MTBirdhunter

Member

- Joined

- Sep 3, 2014

- Messages

- 109

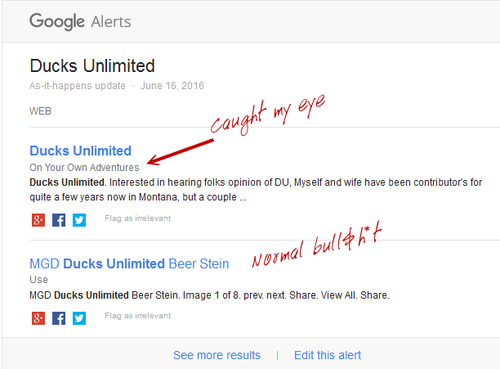

Interested in hearing folks opinion of DU, Myself and wife have been contributor's for quite a few years now in Montana, but a couple of events in the last couple of years has us re-thinking that sponsorship. Thanks.