It sure would be an interesting world if the SEC decided to require COLA (Cost Of Living Allowance/Adjustments) towards the purchase of stocks... Until then, the Stock Market is as it is...I don't see how a future 3-28-2028 stock market valuation which is not adjusted so is apples to apples 3-28-2025 values. Not even sure a stock index is the measure to show whether your neighbors are better off in 36 months than today. Not everyone owns stocks. Or a house. Or a car. We all eat, though.

How about we bet on whether the price of a basket of groceries over these 36 months will go up more as a percentage than wages go up over the same 36 months? No need to adjust since are looking at growth or decline rather than absolute dollar change.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MALA and your money

- Thread starter SAJ-99

- Start date

The reality is Trump has about six months before the next campaign cycle starts for Congress. If the economy is terrible, Rs will break from him. There’s a multitude of possibilities that can occur before 2028. Corrections will be made to correct the errors. Or, Trump will change his mind, or he won’t, or he will or…

This is a valid point and great characterisation of how things tend to happen and how change impacts the way future events may pan out.

In another thread, I observed that all the things Trump dreams of doing happened once before, but during a much longer time period: starting in 1933 when tons of jobs were added in the US to 1959 when two (2) states were added.

I also mentioned that he has four years, but your point about 6 months to make big moves is certainly the first time period to watch closely.

Investment strategy now, since the OP requested input from our us/advisors. I ran through my picks and thought about trading out of those that have remained stable since the recent potus election and into those that dropped significantly since then. Here's what my plan was:

Shifting funds from stocks of mine that held their value well in the past six months to balance with those picks that:

Shifting funds from stocks of mine that held their value well in the past six months to balance with those picks that:

- dropped the steepest, but remain good businesses with low debt,

- have most assets and HQ's are on US soil,

- and to those that provide streaming services.

I thought about going to cash in January. It didn’t take much foresight to see the potential for a big mess.

I looked at the Oracles portfolios over the last two years and realized he shifted companies some but his market exposure didn’t change.

I buy S&P 500 funds. My exposure is the market not an individual company that may have significant tariff exposure. Although I saw yesterday that 41% of the S&P 500s revenue was foreign sales.

Buy and hold is still the best strategy for most investors. I’ve suffered through the Great Recession and the ‘22 recession. I can suffer through this mess because it too will eventually be solved.

I’m writing emails to my congressman and senators today to let them know my feelings about this mess. I’ve never written them before.

I looked at the Oracles portfolios over the last two years and realized he shifted companies some but his market exposure didn’t change.

I buy S&P 500 funds. My exposure is the market not an individual company that may have significant tariff exposure. Although I saw yesterday that 41% of the S&P 500s revenue was foreign sales.

Buy and hold is still the best strategy for most investors. I’ve suffered through the Great Recession and the ‘22 recession. I can suffer through this mess because it too will eventually be solved.

I’m writing emails to my congressman and senators today to let them know my feelings about this mess. I’ve never written them before.

Despite the current positive news from POTUS about tariffs, I don't think we are in the clear right now. However, here is a good article that provides a snapshot of the industries (with ticker symbols) that were most and least impacted by the tariffs:

Energy investments may be another good future bet. Even after the EU offered a 0 for 0 tariff concession, Trump banged back and requested them to import more energy from the US.

This intrigues my curiosity since it seems like it could improve his leverage in the war with Ukraine and Russia. Russia is the second largest importer of energy to the EU. If Trump can achieve a larger share, his cards seem to get better. More power to that, especially if he can do it without escalating lives lost or engaging US troops to avert WWIII.

This intrigues my curiosity since it seems like it could improve his leverage in the war with Ukraine and Russia. Russia is the second largest importer of energy to the EU. If Trump can achieve a larger share, his cards seem to get better. More power to that, especially if he can do it without escalating lives lost or engaging US troops to avert WWIII.

SAJ-99

Well-known member

That will happen, or at least there will be an announcement of “new/morr” purchases. There are constraints, as the article below points out. I will add, there needs to be a place to put the gas. There is only so much storage. And what happens when some European country buys a tanker from US and then sells it to China to avoid a tariff?Energy investments may be another good future bet. Even after the EU offered a 0 for 0 tariff concession, Trump banged back and requested them to import more energy from the US.

This intrigues my curiosity since it seems like it could improve his leverage in the war with Ukraine and Russia. Russia is the second largest importer of energy to the EU. If Trump can achieve a larger share, his cards seem to get better. More power to that, especially if he can do it without escalating lives lost or engaging US troops to avert WWIII.

American energy producers are mostly just pissed off due to market prices right now.

Bridging the US-EU Trade Gap with US LNG Is More Complex than It Sounds - Center on Global Energy Policy at Columbia University SIPA | CGEP %

Get the latest as our experts share their insights on global energy policy.

