D

Deleted member 38069

Guest

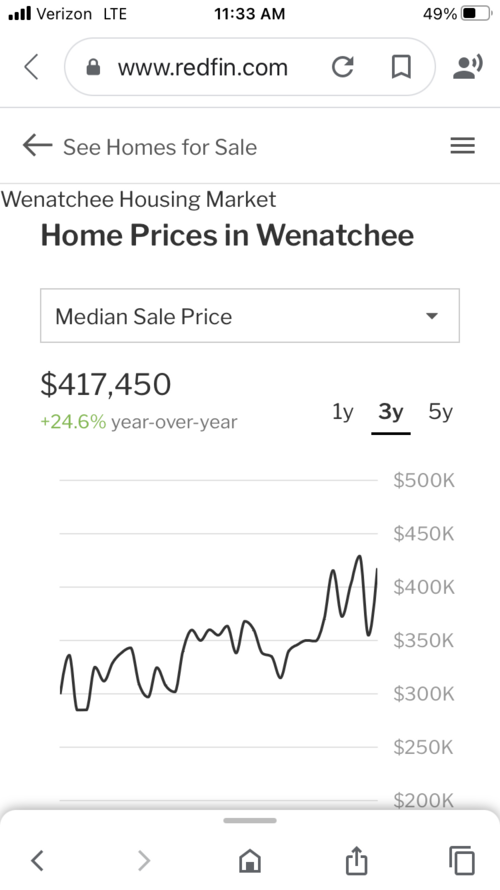

You can do better than Newell, trust me!In the end. 12 years later we managed 25% value increase when we sold it. It took 10 yrs to break even, then it started to take off. Now I wish I hadn't sold the first home but kept it as a rental. We're be making a killing. But ya live and learn and work with what you have.

While I'm with @rtraverdavis, I'd miss the mountains terribly, and living a few hrs from my family isn't bad, part of me sees stuff like this and I just want to send in my two weeks. https://www.zillow.com/homedetails/810-Cornell-Ave-Newell-SD-57760/194901962_zpid/

View attachment 173792