Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Housing Appreciation and Inflation: Future Outlook?

- Thread starter Sytes

- Start date

BigHornRam

Well-known member

So rent your house out one weekend a month and have some strangers have fauk great sex in your bed? Gross!3 people in our office get hotels for 1 weekend a month and ABnB their entire homes. That one weekend pays the mortgage in 2 of the 3 cases. Hotels only still work because some people still don't understand that they can rent a house for the same costs and not have to listen to someone else having fauk great sex 18" from your head though a paper thin wall.

Anyone can find ways to lose money, but ABnB is one of the harder ways.

westbranch

Well-known member

3 people in our office get hotels for 1 weekend a month and ABnB their entire homes. That one weekend pays the mortgage in 2 of the 3 cases. Hotels only still work because some people still don't understand that they can rent a house for the same costs and not have to listen to someone else having fauk great sex 18" from your head though a paper thin wall.

Anyone can find ways to lose money, but ABnB is one of the harder ways.

Another option is rent your home <14 days a year and no tax reporting required. We have thought about doing that for the local triathlon and other big events. Could just go camping/hiking/fishing when its in the summer.

? check the word right before great.

View attachment 255375

i guess i just wasn't sure what was going on with this typo. could be multiple assumptions based on the context.

Irrelevant

Well-known member

Agree! That's why I don't do it, money ain't everything!So rent your house out one weekend a month and have some strangers have fauk great sex in your bed? Gross!

Irrelevant

Well-known member

LOL I literally went back and read it again, and thought you were crazy. I can never see my own spelling errors, it part of my dyslexia. Just take that top left line and bend it counter clockwise a bit!View attachment 255376

i guess i just wasn't sure what was going on with this typo. could be multiple assumptions based on the context.

BigHornRam

Well-known member

I just thought you found a clever new way to spell the naughty word.LOL I literally went back and read it again, and thought you were crazy. I can never see my own spelling errors, it part of my dyslexia. Just take that top left line and bend it counter clockwise a bit!

D

Deleted member 28227

Guest

IDK, I know a lot of people that own short-term rentals, so many in fact, that our county now has a specific lottory permit system for new ones. Everyone seems to find the level of engagement they're looking for. One person has already left a career as an engineer to make more money and work less with two ABnBs, another is on the verge with only 1 house (though it has a second living space for additional guests).

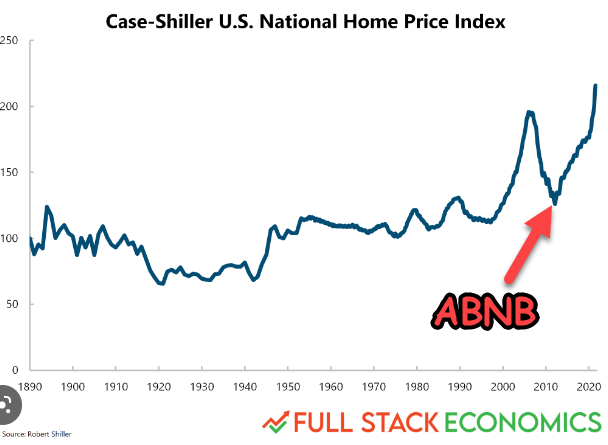

As @SAJ-99 people suck at actually running the numbers when it comes to real-estate so I'm always just a bit suspicious. Couple of things...

1. You need long term viability, you can get away with a lot in hot markets, but can that weather learner times

2. Debt to income ratio, I assume one is financing the properties rather than owning them outright... which if you own them outright and not using them... why, waaaaaay better return in the market. So assuming financing, you are covering all the business expenses + the mortgage +paying yourself at 2.75% or whatever sure... but get's more interesting at 6%. You also have long term wear and tear. This whole concept has only been around for a bit over a decade.

3. Bed and Breakfast and Hotels are obviously a thing and every Christmas we are regaled with hallmark movies about couples calling it quits on the city to run their own little inn upstate. So yeah I'm sure you can make it work, but I think the long term profitability is a bit over stated. I also wonder what your ROR is over just buying a Holiday Inn Franchise or the like.

The latter argues there's almost no work involved. If you think about a weekend stay, most people show up late Friday and go straight to bed, get up Saturday and after breakfast go do something all day, often eat out, then leave early Sunday to get home. They're not even in the house long enough to get it dirty.

