SAJ-99

Well-known member

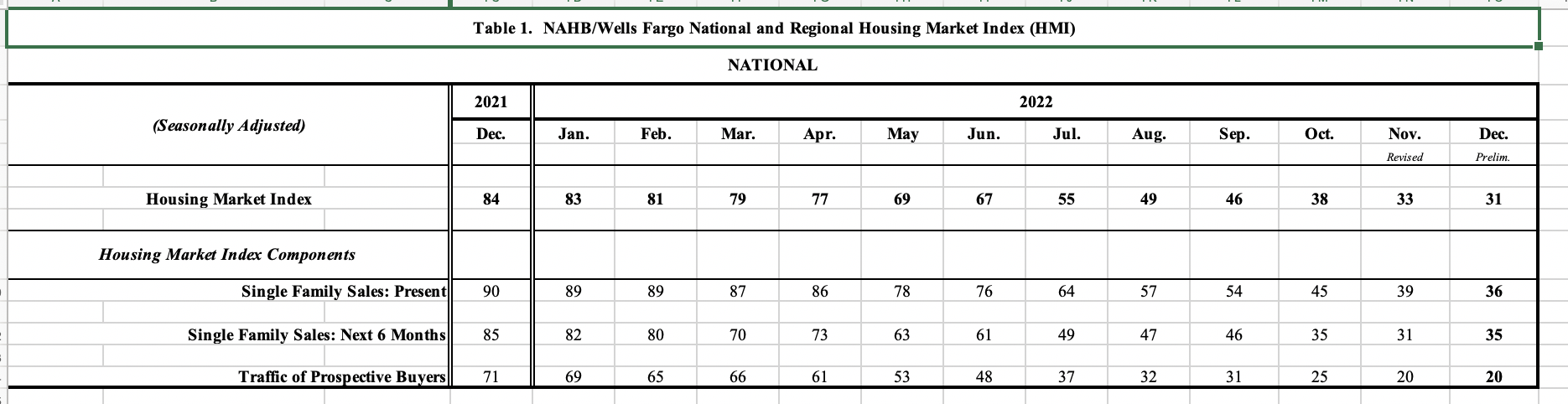

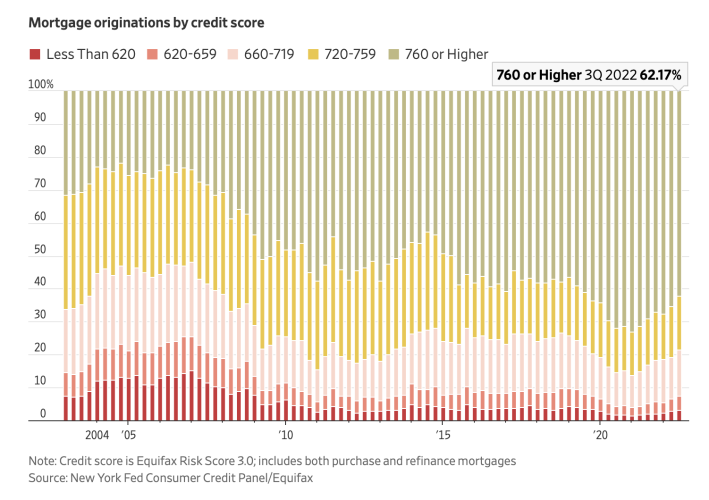

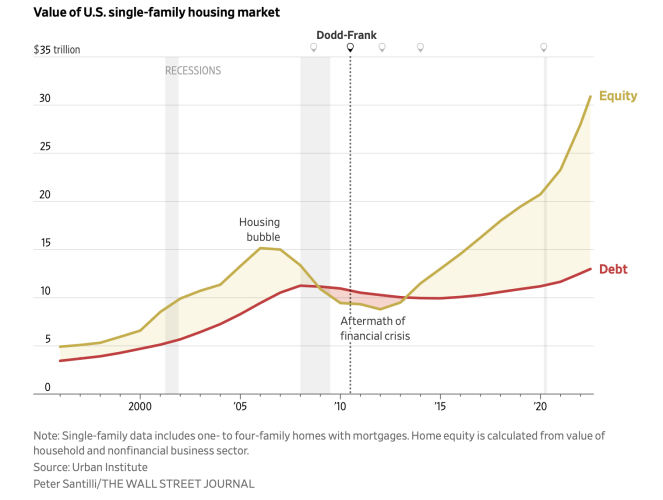

Sorry, catching up. Easy analysis, but a little flawed. Below is another take (which I tend to agree with, hence the post). For the TLDR crowd I post the charts. It doesn't mean prices don't fall, it just means the structure of the market is different - so no "crash".Easy to follow analysis here.

We’re facing another 2008-style housing crisis

The housing market is in serious trouble… It’s imperative to protect your portfolio from another “Lehman moment.” Here’s what you need to know.www.curzioresearch.com

Why This Housing Downturn Isn’t Like the Last One

Before the 2008 financial crisis, lenders barely bothered to verify mortgage applicants’ income. Today, they demand reams of evidence that borrowers can afford their loans.