It's odd hearing that because one of my main complaints with the current stock of Republicans is that they all seem like Big Government cronies, just like at how quickly the "fiscal conservatives" are running up our deficit. It's didn't appear to me that the "small government" Republicans, if any are left, have much influence at all. Might just be the circles of influence I notice though, since I lean more on the side of states rights in most things I don't tend to notice agreement as much as disagreement.While that may be true of the Democrats I think it's worth noting that a large contingent of Republicans believe in a strict 10th amendment interpretation and don't acknowledge the legitimacy of federal government authority in many things. Libertarianism/ anarchism is pervasive in the rural culture I grew up in, and I believe that's just as problematic.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Potential SCOTUS Nomimee

- Thread starter Wildabeest

- Start date

- Status

- Not open for further replies.

Laszlo Cravensworth

Well-known member

It's odd hearing that because one of my main complaints with the current stock of Republicans is that they all seem like Big Government cronies, just like at how quickly the "fiscal conservatives" are running up our deficit. It's didn't appear to me that the "small government" Republicans, if any are left, have much influence at all. Might just be the circles of influence I notice though, since I lean more on the side of states rights in most things I don't tend to notice agreement as much as disagreement.

Big part of the reason I left the Republican party. They're often only fiscal conservatives when the issue is on the other side of party lines.

Yep exactly, at this point I'd welcome some return to true libertarian small central government and fiscal conservatism within that party. An inflection point is coming, technology makes history happen faster.Big part of the reason I left the Republican party. They're often only fiscal conservatives when the issue is on the other side of party lines.

BuzzH

Well-known member

The corp tax rate cut from 34% to 21% was fantastic for C corps. It allowed them to invest in capital and their employees instead of paying big government. Not every C corp is a fortune 500 company as many are small companies with under 100 employees who have employees who own stock in their jobs/company. They contribute heavily to local charities in their communities and the overall local business cycle. Was great for the markets also.

Sure it was fantastic...billionaires don't make 500 billion more during a downturn/pandemic paying taxes, but the deficit sure continues to grow.

BuzzH

Well-known member

Take home is that individuals know far better how to spend money efficiently than the federal government does.

Really, then why doesnt the Government give the individuals 100% of the bailout money instead of handing it to boeing, American Airlines, big banks, etc. etc. etc. every single time they don't act responsibly? The individual doesn't act responsibly, we're told we need to manage our money better, we need to save more, we need to better ourselves. Big business screws up, they have their hand out quicker to the .gov than a fat kids hand on a plate full of twinkies. They aren't scolded for their crap money management, they aren't expected to save for a rough patch...its socialize losses and privatize profits.

Your logic says that instead of bailing out every business under the sun, and having the .gov picking the winners and losers, we should just give the $$$ to the American public and let them decide what businesses go bankrupt and which one doesn't.

Yet, that isn't how it happens is it? Really surprised...shocked I tell you.

BigHornRam

Well-known member

Paper money buzz. If the billionaires start selling a bunch of their inflated stocks, they will start paying taxes. If their propped up stocks go down in flames, they wont pay any. In case you haven't figured it out yet, the world is playing with monopoly money.Sure it was fantastic...billionaires don't make 500 billion more during a downturn/pandemic paying taxes, but the deficit sure continues to grow.

Boeing> someone has to produce our military equipment or should we let them go belly up and buy our planes and tanks from china.Really, then why doesnt the Government give the individuals 100% of the bailout money instead of handing it to boeing, American Airlines, big banks, etc. etc. etc. every single time they don't act responsibly? The individual doesn't act responsibly, we're told we need to manage our money better, we need to save more, we need to better ourselves. Big business screws up, they have their hand out quicker to the .gov than a fat kids hand on a plate full of twinkies. They aren't scolded for their crap money management, they aren't expected to save for a rough patch...its socialize losses and privatize profits.

Your logic says that instead of bailing out every business under the sun, and having the .gov picking the winners and losers, we should just give the $$$ to the American public and let them decide what businesses go bankrupt and which one doesn't.

Yet, that isn't how it happens is it? Really surprised...shocked I tell you.

BuzzH

Well-known member

The .gov picking winners and losers, free markets are a fantasy.Boeing> someone has to produce our military equipment or should we let them go belly up and buy our planes and tanks from china.

Guess fiscal responsibility is also a one way street...