It was the accounting and taxes and scheduling that drove me nuts. A couple times I had to do my quarterly filling in between hunting trips and that was annoying.

If I owned the place and wasn't doing it essentially for free but making like 10K or something all said and done sure worth it, but also definitely not passive income.

Agreed... lot of places now though it's like $200 more an you have to wash your own sheets, sweep, vacuum, check the mail, let out the cat and mow the law (hyperbolic... maybe?)I tried going back to a hotel twice in the last year, both times I regretted it and would have gladly paid the extra $20 a night for a quiet house and the ability to make a breakfast burrito in a undies in the morning.

Had a sweet house in AK that was all set up for fishing, that one was worth every penny. Stayed at a motel 6 in Utah for like $58 also tolerating the funkiness' was easily worth the $1000 I saved by staying there over literally any ABNB in the area.

It all just depends

Last edited by a moderator:

We had a separate house that a friend knew the coordinator for residency doctors, temp housing while situating. We rented it three separate Medical exec / doctor families before the last offered to buy the house.I’m speaking of ABNB rentals rather than renting your house for a couple of weekends a year, like 60+ days a year occupancy.

It’s a separate part time job.

There are occasionally some decent ABNBs but I’m mostly back to hotels only. Less hassle and cheaper.

They had housing coordinator manage repairs, etc... Better than VRBO/AirB&b/rentals managed by ourselves.

If we were to ever hop into another quality rental purchase, we would work with the Medical coordinator to find what they're looking for and enter another setting of that sort.

It was hands free $.

D

Deleted member 28227

Guest

Absolutely, that would actually be my preference too if I was going to rent a property.We had a separate house that a friend knew the coordinator for residency doctors, temp housing while situating. We rented it three separate Medical exec / doctor families before the last offered to buy the house.

They had housing coordinator manage repairs, etc... Better than VRBO/AirB&b/rentals managed by ourselves.

If we were to ever hop into another quality rental purchase, we would work with the Medical coordinator to find what they're looking for and enter another setting of that sort.

It was hands free $.

Irrelevant

Well-known member

As @SAJ-99 people suck at actually running the numbers when it comes to real-estate so I'm always just a bit suspicious. Couple of things...

1. You need long term viability, you can get away with a lot in hot markets, but can that weather learner times

2. Debt to income ratio, I assume one is financing the properties rather than owning them outright... which if you own them outright and not using them... why, waaaaaay better return in the market. So assuming financing, you are covering all the business expenses + the mortgage +paying yourself at 2.75% or whatever sure... but get's more interesting at 6%. You also have long term wear and tear. This whole concept has only been around for a bit over a decade.

View attachment 255389

3. Bed and Breakfast and Hotels are obviously a thing and every Christmas we are regaled with hallmark movies about couples calling it quits on the city to run their own little inn upstate. So yeah I'm sure you can make it work, but I think the long term profitability is a bit over stated. I also wonder what your ROR is over just buying a Holiday Inn Franchise or the like.

It was the accounting and taxes and scheduling that drove me nuts. A couple times I had to do my quarterly filling in between hunting trips and that was annoying.

If I owned the place and wasn't doing it essentially for free but making like 10K or something all said and done sure worth it, but also definitely not passive income.

Agreed... lot of places now though it's like $200 more an you have to wash your own sheets, sweep, vacuum, check the mail, let out the cat and mow the law (hyperbolic... maybe?)

Had a sweet house in AK that was all set up for fishing, that one was worth every penny. Stayed at a motel 6 in Utah for like $58 also tolerating the funkiness' was easily worth the $1000 I saved by staying there over literally any ABNB in the area.

