Cheesehead

Well-known member

- Joined

- Dec 6, 2017

- Messages

- 1,046

Oh, and I realize the irony because I literally started a thread about walnut trees that I need to get back to

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Reasoning?

I'm definitely the Tesla of the forum... lotta bullshit not a lot of value.It was a funny meme that would garner him additional coveted "likes" towards his inflated "reaction score"

And just like Tesla you are saving the world single-handedly (or maybe not)I'm definitely the Tesla of the forum... lotta bullshit not a lot of value.

And just like Tesla you are saving the world single-handedly (or maybe not)

It says they are accepting backup offers........you still got a chance!We looked at this house last week. It's the size of a condo, 2 bedroom, one of which you can barely fit a twin bed in and I had major concerns about the foundation and concrete. It's under contract for $590000, 105k over asking

I'm GONNA BE RICH!!! Just wait until I leave in ~10 years before bursting this insanityWe looked at this house last week. It's the size of a condo, 2 bedroom, one of which you can barely fit a twin bed in and I had major concerns about the foundation and concrete. It's under contract for $590000, 105k over asking

Straight lumber, or home depot lumber?Where do people see lumber prices going over the next year?

If @SAJ-99 decides to short it, to theWhere do people see lumber prices going over the next year?

the TLDRRe: the instareels, well, yes…my favorite are the ones that tell you what the effects are on your retirement account for chopping out that Starbucks latte. I feel @ElkFever2 could help here or perhaps we’ll wait a minute for the realest Dave Ramsey leg humper to please stand up.

In short (in long?), the answer is that yes, saving money (PMT) consistently in a retirement account from even a starting point of zero (PV) at an assumed rate (the million $ question of how much it will be … INT or RATE) will grow to a tidy sum eventually (FV). You then must handicap it by the inflation rate over the time period (N) to get to your real return, ie., how much you were truly paid to take on the investment risk. The equation today has substantially changed for most savers, especially younger ones, because: 1) the world is awash in money, and markets are much more efficient (in HT terms, fewer #honeyholes)…so S&P’s PE ratio of 25 means you are ‘getting’ a 4% return (100/25) on your money in terms of overly simplified cash flow (forget Price / Cash flow vs Price / Earnings for the moment)…so assets are expensive. So we won’t be getting that >10% long term S&P index fund return (or else it will only be on the back of high inflation so not real return).

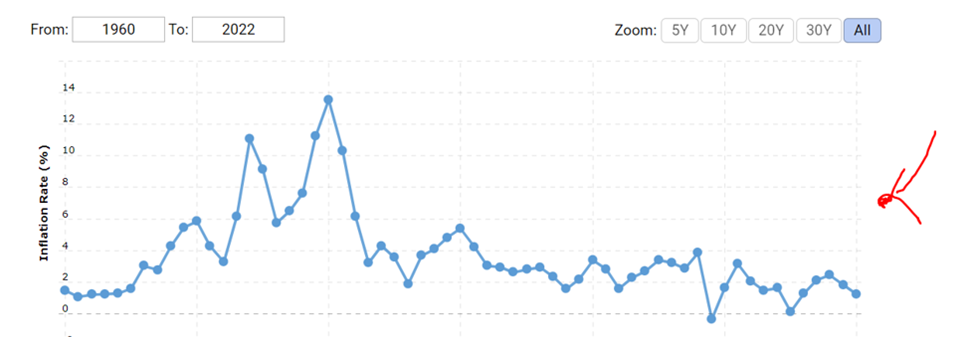

View attachment 212033

Unfortunately, in addition to expensive assets, and to your point, inflation is now popping to now >7%, which is because we are moving closer to Jimmy Carter era inflation than anytime in recent period.

