SAJ-99

Well-known member

Yeah, I get it. I don’t necessarily disagree with that model, but I don’t know that I agree with it either. It’s an odd space for me to be in. FF rate was still well above wage growth rate and inflation continues to slowly decline, so maybe. I just don’t see the direct impact to tariffs- not seeing anything like this in 100yrs doesn’t help. So I continue to wonder if that model overemphasizes int rate’s impact on wages. Way too deep of a discussion for this thread. LOL.There are a lot of pieces of this complicated economic pie. I don’t envy Powell at this time.

I’ll parrot what the main economist (group of 5) I’ve been reading/listening to think on the rate issue.

The Feds is in a tough position because the Fed needs to decide if it lowers rates to encourage employment (spur the economy) or raise rates to fight inflation.

The economists said that the Fed considers full employment as an unemployment rate of 4.6%. Any unemployment rate lower than 4.6% causes salary inflation. Current unemployment rate is 4.2%.

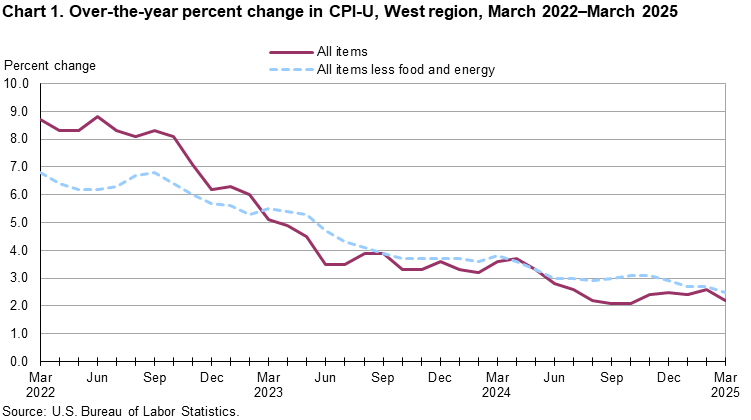

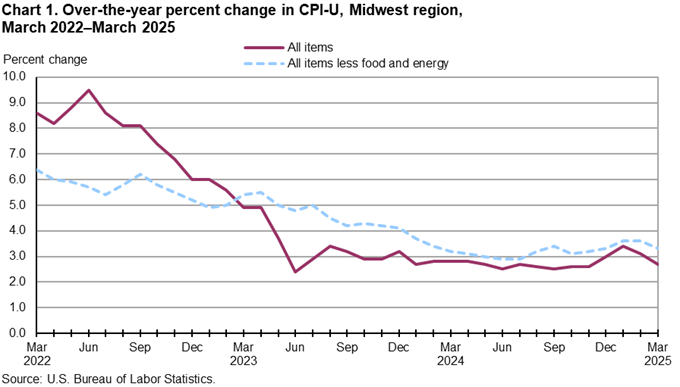

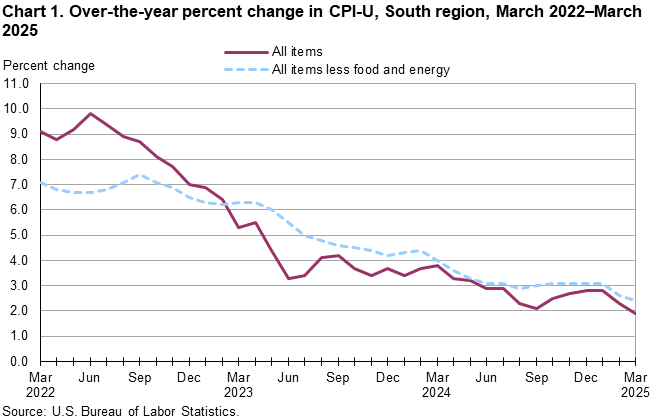

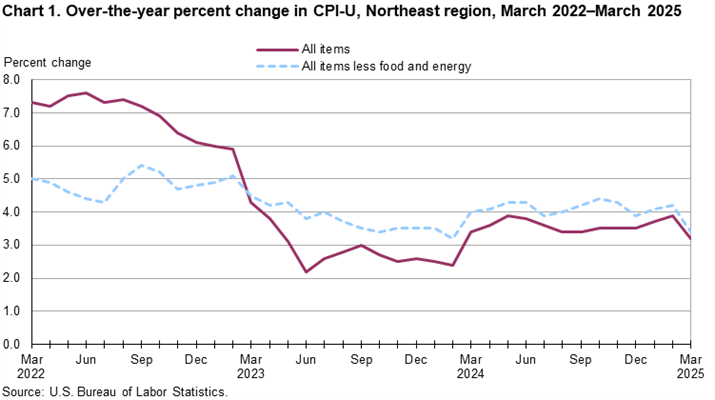

On the other hand, Fed wants inflation at 2%. Current inflation is 2.4%. Close to the goal but an inflation gap exists.

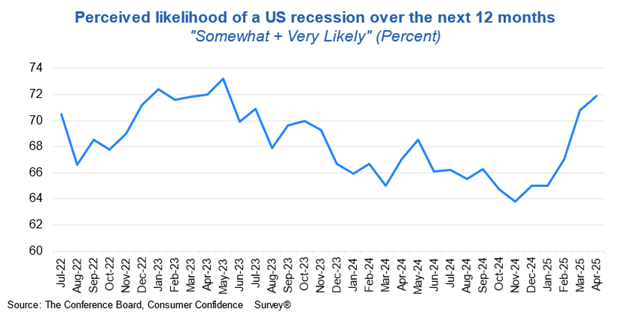

Due to the expected inflationary pressure from tariffs, the economist thought the Fed would choose to fight inflation. Raising rates was never mentioned but the thought was no lowering of rates in 2026.

No discussion of the effects of the rates on Federal debt because the economists wouldn’t expect the Fed to react for that reason. Politicians probably have closed door discussions about the subject with Fed board members.

I get both confidential information (job related) and have read public comments from the economic group. Private information is doom and gloom. Public information is more economist cagey with asterisks.

The decisive factor will be how long the tariff situation continues.

The main question for markets is Fed rate cut in May, Y or N. The reality is there might be more impact from perception of not bending to Trump as there is to actual data. The tariff-impacted data will continue to trickle in and it will be harder to spin as positive. China made sure of that by shutting down factories and sending back empty boats.