It all just depends

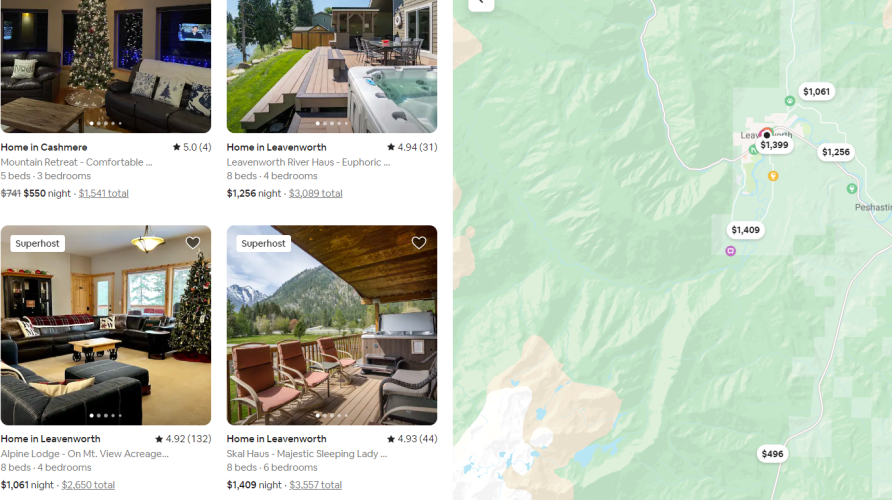

Random weekend in January. There are only 4 shown in Leavenworth right now, but there are over 100 permits in use.

I just watched the Croatia v Argentina game at a house in Leavenworth that AirB&B's a few days a month to pay it's mortgage and the second home (on the beach) mortgage. He doesn't work anymore unless it's exceptionally lucrative. His mom runs 7 rentals, they are >80% occupancy rates, doesn't even use AirB&B or VRBO just word of mouth.

Sure O&M is a thing on a house, but for the love of god I could rebuild my house every year damn near and still make money.

Now if we are looking at the WA coast, then we shift a lot closer to a push as the rates are less, the occupancy is less, and the O&M is a ton higher.

Nick87

Well-known member

What blows my mind is how many cash buyers there still are our there and were not talking shitty flip houses either.

D

Deleted member 28227

Guest

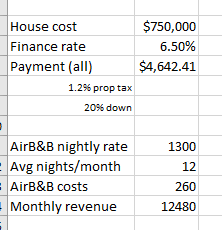

View attachment 255414

Random weekend in January. There are only 4 shown in Leavenworth right now, but there are over 100 permits in use.

View attachment 255415

I just watched the Croatia v Argentina game at a house in Leavenworth that AirB&B's a few days a month to pay it's mortgage and the second home (on the beach) mortgage. He doesn't work anymore unless it's exceptionally lucrative. His mom runs 7 rentals, they are >80% occupancy rates, doesn't even use AirB&B or VRBO just word of mouth.

Sure O&M is a thing on a house, but for the love of god I could rebuild my house every year damn near and still make money.

Now if we are looking at the WA coast, then we shift a lot closer to a push as the rates are less, the occupancy is less, and the O&M is a ton higher.

Must be nice to have the ability to take on $750k for your side hustle lolView attachment 255414

Random weekend in January. There are only 4 shown in Leavenworth right now, but there are over 100 permits in use.

View attachment 255415

I just watched the Croatia v Argentina game at a house in Leavenworth that AirB&B's a few days a month to pay it's mortgage and the second home (on the beach) mortgage. He doesn't work anymore unless it's exceptionally lucrative. His mom runs 7 rentals, they are >80% occupancy rates, doesn't even use AirB&B or VRBO just word of mouth.

Sure O&M is a thing on a house, but for the love of god I could rebuild my house every year damn near and still make money.

Now if we are looking at the WA coast, then we shift a lot closer to a push as the rates are less, the occupancy is less, and the O&M is a ton higher.

40% occupancy is awesome, that’s an amazing property.

Last edited by a moderator:

Irrelevant

Well-known member

We already talked about this, less Ramsey more Bankman-Fried, you too can be a millionaire! We all can be!Must be nice to have the ability to take on $750k for your side hustle lol

I've personally not dabbled in the STR market, even though I live in one of the best places for it, because I value my time too much. Hell, I'm strongly looking at moving back into town just because I'm sick of taking care of a few acres. I may only have another 50 summers in my life, do I really want to spend them on a mower? Fixing irrigation? Mending fence? Or would I rather float the river? However, STR are absolutely one way to wealth with significantly more upside and less risks than long-term rentals, albeit also more work.

People who bought our house was a site unseen (our realtor did a phone video walk through for them - they're from HI) cash sale, no (zero) contingencies, short close and $25k over asking.What blows my mind is how many cash buyers there still are our there and were not talking shitty flip houses either.

This was on the market showing over the weekend with 7 offers before our realtor stopped showing Sunday afternoon and responded to all, re-submit offers by end of Tuesday.

It was insane! We had one offer $50k over (cash sale) asking though w/ contingencies... We didn't want any hiccups and the first offer above was a done deal.

