Devilscrown

Well-known member

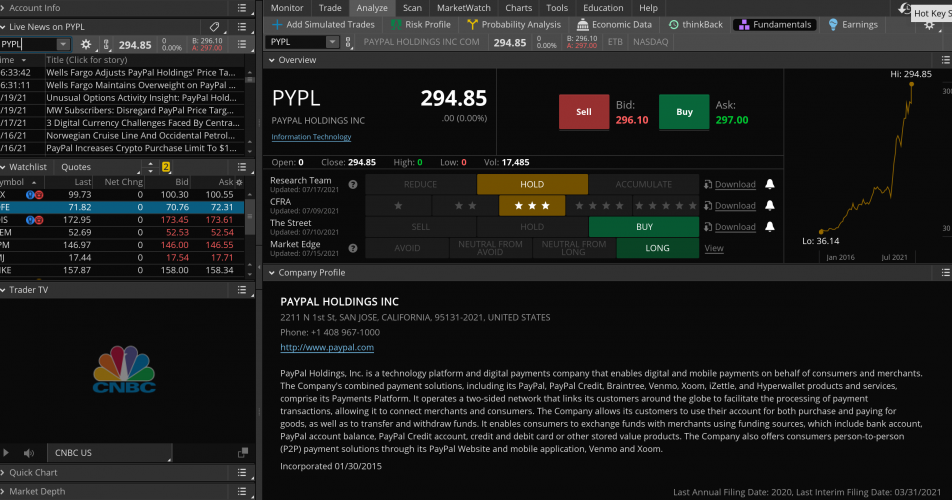

I started “managing” a portfolio about a year ago. I started out by listening to podcasts, reading articles and relying on what others were saying about good investments.

I am trying to learn more about how to read stock charts and look for themes or trends to try and have my own opinions about stocks that have strong potential. Can anyone offer advice on themes to look for or resources to read to help me develop a better understanding?

Thanks!

I am trying to learn more about how to read stock charts and look for themes or trends to try and have my own opinions about stocks that have strong potential. Can anyone offer advice on themes to look for or resources to read to help me develop a better understanding?

Thanks!