rjthehunter

Well-known member

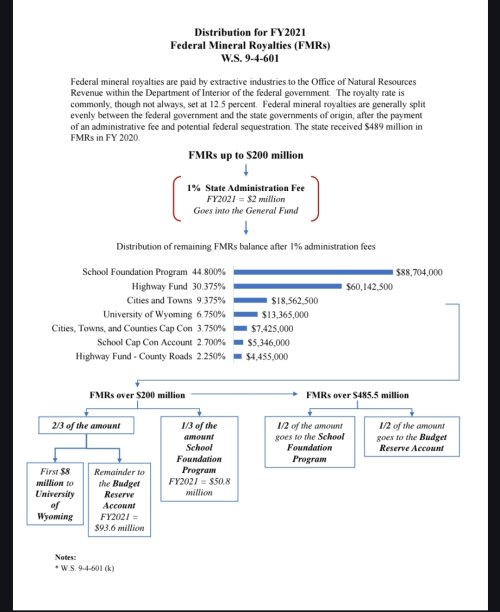

Name checks out as someone who knows a thing or 2 about coal mining in WY.Not sure I am following you correctly, but are you saying that coal royalty payments are to cover the cost incurred by the Feds and State to manage these resources? If so, they are not. Lease payments, cost recovery payments to agencies and various taxes applied to each ton of coal mined largely do that.

For sure the reduced royalty rate will lead to a reduction in some royalty streams. It will also lead to an increase in others. Take my mine for instance. This reduction will immediately put our operation back into a far more competitive position. At the moment my coal royalty payments are $0. This reduction puts me back in the game for contracts. If I am successful, then those royalty payments start back up again. The reduced royalty rate also allows operations to mine currently held reserves that may not have been profitable under the prior rate. This is exactly what it has done for me. A reduction in royalty rate has incredible benefits for high strip ratio operations.

The Feds have always had a program where lease holders could apply for a Royalty Rate Reduction (RRR) to help maximize the minable reserve, therefore maximizing the total revenue back to the Feds and State. To receive a RRR you had to demonstrate that under current economics it was not profitable to mine either entire pits or individual seams. You also had to demonstrate that your total royalty payments would increase. I have applied and received RRR's in the past. I applied in early 2021 for a RRR for two pits. The review of those applications by the BLM, never started until March of 2025. In the past it was a 4-6 month process. The prior Administration sat on its thumbs for 4 years while I had two layoffs and eventually moved to nothing but reclamation. This Admin has a different goal in mind. The folks that I have already been able to re-hire as sure pleased with the outcome.

Glad to hear business is picking up for you and the future is bright!