So many people get sucked into the "correction" equals going back to the good ol days. My advice is "good luck". You may see a correction of 20 or even 30%. I doubt you will see one of 50% and based on my 53yrs and I would say it wont last. Inflation in housing (and elsewhere) stays and that is the bitter truth.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Another Housing Market Crash Looming?

- Thread starter BigHornRam

- Start date

Nick87

Well-known member

Sounds pretty good to me considering thatd save me 80 to 100k give or take.So many people get sucked into the "correction" equals going back to the good ol days. My advice is "good luck". You may see a correction of 20 or even 30%. I doubt you will see one of 50% and based on my 53yrs and I would say it wont last. Inflation in housing (and elsewhere) stays and that is the bitter truth.

ida homer

Well-known member

I am pretty sure that within a couple of years I will see my home worth much less than it would be if I listed it now. My strategy is to ensure my mortgage stays low enough so that it’s never worth less than I have to pay on it.

In this area I think it’s going to be a solid plan long term.

I agree. I’m no financial advisor. But I think that’s always a good, safe route. The building costs are so outrageous, the past 3-4 months specifically.

Carnage2011

Well-known member

Never mind…My point is your ramblings are wrong. I work as a commercial banker and see the business coming into Boise.

Last edited:

JEL

Well-known member

We had a contractor give us a bid on a deck in May. The bid was good for 24 hours. Crazy.Unbelievable, the cost of materials changes daily. I think that we are in for a very rough ride.....soon.

fair amount to digest, but a pretty good article on whether or not his is a housing bubble

"The story of the Great Recession is still being debated over a decade later, and the smartest minds in economics have yet to figure out how to decide if something is a bubble, especially while it’s happening. That means you should be very wary of people telling you they know that something is a bubble or that it isn’t."

www.vox.com

www.vox.com

tldr: hard to say; not really; there is no agreed upon definition of a bubble; probably some local bubbles; good arguments for and against there being a bubble; regardless, the current state of affairs is unsustainable and america has a historical problem of not building enough houses

"The story of the Great Recession is still being debated over a decade later, and the smartest minds in economics have yet to figure out how to decide if something is a bubble, especially while it’s happening. That means you should be very wary of people telling you they know that something is a bubble or that it isn’t."

Is there a housing bubble?

Houses are getting more and more expensive. There’s a simple fix for that.

tldr: hard to say; not really; there is no agreed upon definition of a bubble; probably some local bubbles; good arguments for and against there being a bubble; regardless, the current state of affairs is unsustainable and america has a historical problem of not building enough houses

Last edited:

D

Deleted member 28227

Guest

fair amount to digest, but a pretty good article on whether or not his is a housing bubble

"The story of the Great Recession is still being debated over a decade later, and the smartest minds in economics have yet to figure out how to decide if something is a bubble, especially while it’s happening. That means you should be very wary of people telling you they know that something is a bubble or that it isn’t."

Is there a housing bubble?

Houses are getting more and more expensive. There’s a simple fix for that.www.vox.com

tldr: hard to say; not really; there is no agreed upon definition of a bubble; probably some local bubbles; good arguments for and against there being a bubble; regardless, the current state of affairs is unsustainable and america has a historical problem of not building enough houses

TLDR: F- if I know

There are a handful of places I hope my wife and I end up someday, places where I want to raise a family. I have watched prices in these places steadily increase for years.

I'd love to own a 3 bed 2 bath, 2 car garage, ~ 2000 sqft, with a yard. Time line is 5 to 7 years from now.

I'm guessing that property with reasonable finishes, nothing super high end, is going to be about $1MM

TLDR: F- if I know

There are a handful of places I hope my wife and I end up someday, places where I want to raise a family. I have watched prices in these places steadily increase for years.

I'd love to own a 3 bed 2 bath, 2 car garage, ~ 2000 sqft, with a yard. Time line is 5 to 7 years from now.

