BrentD

Well-known member

I just skimmed through it, and I would not say it is a great article. It makes some good points worth reading, but it also makes a lot of assumptions and evaluations that are pretty limiting. It would not be hard to look at the flip side and see a ton of downsides to renting.Great article

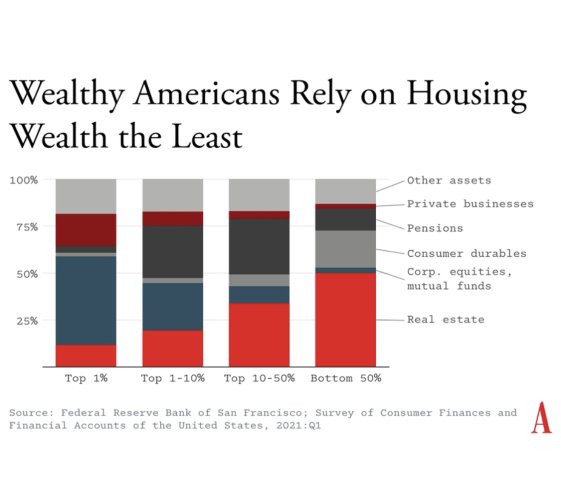

The Homeownership Society Was a Mistake

Real estate should be treated as consumption, not investment.www.theatlantic.com

The part that irks me the most about these types of articles which are currently quite fashionable in my opinion, is that they consider finances almost exclusively (and not very fairly). There is a lot to home owning that doesn't compute to just dollars. Owning a home is a lifestyle and a level of freedom that renting can never match. It is hard to put $$s on that. And there are also $$ issues that they did not discuss at all.

YMMV, but articles like this one overstate one side of the equation without giving equal dilligence to the alternative position - that's because the alternative (the "American Dream/home") is so widely discussed and acknowledged as to not be a viable publication to make an author a buck, esp in a glossy like The Atlantic. Gotta buck the trend to sell a story, and this, I think, is one of those, though far from the most egregious example.

I cannot imagine renting again. Nor do I envy anyone's lifestyle that is renting.