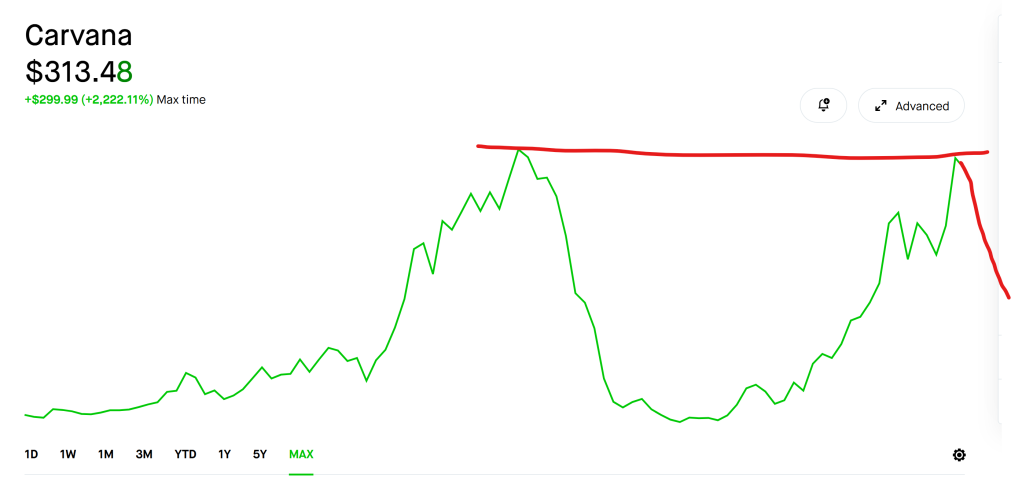

Recently I've been tracking to predict what to buy into. If I see enough politicians buy a stock I look into it some more

https://unusualwhales.com/politics

https://unusualwhales.com/politics