geetar

Well-known member

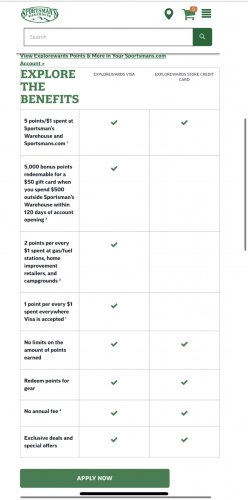

Ok before y’all let me have it about what Dave Ramsey says about credit cards I will tell you this question is only related to a credit card that will be used to pay most of my monthly expenses and be paid off monthly with no carried balance. With that being said what is the best credit card for a hunter who wants to use a credit card to gain rewards points and then turn the rewards points into hunting gear or hunting trips? Does anyone do this? Has anyone had any good experiences with particular companies or cards? This all started with my brother in law getting a Ruger 1911 off of Cabelas points from putting his business expenses on his Cabelas card and my dad getting a leather motorcycle jacket with his Harley Davidson credit card points so just wondering can I do the same with trips and gear? I know Sportsman’s Warehouse has a card now. Has anyone used it?