NDGuy

Well-known member

- Joined

- Apr 26, 2018

- Messages

- 2,381

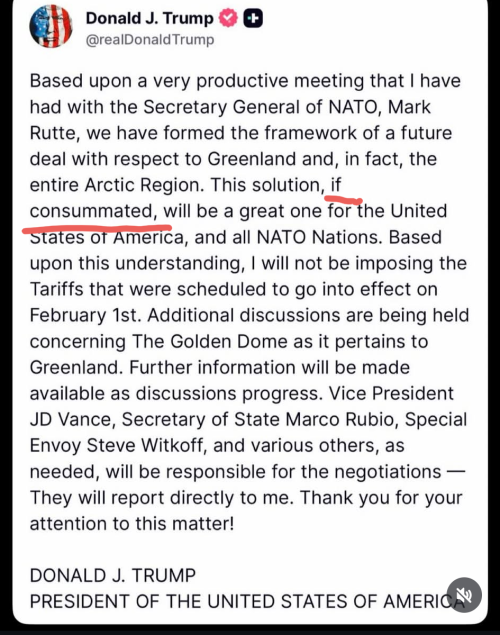

Believe it or not callsanyone who watched today’s press conference can clearly see the guy has lost his marbles. The hope that Congress will step up is the only thing holding this together. But yeah, letting him rant about Greenland and such takes away talk about the Epstein files.

In other good news.

- Amazon CEO stating that tariffs are starting to raise prices.

- Denmark saying it will sell all US treasuries (Bessent has to be less than thrilled with that)

- sprinkle in the Japan mess

All the ingredients for volatility and the VIX is 20.