I'm guessing that property with reasonable finishes, nothing super high end, is going to be about $1MMby the time we are looking to buy.

f- if i know. exactly lol

my wife and i were among the many playing the lottery for a chance to "win the honor of spending hundreds of thousands of dollars to build"... and we did "win" a couple months ago

and i'm more at ease about it than not at ease about it honestly. the base cost is already 25 grand more than what we locked in

morley.tyler

Well-known member

So if you sold yours, what and where are you replacing it with? Real question, no smart ass, intent. Occasionally I think about offloading mine as the prices in Portland are nucking futs. (house 3 doors down sold for $1.3M last week- $400/sqft!), but I have no idea where I'd go to replace what I have...A majority of the people flocking to Boise are retirees that are done with WA, OR and CA. Or fairly close to retirement.

Sold my house last month. All of our showings were retirees that had literally sold all their shit back home, loaded up their RV’s and found short term rentals up here. They’re driving around looking at homes and putting many offers in, looking for quick closes. The people that purchased ours told me they had been putting offers in for months, and if they couldn’t get an offer accepted by summer, they were moving onto the Midwest to try their luck there. Crazy.

Man we are in desperate need of a correction. And I hope it comes soon. At least for the sake of the draw odds. Wishful thinking.

SAJ-99

Well-known member

Maybe you need to start looking where no one wants to raise a family. Kind of kidding, but not really. These things tend to go in waves. Look at the gentrification of some cities. I'm am always looking for places where something similar exists in rural areas.TLDR: F- if I know

There are a handful of places I hope my wife and I end up someday, places where I want to raise a family. I have watched prices in these places steadily increase for years.

I'd love to own a 3 bed 2 bath, 2 car garage, ~ 2000 sqft, with a yard. Time line is 5 to 7 years from now.

I'm guessing that property with reasonable finishes, nothing super high end, is going to be about $1MMby the time we are looking to buy.

D

Deleted member 28227

Guest

I think my problem is I’m looking at rural places, that have a lack of healthcare services.Maybe you need to start looking where no one wants to raise a family. Kind of kidding, but not really. These things tend to go in waves. Look at the gentrification of some cities. I'm am always looking for places where something similar exists in rural areas.

Apparently boomers have decided those are the best places to build their mausoleums.

SAJ-99

Well-known member

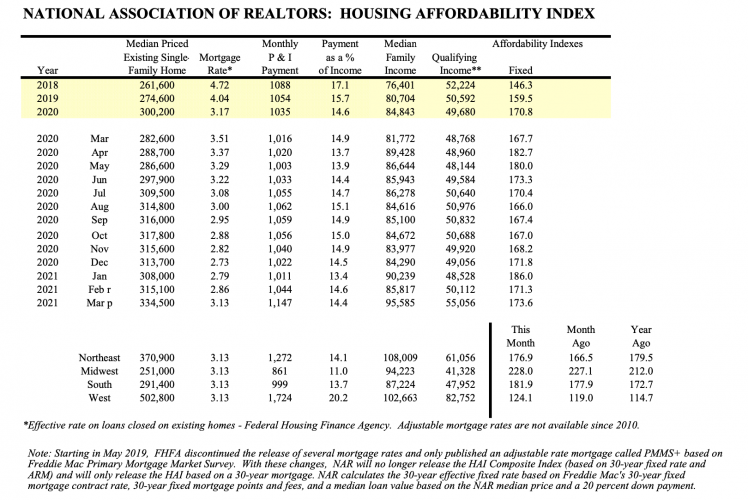

This should give you a picture of the current state of hte housing market. Per my previous comment, what matters is the ability to pay the mortgage.fair amount to digest, but a pretty good article on whether or not his is a housing bubble

"The story of the Great Recession is still being debated over a decade later, and the smartest minds in economics have yet to figure out how to decide if something is a bubble, especially while it’s happening. That means you should be very wary of people telling you they know that something is a bubble or that it isn’t."

Is there a housing bubble?

Houses are getting more and more expensive. There’s a simple fix for that.www.vox.com

tldr: hard to say; not really; there is no agreed upon definition of a bubble; probably some local bubbles; good arguments for and against there being a bubble; regardless, the current state of affairs is unsustainable and america has a historical problem of not building enough houses

if you like the data (this and more), try here https://www.nar.realtor/research-and-statistics/housing-statistics/housing-affordability-index

I have problems with the data and calc, but I don't want to kill the mood by getting all wonky.

This should give you a picture of the current state of hte housing market. Per my previous comment, what matters is the ability to pay the mortgage.

View attachment 185202

if you like the data (this and more), try here https://www.nar.realtor/research-and-statistics/housing-statistics/housing-affordability-index

I have problems with the data and calc, but I don't want to kill the mood by getting all wonky.

so i high index is a "good" affordability index? more affordable? or at least owners can better afford?

what do those indices look like for 2005-2007? my gut says scary.

i feel like a takeaway is that homebuyers are richer than they used to be. whether that's because people are priced out, more strict lending, pandemic making the rich richer and the poor poorer, probably a thousand reasons yeah?

after your comments yesterday i was thinking about The Matrix: "follow the white rabbit" - to find the bubble, one must just follow the leverage

X13

Well-known member

- Joined

- Jul 13, 2017

- Messages

- 1,783

I missed out on the 15k raise from March 2020 to March 2021. I shall inform my employer of their mistake.

SAJ-99

Well-known member

Yes. 100 assumes the median family has 100% of the amount needed to afford the home. 120 means they have 20% more income.so i high index is a "good" affordability index? more affordable? or at least owners can better afford?

what do those indices look like for 2005-2007? my gut says scary.

i feel like a takeaway is that homebuyers are richer than they used to be. whether that's because people are priced out, more strict lending, pandemic making the rich richer and the poor poorer, probably a thousand reasons yeah?

after your comments yesterday i was thinking about The Matrix: "follow the white rabbit" - to find the bubble, one must just follow the leverage

The index was about the same level. 2006 was actual the height of the housing bubble. The picture below I "borrowed" from The Big Picture blog. So by NAR calc, housing has never been "unaffordable".

You have to laugh at the NAR because they are so bad at forecasting and measuring anything. The flaws are pretty obvious - the fact they use completed transactions, the median income changes, etc. It all just makes the number pretty useless. What does matter though, is interest rates. You can see from the table that the average P&I number is comparable to 2018 - and that is all because of lower rates.

BigHornRam

Well-known member

The old boomers know that young guys with doctor wives will be moving there shortly.I think my problem is I’m looking at rural places, that have a lack of healthcare services.

Apparently boomers have decided those are the best places to build their mausoleums.

D

Deleted member 28227

Guest

TouchéThe old boomers know that young guys with doctor wives will be moving there shortly.

Doublecluck

Well-known member

I don’t trust any of it. It’s been a wild ride but we cashed in our chips twice in the last year, once in august and then again last month. Kept all the equity and bought land paid in full in two places, one We want to finish raising our family and one We want to escape to when the kids are out. In the mean time picked up a house fha to wait and see what (if anything) happens. Market keeps going, great do it again, crashes, We can live in it or rent it for what the payment is when our house is built.

LuketheDog

Well-known member

I'm very pleased we bought 3 years ago and don't have to deal with the current market, although I'm reactivating my broker license so I can make hay out of it. There's no way I could afford my house now and I thought the market was stupid when we made the purchase. And then they kept dropping the interest rates and blew it up even more, our last refi put us at a lower rate than either my wife's or my parents ever had on a house. Sorry to all you guys looking to buy a house in the near future, it's not going to be pretty even if there is some sort of market correction.

jryoung

Well-known member

Got a letter from a property buyer this weekend regarding a piece of land we had in Truckee, CA. They were offering 25% less than we paid for it 2 years ago. I wanted to send the closing price that we just sold it for and say "LOL, no" with a picture of Grumpy Cat

Similar threads

- Replies

- 199

- Views

- 14K

- Replies

- 4

- Views

- 748

- Replies

- 320

- Views

- 27K