SAJ-99

Well-known member

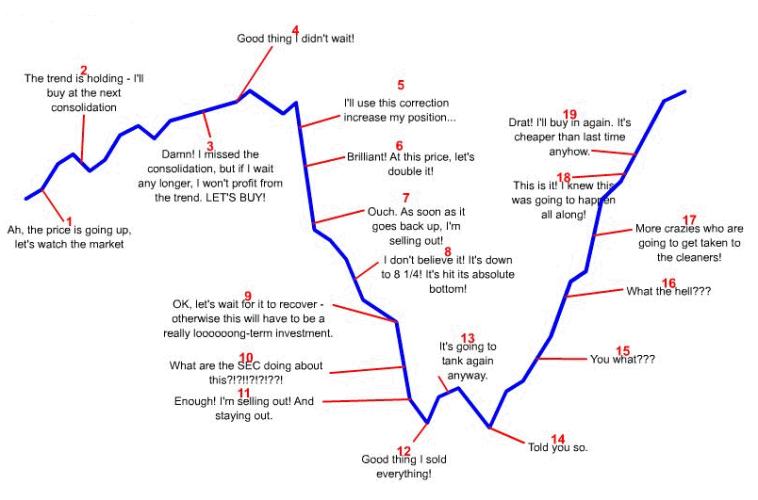

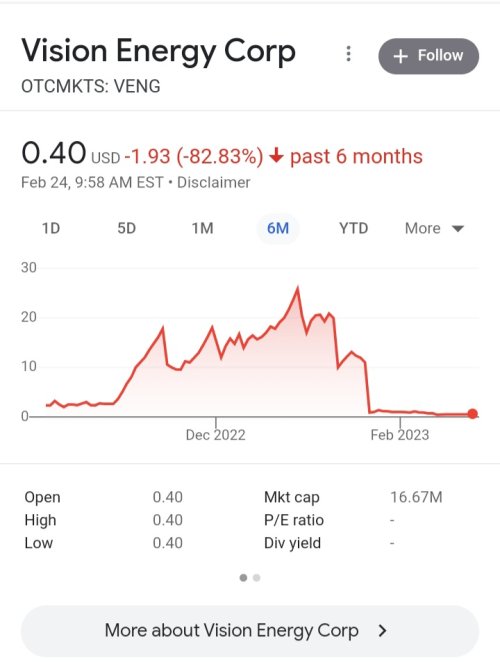

Equites still up 4-5% so far this year. You can sell it all and buy a 1yr treasury and earn another 5%. Pretty solid return if you do.That was sort of a joke.But I do wish I listened to my own advice at the beginning of the year and liquidated everything. Then watch the show from the cheap seats for a while. Hindsight......