BrentD

Well-known member

Shhh!!! Don't tell anyone about the free lunch...Not SS. Different pool of money. And there are limitations on that. Funny part is most immigrants with a job are paying SS taxes that they will never receive the benefit of.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Shhh!!! Don't tell anyone about the free lunch...Not SS. Different pool of money. And there are limitations on that. Funny part is most immigrants with a job are paying SS taxes that they will never receive the benefit of.

Agree. But because most people incorrectly think of it as a retirement plan when it isn’t, they are part of the problem in turning it into retirement. Look at 401ks. Law changes over the last couple of decades include auto enrolling members, then auto investing them in a default investment (target date funds now) because they sat in cash, then when they leave the job they just liquidate the thing, pay the penalty and yolo a trip to Europe or something. It is fine to think these people will have to endure the consequences of their choices but not realistic when “these people” is 60% of the population.I think it almost has to be discussed in that manner. It’s currently managed like insurance and treated like retirement by the users, eventually that’s not going to play out

It has to. You sound skeptical. How could it not?Suuuuure it does.

You are correct. That’s why I mentioned early on that something would have to be done to remove access to that money until retirement. I hate the idea of control but I don’t know how else you protect people from themselves. Maybe at least lockdown the employer contribution??Agree. But because most people incorrectly think of it as a retirement plan when it isn’t, they are part of the problem in turning it into retirement. Look at 401ks. Law changes over the last couple of decades include auto enrolling members, then auto investing them in a default investment (target date funds now) because they sat in cash, then when they leave the job they just liquidate the thing, pay the penalty and yolo a trip to Europe or something. It is fine to think these people will have to endure the consequences of their choices but not realistic when “these people” is 60% of the population.

How much you get back isnt always a product of how much you pay, its a product of the extra you paid. In other words - its your with holding that matters.SS was a good idea in the begining. Like everything gov't gets involved in it has been abused. I wish I could opt out I doubt I will ever see a cent form it. I have no problem with taxes to take care of America but so much money is wasted by both sides of the aisle. It is odd to me how people want to pay more in taxes, I know there are people on here that pay a lot more in taxes than I do. But I get mad when people who do not pay hardly anything in are telling me about thier big refund check and I am still having to pay more. It is like being punished for working hard and trying to make something of your self and to give your family a good life.

Unless I misunderstand what the P meant. You mean the individual person? Why am I skeptical? Because that is not the way stuff has worked the last 20years for sure, and probably much longer. If there is a problem, the Government cuts people a check. Examples, 2008-09 GFC, Florida hurricanes, NC floods, Cali fires, the list goes on and is too long to type. The Government is the insurer of last resort and is too frequently cutting checks to mitigate any pain. Not sure why SS would be any different. We continue to build in flood-prone and fire-prone areas while the number of multi-Billion events is increasing.It has to. You sound skeptical. How could it not?

Agree. The solution on the economic/money is pretty easy, but getting people to do the right thing is hard.You are correct. That’s why I mentioned early on that something would have to be done to remove access to that money until retirement. I hate the idea of control but I don’t know how else you protect people from themselves. Maybe at least lockdown the employer contribution??

Source?

So a 3 year dip?

How Does U.S. Life Expectancy Compare to Other Countries? | KFF

This chart collection examines how life expectancy in the U.S. compares to that of other similarly large and wealthy countries. Between 2019 and 2022, the U.S. experienced a sharper decline and a slower rebound in life expectancy than peer countries, on average, due to increased mortality and...www.kff.org