SAJ-99

Well-known member

Sure it is. You cite R reasonings for which there is little economic theory to support for the general view. Kennedy cut top tax rate from 90% to 65%- Laffer curve WORKs when you make huge changes in tax rates. Unfortunately it doesn't work all the time, as we have discovered since. Reagan comes into office in the middle of hyper inflation. Government raises interest rates and causes a recession. Reagan cuts taxes and government collections plummet, so he then reverses some of those cuts. What drove the economy in the 80's was 1) there was pent up demand caused by ridiculously high interest rates in the late 70s 2) the recession brought inflation under control and allowed rates to return to "reasonable" levels, 3) cutting taxes gave people more money to spend on pent up demand and 4) Reagan significantly increased military spending to win the cold war. Counter argument- Clinton raised taxes and cut military spending and we had an economic boom.This isn't an R vs D thing. JFK did the same thing in 1964; at the time, tax revenues were expected to decline, but did not.

Reagan did this also, lowering taxies and leading to the longest peacetime expansion of the economy ever (until now, pre-Covid).

Take home is that individuals know far better how to spend money efficiently than the federal government does.

The sample size on any economic idea is pretty small, especially tax cuts. This stuff is complicated with lots of moving pieces. The general consensus on the most recent tax cuts is there was no broad long term economic impact. Sure, people will say it helped business spend and grow and hire. The data says there was no change from trend of the previous 8yrs. That tax cut had the same impact as unicorns that crap rainbows.

I do push back on the last sentence. The "theory" that individuals know how to spend their money better than the government is not an economic thing. There is no measure of "spending efficiency" in GDP. Some people have tried to back into it such a measure but it is iffy at best. What we know is that every dollar the government collects get recirculated back into the economy (actually, every dollar plus more because the government has net borrowed since WWII). Every dollar kept in the hands of citizens is parsed - A % gets spent and a % get saved. In recent years savings has increased, as demonstrated by the drop in money spending velocity. The paradox of thrift would suggest the economy as a whole is better off with the government collecting and spending money. Although it stinks for the individual earner. So the argument is purely emotional. There is no economic basis to it at all, but it sounds good.

L

longbow51

Guest

Really, then why doesnt the Government give the individuals 100% of the bailout money instead of handing it to boeing, American Airlines, big banks, etc. etc. etc. every single time they don't act responsibly?

My post actually concerned the effect of tax cuts on small businesses, which are the only ones I have leadership experience with (revenues of a few tens of millions, so pretty small in the scheme of things). As far as letting companies like Boeing simply fail, macroeconomics, and the effect not only on directly employed workers, but on supply chain and upstream customers is way beyond my knowledge base or skill set. Maybe China just buys it, who knows? Certainly not me. I wouldn't presume to comment on a solution to a problem I don't understand just because of an emotional response to the government wasting our hard-earned tax dollars, which it most certainly does.

BigHornRam

Well-known member

So are we appointing a new Supreme Court justice or a new federal reserve chairman.

L

longbow51

Guest

Well said, BigHorn.So are we appointing a new Supreme Court justice or a new federal reserve chairman.

antlerradar

Well-known member

Trickle Down Government. Sounds like a winning economic strategy to me.Sure it is. You cite R reasonings for which there is little economic theory to support for the general view. Kennedy cut top tax rate from 90% to 65%- Laffer curve WORKs when you make huge changes in tax rates. Unfortunately it doesn't work all the time, as we have discovered since. Reagan comes into office in the middle of hyper inflation. Government raises interest rates and causes a recession. Reagan cuts taxes and government collections plummet, so he then reverses some of those cuts. What drove the economy in the 80's was 1) there was pent up demand caused by ridiculously high interest rates in the late 70s 2) the recession brought inflation under control and allowed rates to return to "reasonable" levels, 3) cutting taxes gave people more money to spend on pent up demand and 4) Reagan significantly increased military spending to win the cold war. Counter argument- Clinton raised taxes and cut military spending and we had an economic boom.

The sample size on any economic idea is pretty small, especially tax cuts. This stuff is complicated with lots of moving pieces. The general consensus on the most recent tax cuts is there was no broad long term economic impact. Sure, people will say it helped business spend and grow and hire. The data says there was no change from trend of the previous 8yrs. That tax cut had the same impact as unicorns that crap rainbows.