Irishman

Well-known member

I think the ship has sailed right now for buying a home as an investment. Maybe in another 2 to 4 years an opportunity will come around again.

House prices may be staying up, but are houses selling? Homes are definitely staying on the market longer than a year ago. Apartment owners are offering winter rates, advertising (things they weren't doing a year ago). A year ago you had to do some research to find out who was leasing Apartments, and then you'd find out they were all already taken.

Interest rates are much higher, and there also comes a point when those that can afford a house, have bought one already. I think we are past that point, and based on history, builders will continue to build spec houses and put further pressure on prices, long after demand tails off.

I hope I'm wrong as I've been trying to talk my wife into selling our house for a couple of years now.

House prices may be staying up, but are houses selling? Homes are definitely staying on the market longer than a year ago. Apartment owners are offering winter rates, advertising (things they weren't doing a year ago). A year ago you had to do some research to find out who was leasing Apartments, and then you'd find out they were all already taken.

Interest rates are much higher, and there also comes a point when those that can afford a house, have bought one already. I think we are past that point, and based on history, builders will continue to build spec houses and put further pressure on prices, long after demand tails off.

I hope I'm wrong as I've been trying to talk my wife into selling our house for a couple of years now.

SAJ-99

Well-known member

And not a one about the guest who dressed out an entire deer in the bathroom.

www.lodgify.com

www.lodgify.com

15 Airbnb Horror Stories You Won't Believe Are True

While most Airbnb hosts will only have great guest experiences, there are some rare occasions when it doesn't go to plan. Here are 15 Airbnb horror stories!

AlaskaHunter

Well-known member

First time home buyers will not see many "starter homes" and will not be able to afford "McMansions".Unanswerable question but one I'm wondering about.

Lot of folks sat out of the 2020-Q322 craziness. How does that change everything, are those folks mostly renting who are looking to buy their first home, are there a decent number of homeowners who are looking to upgrade and were waiting to buy their second home and thus will increase entry level inventory when they move.

AirBnB/ short-term rentals what happens if there is a recession and this market takes it in the shorts. Do people sell these properties or hold and try long term rentals, how does this effect the market.

I'm not predicting anything really, but things I've been wondering about.

Also seems almost universally true that buying habits follow a curve, people notice things going up then their is an exponential acceleration as people don't want to be the left behind... same thing happens on the decline side.

The AirBnB/ short-term rentals seems like a small portion of the market relative to residential single family homes.

Because the inventory of single-family homes on the market is half pre-pandemic levels, and the cost of new construction is high,

the supply will likely remain low for a decade or so and demand will be less than supply, hence no housing crash.

D

Deleted member 28227

Guest

While will demand be less than supply? I'm not tracking.Because the inventory of single-family homes on the market is half pre-pandemic levels, and the cost of new construction is high,

the supply will likely remain low for a decade or so and demand will be less than supply, hence no housing crash.

Our Cabo Pulmo vacation rental was directly through Baja Paradise. Over our two vacations in Pulmo, we've stayed at each of her three locations.few days a month to pay it's mortgage and the second home (on the beach) mortgage.

We'll gladly rent again and she makes hand over fist $$$.

An added bonus, she lives in Idaho. The history of Idaho and Pulmo is extensive, though aside the point - sidetracking haha!

Basically, figuring the $ to purchase back whenever, current expenses, I'd imagine she's doing quite well!

We are looking at vacation rentals as we'd love to enjoy our time ourselves as well as rent a few casas/bungalows, nearing retirement.

To this point, and the thread intent, wife and I have contemplated VRBO settings as an investment AND a means to retire following warmer weather. Properties in VT / NY and southern US or South of the border.

On note of short / mid term rental for vacation intent, I don't believe this will take a hit, to the extent of loss.

It's opened a venture for family vacation beyond hotels for couples, families, and groups. With the ability to moderate our own time retired, it makes this a very lucrative endeavor.

***

@AlaskaHunter

"the supply will likely remain low for a decade or so and demand will be less than supply, hence no housing crash."

I believe the demand for private housing vacation rentals will continue to accelerate as it validates alternatives to a post COVID environment - beyond compact resorts. Supply will keep up to balance the values, IMO.

Personally, I don't believe there will be a housing crash though I'm very curious of the likelihood of a housing dip and the timing of interest rate / inflation and housing appreciation.

Last edited: