WyoDoug

Well-known member

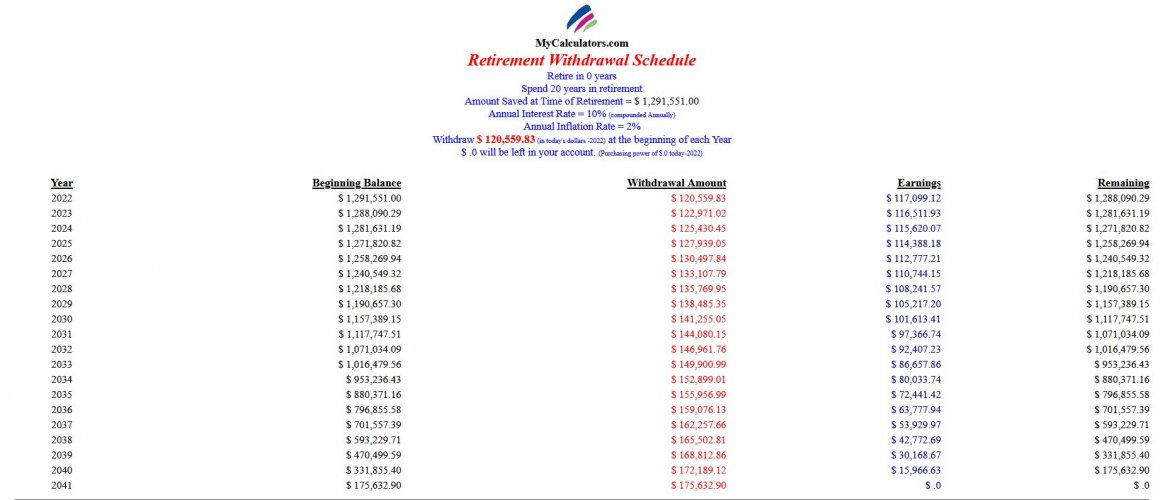

Inflation puts a huge dent on retirement plans. I draw retirement from four different sources and should be able to live quite comfortably. However, inflation has knocked spending power way down and I had to do some odd jobs to get extra things I wanted like new hunting gear. I make enough to pay for the basic living expenses but discretionary spending is way down mainly because of budget. Plus I found out that retirement income is taxed at a much higher rate than earned income is. Explain that to me. LOL