I do push back on the last sentence. The "theory" that individuals know how to spend their money better than the government is not an economic thing. There is no measure of "spending efficiency" in GDP. Some people have tried to back into it such a measure but it is iffy at best. What we know is that every dollar the government collects get recirculated back into the economy (actually, every dollar plus more because the government has net borrowed since WWII). Every dollar kept in the hands of citizens is parsed - A % gets spent and a % get saved. In recent years savings has increased, as demonstrated by the drop in money spending velocity. The paradox of thrift would suggest the economy as a whole is better off with the government collecting and spending money. Although it stinks for the individual earner. So the argument is purely emotional. There is no economic basis to it at all, but it sounds good.

SAJ-99

Well-known member

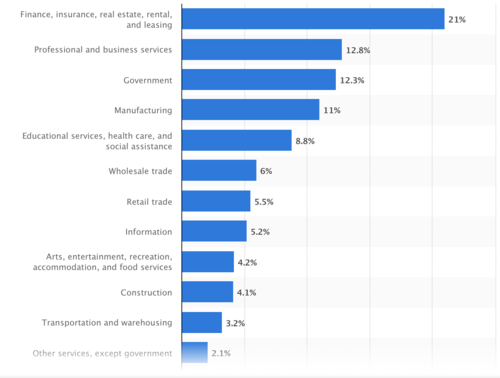

Shhh, don't tell anyone, but that is the way the US is set up, and has been for years. Below is a chart for you for 2019 GDP contribution. Government funds touch EVERY category. Here are some examples:Trickle Down Government. Sounds like a winning economic strategy to me.

1) Government-owned Fannie, Freddie, and FHMC underwrite about 75% of all US mortgages. Reasonable date is 2018 mortgages originated were $1.6Trillion (with a T). Lending rates are set by the FOMC (independent? please...) affecting all banking sectors, like commercial mortgages.

2) The Education, HC and Social Assistance- in 2016, the five largest health insurers reported that 60% of revenue came from Medicare and Medicaid (that number hasn't gone down in 2019, I promise).

3) the Small Business Administration issued almost $21B in loans in FY 2019

4) Tariffs are indirect governmental policy impacts- In theory, positive for manufacturing, negative for retail, wholesale trade, construction, etc.

The entire economy is built around direct government payments or indirect assistance in some way. Politics isn't about how a government or economy is structured. It is about who is going to pay for it and how benefits are distributed - Labor vs. Capital. Its been going on for 200yrs.

antlerradar

Well-known member

And now we know why we are 20+ trillion in debt and the rich keep getting richer.Shhh, don't tell anyone, but that is the way the US is set up, and has been for years. Below is a chart for you for 2019 GDP contribution. Government funds touch EVERY category. Here are some examples:

1) Government-owned Fannie, Freddie, and FHMC underwrite about 75% of all US mortgages. Reasonable date is 2018 mortgages originated were $1.6Trillion (with a T). Lending rates are set by the FOMC (independent? please...) affecting all banking sectors, like commercial mortgages.

2) The Education, HC and Social Assistance- in 2016, the five largest health insurers reported that 60% of revenue came from Medicare and Medicaid (that number hasn't gone down in 2019, I promise).

3) the Small Business Administration issued almost $21B in loans in FY 2019

4) Tariffs are indirect governmental policy impacts- In theory, positive for manufacturing, negative for retail, wholesale trade, construction, etc.

The entire economy is built around direct government payments or indirect assistance in some way. Politics isn't about how a government or economy is structured. It is about who is going to pay for it and how benefits are distributed - Labor vs. Capital. Its been going on for 200yrs.

View attachment 155712

L

longbow51

Guest

While your "theory" might be good in an economics classroom (although not in mine, as my MBA Economics professor was a confirmed capitalist), but most folks I know would rather pay out fewer dollars in taxes, and invest those dollars in their retirement, their children's college funds, and support their charities. Do good things. YMMV, though. I should learn not to leave comments that might be considered conservative.Sure it is. You cite R reasonings for which there is little economic theory to support for the general view. Kennedy cut top tax rate from 90% to 65%- Laffer curve WORKs when you make huge changes in tax rates. Unfortunately it doesn't work all the time, as we have discovered since. Reagan comes into office in the middle of hyper inflation. Government raises interest rates and causes a recession. Reagan cuts taxes and government collections plummet, so he then reverses some of those cuts. What drove the economy in the 80's was 1) there was pent up demand caused by ridiculously high interest rates in the late 70s 2) the recession brought inflation under control and allowed rates to return to "reasonable" levels, 3) cutting taxes gave people more money to spend on pent up demand and 4) Reagan significantly increased military spending to win the cold war. Counter argument- Clinton raised taxes and cut military spending and we had an economic boom.

