AlaskaHunter

Well-known member

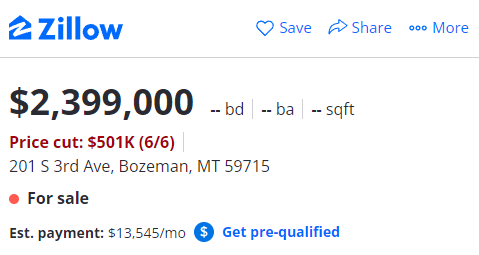

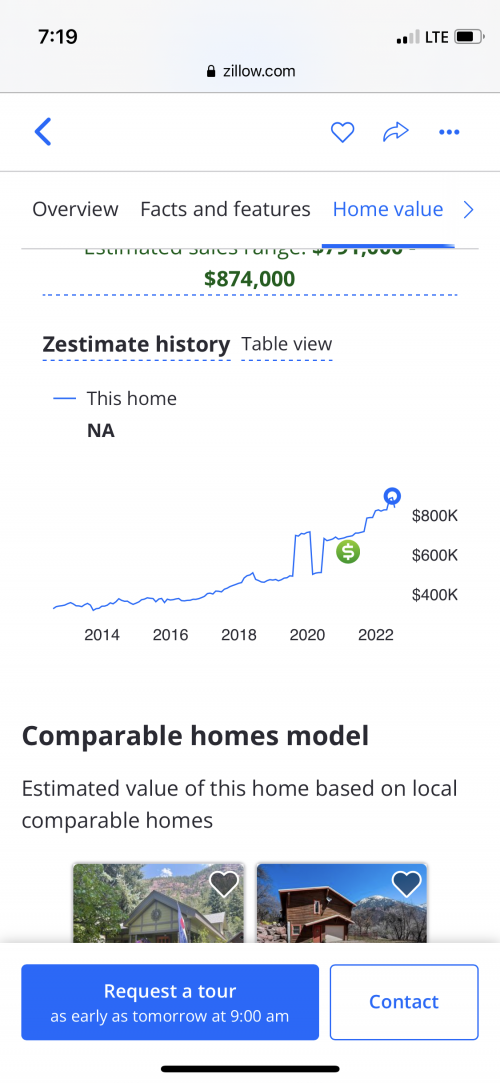

I've seen prices decreased in AK and MT markets which is unusual for June.

Typically price decreases don't occur until the fall.

Here is a place in Charlo, MT for 150k, been on the market for over 30 days

https://www.zillow.com/homedetails/56705-State-Highway-212-Charlo-MT-59824/227179970_zpid/

...don't think you would see that a year ago.

Typically price decreases don't occur until the fall.

Here is a place in Charlo, MT for 150k, been on the market for over 30 days

https://www.zillow.com/homedetails/56705-State-Highway-212-Charlo-MT-59824/227179970_zpid/

...don't think you would see that a year ago.