Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Im bowing out

- Thread starter Bigjay73

- Start date

D

Deleted member 28227

Guest

1. I don’t see anything wrong with those windows.

2. Get 2 cases of anything but bud light and @Nick87 and I’ll get a 3-5 year roof on that house.

God that carpet is heinous… and the tile on the counters in the kitchen

BigHornRam

Well-known member

1 square mile of bighorn basin desert, with a sweet little unabomber hut for 299k. One of you guys needs to jump on this!

www.realtor.com

www.realtor.com

Road # 15, Burlington, WY 82411 | realtor.com®

View detailed information about property Road # 15, Burlington, WY 82411 including listing details, property photos, school and neighborhood data, and much more.

D

Deleted member 28227

Guest

Shaul is finally selling his place I see1 square mile of bighorn basin desert, with a sweet little unabomber hut for 299k. One of you guys needs to jump on this!

Road # 15, Burlington, WY 82411 | realtor.com®

View detailed information about property Road # 15, Burlington, WY 82411 including listing details, property photos, school and neighborhood data, and much more.www.realtor.com

SAJ-99

Well-known member

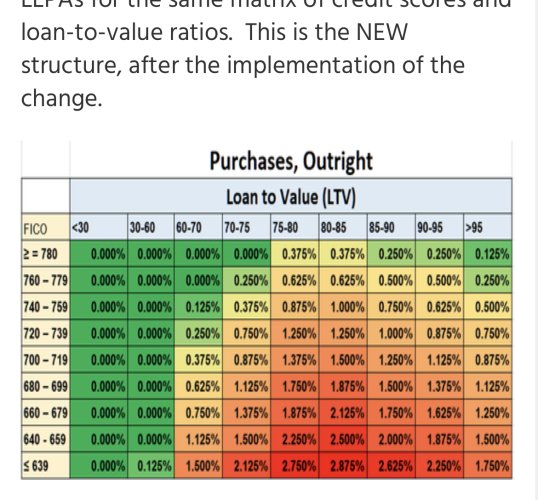

It’s not that there wasn’t a difference, just that we saw default rates for high fico and low fico weren’t as different as the score would suggest.I am confused. You stated that the rates in the LLPAs reflect probability of default but then stated that borrower credit score was not a great indicator of default. Then why use credit score in the LLPA tables? Find some other better indicator. Isn’t probability of default a component of the risk assessment for lenders? Maybe bankers should just scrap the credit check requirement entirely.

Attached is a link that explains the changes the best. The fee difference between high fico and low fico changed (narrowed) but high fico is still better off. Like the author, I don’t have an opinion on the change, but think it needs to be presented correctly. I agree it is confusing, but mostly at the higher LTV differences, not the Fico. I assume that is reflective of market prices and need to keep the mortgage affordable to a wide group of people.

Is There Really a New, Unfair Mortgage Tax on Those With High Credit?

Seemingly overnight, the internet is awash with news regarding a "new," unfair tax on mortgage borrowers with higher credit scores. Some have gone so far as to suggest that someone could intentionally lower their credit score in order to get a better deal. Before you stop paying your bills in...

www.mortgagenewsdaily.com

For the TLDR crowd.

VikingsGuy

Well-known member

I recall the last time they tried to “help” folks buy homes they couldn’t afford and encouraged low starting equity - it didn’t end well for anybody- and particularly not those who were the target of the “help”.It’s not that there wasn’t a difference, just that we saw default rates for high fico and low fico weren’t as different as the score would suggest.

Attached is a link that explains the changes the best. The fee difference between high fico and low fico changed (narrowed) but high fico is still better off. Like the author, I don’t have an opinion on the change, but think it needs to be presented correctly. I agree it is confusing, but mostly at the higher LTV differences, not the Fico. I assume that is reflective of market prices and need to keep the mortgage affordable to a wide group of people.

Is There Really a New, Unfair Mortgage Tax on Those With High Credit?