The sample size on any economic idea is pretty small, especially tax cuts. This stuff is complicated with lots of moving pieces. The general consensus on the most recent tax cuts is there was no broad long term economic impact. Sure, people will say it helped business spend and grow and hire. The data says there was no change from trend of the previous 8yrs. That tax cut had the same impact as unicorns that crap rainbows.

I do push back on the last sentence. The "theory" that individuals know how to spend their money better than the government is not an economic thing. There is no measure of "spending efficiency" in GDP. Some people have tried to back into it such a measure but it is iffy at best. What we know is that every dollar the government collects get recirculated back into the economy (actually, every dollar plus more because the government has net borrowed since WWII). Every dollar kept in the hands of citizens is parsed - A % gets spent and a % get saved. In recent years savings has increased, as demonstrated by the drop in money spending velocity. The paradox of thrift would suggest the economy as a whole is better off with the government collecting and spending money. Although it stinks for the individual earner. So the argument is purely emotional. There is no economic basis to it at all, but it sounds good.

Last edited by a moderator:

406dn

Well-known member

- Joined

- Dec 12, 2019

- Messages

- 2,564

The "middle" has continued to go left, not right, in my lifetime. The "middle" today would have been seen as extreme, to the left, when I cast my first vote. AOC would have been ignored at one time, even by the left, but today she holds a seat in congress.

You fellows are all more in tune with "today" than I, but be careful. Death by a thousand cuts

In my research I think Barrett is a good choice for gun owners.( 2A ) Do you agree ? Does anyone know if the NRA has supported the nomination or not ?

I don't think that Joe Biden can by any measure be called to be the left of Hubert Humphrey or George McGovern. Each was mainstream enough in their time to win the nomination.

I don't think there is much political distance between AOC and Bernie Sanders. Sanders has been in Congress or the Senate for a good while.

Also, for years the Communist party managed to qualify a candidate for the ballot in presidential elections.

There has always been a very wide spectrum of political thought in our country,,actually everywhere.

I would agree that in the past that there were more numbers of conservative Democrats and liberal Republicans than there is presently. Over the last thirty or so years, conservatives and liberals have gone to their respective corners.

I don't think that Joe Biden can by any measure be called to be the left of Hubert Humphrey or George McGovern. Each was mainstream enough in their time to win the nomination.

I don't think there is much political distance between AOC and Bernie Sanders. Sanders has been in Congress or the Senate for a good while.

Also, for years the Communist party managed to qualify a candidate for the ballot in presidential elections.

There has always been a very wide spectrum of political thought in our country,,actually everywhere.

I would agree that in the past that there were more numbers of conservative Democrats and liberal Republicans than there is presently. Over the last thirty or so years, conservatives and liberals have gone to their respective corners.

Sometimes only the "argument" changes sides.

Eisenhower campaigned on how the Korean War was handled AND for letting Soviet spies into the U.S. ( Russia was used a campaign issue, just a different side using it ) Stevenson and the Democrats didn't like that Eisenhower had not criticized McCarthy. However; Stevenson was able to hold onto the deep south ( excluding Florida ) in the Election however, as the folks in the South thought Eisenhower was too Liberal

Hell, what do I know, I can barely remember what I had for breakfast

Back to the Supreme Court Choice. I did not expect Barrett to be labeled a "White Colonist" for adopting two children of color from Haiti. I thought they might go after her for being a Catholic, but that could come back to bite them in the butt and/or even Roe vs Wade and Obamacare, but "White Colonist" ?

I know of a couple who were unable to have children and they adopted 3 children. They are both white and they adopted three children of color. I contacted them and found out they had never received criticism from people of color for doing so, but had received criticism from white people for doing so .

BuzzH

Well-known member

Paper money buzz. If the billionaires start selling a bunch of their inflated stocks, they will start paying taxes. If their propped up stocks go down in flames, they wont pay any. In case you haven't figured it out yet, the world is playing with monopoly money.

You're actually naïve enough to believe that?

Laffin'...

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 700

- Replies

- 199

- Views

- 13K

- Replies

- 35

- Views

- 4K

D