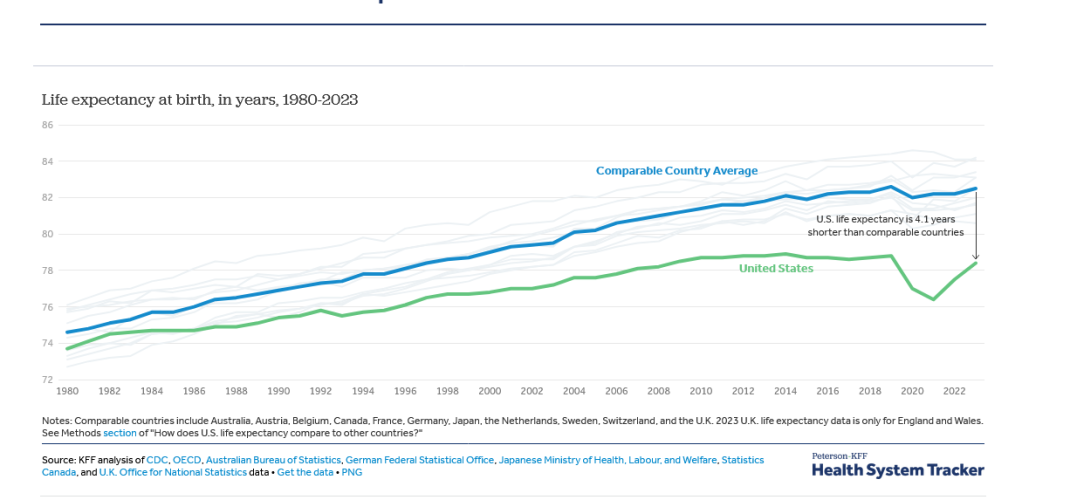

Between 2019 and 2022, the U.S. experienced a sharper decline and a slower rebound in life expectancy than peer countries, on average, due to increased mortality and premature death rates in the U.S. from the COVID-19 pandemic. Updated life expectancy estimates in this chart collection show that in 2023, life expectancy in the U.S. returned to pre-pandemic levels, but remains lower than that of comparable countries.

View attachment 362660

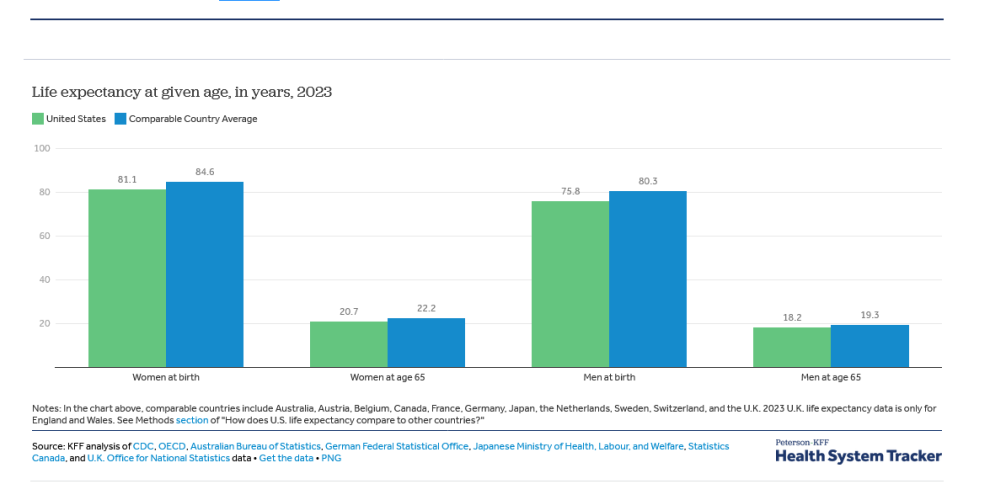

Among peer countries, the U.S. has the lowest life expectancy at birth for both women and men.

The life expectancy gap between men and women is wider in the U.S. than in comparable countries.

The disparity in life expectancy between the U.S. and peer countries persists at older ages.