Seemingly overnight, the internet is awash with news regarding a "new," unfair tax on mortgage borrowers with higher credit scores. Some have gone so far as to suggest that someone could intentionally lower their credit score in order to get a better deal. Before you stop paying your bills in...www.mortgagenewsdaily.com

For the TLDR crowd.

View attachment 273103

DouglasR

Well-known member

Why does it matter if you're only gonna be there 3-5 years?God that carpet is heinous… and the tile on the counters in the kitchen

View attachment 273100

why do you need such a big house for 3 people and 3-5 years?

I thought you were the hardcore legend/frugality king.

I'm so confused right now.

Nick87

Well-known member

If your gonna be picky about something like that your #@)(*%* in this marketGod that carpet is heinous… and the tile on the counters in the kitchen

View attachment 273100

SAJ-99

Well-known member

Well, it’s part of their mandate. Previously, when they made those mistakes they were private entities. Now they are owned by the government (us) and the fees are to improve capital ratios. They generate billions $ in income and neither party wants to cut them loose to roam free again because they need the income for their favorite expenses.I recall the last time they tried to “help” folks buy homes they couldn’t afford and encouraged low starting equity - it didn’t end well for anybody- and particularly not those who were the target of the “help”.

I certainly have an opinion on the subject and it probably is pretty close to yours, but we can have a thread complaining about changes to the mortgage fee structure to help new buyers and simultaneously complaining housing prices are out of reach to new buyers. We get back to the discussion of everyone wanting, even expecting, a handout.

Nick87

Well-known member

Not to mention flooring is probably on of the easiest most affordable things to change. Just saying that kind of stuff I don't even pay attention to when looking because I'm more than likely gonna change it anyway.

D

Deleted member 28227

Guest

Any thing under like 5-10k to fix or update I don’t care about…like you said easy…If your gonna be picky about something like that your #@)(*%* in this market

But it’s still gross

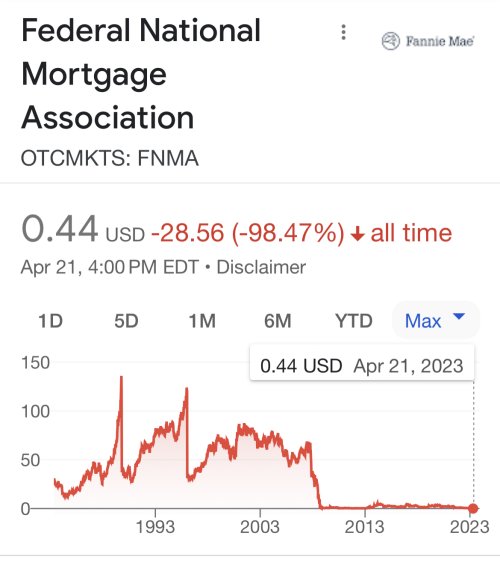

The previous help was no document home loans created by Congress with government guarantees. Nothing private about that mistake.Well, it’s part of their mandate. Previously, when they made those mistakes they were private entities. Now they are owned by the government (us) and the fees are to improve capital ratios. They generate billions $ in income and neither party wants to cut them loose to roam free again because they need the income for their favorite expenses.

I certainly have an opinion on the subject and it probably is pretty close to yours, but we can have a thread complaining about changes to the mortgage fee structure to help new buyers and simultaneously complaining housing prices are out of reach to new buyers. We get back to the discussion of everyone wanting, even expecting, a handout.

SAJ-99

Well-known member

Not going to argue the GFC for the 1000th time. At that time before Congress took the approach to lessen rules, and we know the result. FNMA was and is a private, government sponsored enterprise. You can still buy the stock (not investment advice). You can also see in the chart where the government started to take a cut. Tax payers made out very well, and continue to. Without some government backing, mortgage rates would be much higher and the economy would be more volatile given housing large percentage contribution. So we either want some government involvement or we want to let the “free market” do its thing and endure the consequences. I think most choose the former and we mostly debate where the balance point is.The previous help was no document home loans created by Congress with government guarantees.

Similar threads

- Replies

- 10

- Views

- 2K

- Replies

- 17

- Views

- 2K