SAJ-99

Well-known member

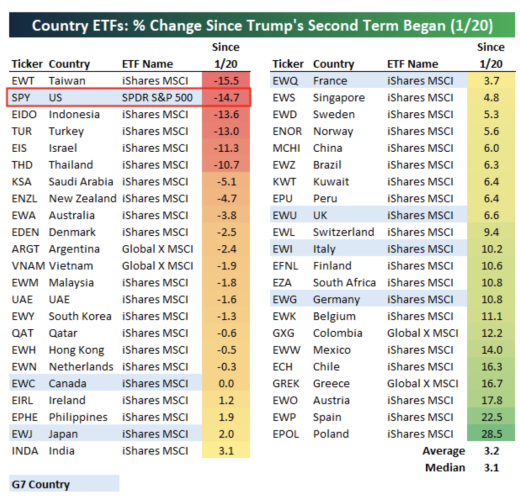

Poland for the Gold!For those keep track at home, got this from Bespoke in email. Most performance is from drop in US$.

SMH.

View attachment 369293

For those keep track at home, got this from Bespoke in email. Most performance is from drop in US$.

SMH.

View attachment 369293

How many dead cat bounces do you see in the next two years?

Longest recession was 18 months. average recession is 8-10 months. If recession is present or bound to happen...

Long story short, regardless our HT key strokers, You will more than likely have more money than you did at the start of Trumps tariffs announcement in 1-3 years IF you're pay deductions continue to buy during the dip and on the rise.

History preaches more than those hammering the pulpit with doomsday, "Mar-A-Lago Accord (MALA)" prophecies. An anti admin spin on the "Plaza Accord" of earlier times.

Long story short, regardless our HT key strokers, You will more than likely have more money than you did at the start of Trumps tariffs announcement in 1-3 years IF you're pay deductions continue to buy during the dip and on the rise.

History preaches more than those hammering the pulpit with doomsday, "Mar-A-Lago Accord (MALA)" prophecies. An anti admin spin on the "Plaza Accord" of earlier times.

D

Deleted member 56631

Guest

Let’s time stamp GLD etf 315 ish today. I’d say that $250 is going up.Longest recession was 18 months. average recession is 8-10 months. If recession is present or bound to happen...

Long story short, regardless our HT key strokers, You will more than likely have more money than you did at the start of Trumps tariffs announcement in 1-3 years IF you're pay deductions continue to buy during the dip and on the rise.

History preaches more than those hammering the pulpit with doomsday, "Mar-A-Lago Accord (MALA)" prophecies. An anti admin spin on the "Plaza Accord" of earlier times.

SAJ-99

Well-known member

lol. Too many to count.How many dead cat bounces do you see in the next two years?

SAJ-99

Well-known member

Bouncing cats are the whims of our great leader.How many dead cat bounces do you see in the next two years?

SAJ-99

Well-known member

It was a Trump "random thought from make-believe land" after talking to someone in the industry. It is nothing and will never happen.What a strange thing to apply a tariff to, and how will it function or how will they track that?

Bonasababy

Well-known member

- Joined

- May 16, 2024

- Messages

- 1,555

This was a prescient post.It’s a sucker bet. Ignores the loss percentage (7%?) since inauguration and has a term way too long. The market has only seen three periods in the last 100 years with three years of losses. Jimmy Carter’s terrible economy doesn’t meet the three year bet.

View attachment 366227

The assumption on three years is that only Trump will make economic decisions. The reality is Trump has about six months before the next campaign cycle starts for Congress. If the economy is terrible, Rs will break from him. There’s a multitude of possibilities that can occur before 2028. Corrections will be made to correct the errors. Or, Trump will change his mind, or he won’t, or he will or…

The real question is are we heading towards a recession. Last study I saw raised the probability of a recession to 50%.

Lots of info out there suggested many Republican legislators told Trump passing his bill would lead to their losing control of at least one and possibly both houses of Congress.

Trump didn't care of course.

Also Vance and others said right after it's passage that there would likely be changes to the bill within a few years. If it's really so beautiful and perfect you wouldn't think they would say that. Perhaps Vance sees a path for becoming President before Trump's 4 years are up?

The impacts are out there but many Trumpers are drunk on the Kool aid to accept them. Not just the huge increase in the deficit. Social security impacts. Rural hospitals closings, health care cost increases, seniors misled on the bill claiming it ends taxes on Social security by communications from the SSA (when it does nothing of the sort).

Talked to a small town hospitals board member yesterday...extremely worried. Medicaid cuts...their estimate is that it will cost them into the 7 figures, but that's just on lack of coverage estimates. Doesn't account for all the people who won't go to a doctor because they no longer have insurance until it's an emergency where the cost of care gets MUCH more expensive.

In the meantime, most measures of the health of the underlying economy are good. The US dollar a huge and worrisome exception.

How long will things go before it hits the fan?

I continue to be glad that as we approach the withdrawal years we can accept the returns of a much more conservative portfolio...with a boost from international increases...and then hang on until some sanity is restored.

Similar threads

- Replies

- 25

- Views

- 1K

- Replies

- 81

- Views

- 4K