View attachment 362661

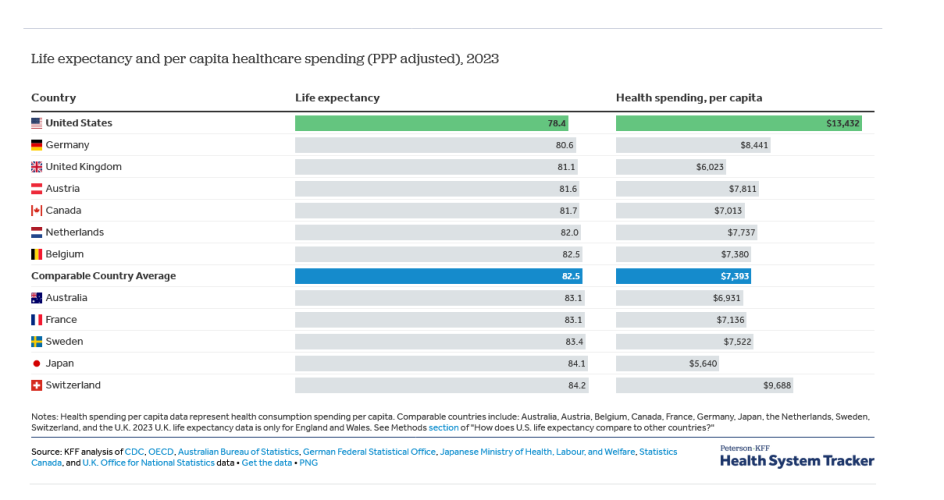

The U.S. has the lowest life expectancy among large, wealthy countries while outspending its peers on healthcare

View attachment 362662

That was the boomer removerSo a 3 year dip?

His average Federal tax rate as a billionaire is less than mine. As is the case when I am compared to Warren Buffett. That indicates a regressive tax system. Regressive implies the more the you make, the less you pay per $1 of income.I guarantee he pays far more into the Federal government than most.

The answer shouldn't be make the rich pay more. The answer should be make those who are capable of working, work and be responsible for themselves.

I think a lot of people don't think beyond their own interests...and don't consider their own future.Most is an huge understatement.

Bezos moved to FL to avoid paying the WA state cap gains tax. Elon to TX to avoid CA. So they used the talent and infrastructure of the region to build the business, but never paid the taxes that help fund the basic stuff. I'm not a huge fan of taxes on unrealized gains, but when I see stuff like this I consider shifting that view. The rich can do a lot of things to avoid taxes. The super rich can do a lot more. The super super rich buy elections.

To help answer you question on "why". I can only point you to the fact that it is an insurance program, not a saving/retirement account. Compare it to other forms of insurance and it might make more sense. Insurance programs are never structured to make you net positive. Note, if you are it is probably insurance fraud- but not legal advice.

If you have paid in 200k at 38, I think you are doing fine. But if you think it would have make a huge difference in you life up to this point, then SS is probably a benefit to you.

So a 3 year dip?

The three year dip may be news, but this sort of thing about the US health care system is very old news. We have the some of the worst health care statistics of any 1st world country for the highest price, and we brag about it. Beats me. It is a subject that rubs me raw and has for most of my life.The 3 year dip can be explained, but what cant be is that Canadians for example live 3 years longer than U.S. Citizens and pay about half in health spending.

Nobody likes talking about that kind of stuff, the 3 year dip is the shiny thing.

Does it also come down to some of the poor choices we make as americans?The three year dip may be news, but this sort of thing about the US health care system is very old news. We have the some of the worst health care statistics of any 1st world country for the highest price, and we brag about it. Beats me. It is a subject that rubs me raw and has for most of my life.

The three year dip may be news, but this sort of thing about the US health care system is very old news. We have the some of the worst health care statistics of any 1st world country for the highest price, and we brag about it. Beats me. It is a subject that rubs me raw and has for most of my life.

No. It comes down to our form of health insurance mostly.Does it also come down to some of the poor choices we make as americans?

High consumption of high calorie and low nutrient meals, nicotine, alcohol.... just to name a few things that might move the needle.

Does it also come down to some of the poor choices we make as americans?

High consumption of high calorie and low nutrient meals, nicotine, alcohol.... just to name a few things that might move the needle.

Apparently you haven't spent much time around the good people of Canada.

I went to fact check you guys and USA is #35 in alcohol consumption. Suprising. Not sure on the sugar/fried food score though.No. It comes down to our form of health insurance mostly.