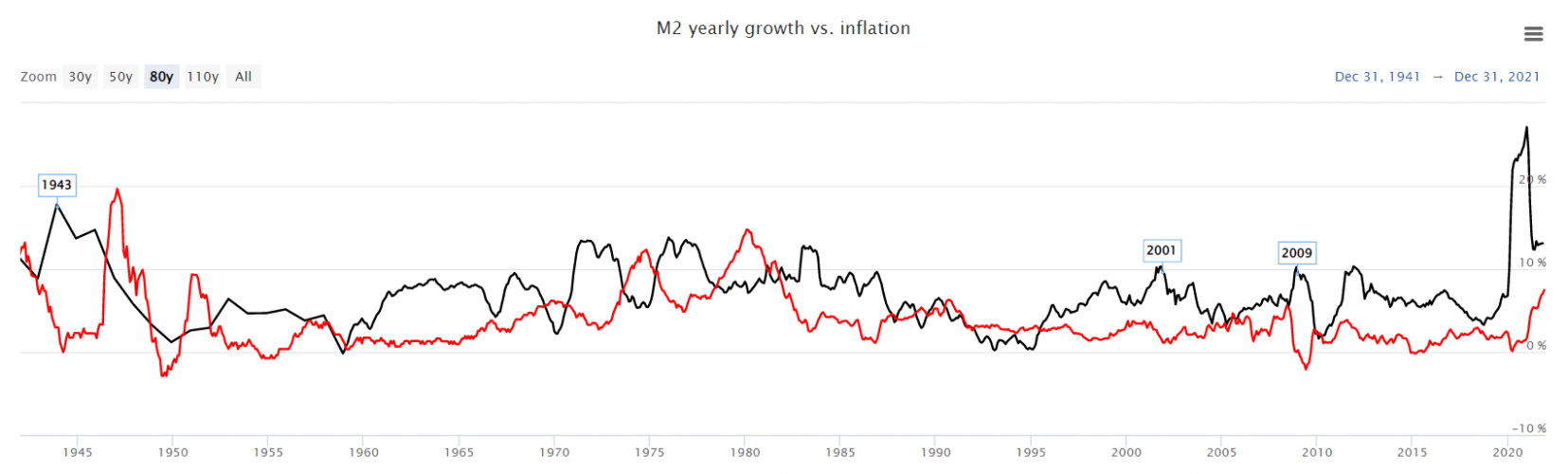

View attachment 212034

As for why aren’t there more millionaires within the boomer population, the answer there is: boomers are relatively wealthy but reports of 401ks/etc underestimate their wealth--they just don’t count all of it ****

For example: within their household wealth calculation you need to include the discounted cash flow of the present value of their pensions, which generally are twofold for many: company defined benefit schemes (millennials very rarely get that luxury) and also SS (which for us will exist but only after substantial raises in taxation to account for the forthcoming demographic collapse based on too few workers supporting too many retirees (see prior post). These get under-counted for boomers if you just look at Roths, 401ks, 403bs, etc.

As for inflation: yes, it is and for a while will continue to be worse than our medium term 2-3% we have had for decades…the pre- but especially post- COVID growth in money supply relative to GDP is about to kick CPI into crazy mode. So being a millionaire ain't what it used to be.

As for what to do about it…this is a bit dated, but prescient. About the only thing to do is: 1) lower expectations (and potentially read Stoic literature) 2) increase one's savings rate (note that the highest level of economic anxiety was in Japan, which is effectively 20-30 years ahead of ‘the West’ when it comes to the ratio of retirees supported by the average worker…but we will close the gap unless we have a systemic change in our view towards immigration), 3) selectively spend money now on experiences because they are about to get more expensive and degraded (#pointcreep in life, if you will)

I need to go make some mint tea.

Young people are saving more for retirement than Boomers and Generation X — and this is why

Young people are saving more than previous generations, according to a study, flipping the historical trend that saw older savers put the most money aside towards retirement.www.cnbc.com

***And also, yes they are stupid if by stupid I can transliterate that to mean they are the up there as the most self-entitled and consumptive generation in US history. My provisional book title is titled, “Thanks for f***ing us over, Boomers.” It’s too multivariate for forums, but they were born with a geopolitical silver spoon up their ass and unique ability to exploit the natural world for their own consumption...

The difference between millennials and boomers is their great fear was MADD with a substantially weaker opponent (Soviets) but cool heads could prevail and nothing happened. Our MADD is with mother nature, and is in large part (substantial if not existential) already in motion, and will slowly make our next few decades heart-wrenching from a perspective of relative helplessness because the commons’ tragedy is already baked. I need to step off my soap box because it’s Friday.

It's Friday and somebody's already baked!Re: the instareels, well, yes…my favorite are the ones that tell you what the effects are on your retirement account for chopping out that Starbucks latte. I feel @ElkFever2 could help here or perhaps we’ll wait a minute for the realest Dave Ramsey leg humper to please stand up.

In short (in long?), the answer is that yes, saving money (PMT) consistently in a retirement account from even a starting point of zero (PV) at an assumed rate (the million $ question of how much it will be … INT or RATE) will grow to a tidy sum eventually (FV). You then must handicap it by the inflation rate over the time period (N) to get to your real return, ie., how much you were truly paid to take on the investment risk. The equation today has substantially changed for most savers, especially younger ones, because: 1) the world is awash in money, and markets are much more efficient (in HT terms, fewer #honeyholes)…so S&P’s PE ratio of 25 means you are ‘getting’ a 4% return (100/25) on your money in terms of overly simplified cash flow (forget Price / Cash flow vs Price / Earnings for the moment)…so assets are expensive. So we won’t be getting that >10% long term S&P index fund return (or else it will only be on the back of high inflation so not real return).

View attachment 212033

Unfortunately, in addition to expensive assets, and to your point, inflation is now popping to now >7%, which is because we are moving closer to Jimmy Carter era inflation than anytime in recent period.

View attachment 212034

As for why aren’t there more millionaires within the boomer population, the answer there is: boomers are relatively wealthy but reports of 401ks/etc underestimate their wealth--they just don’t count all of it ****

For example: within their household wealth calculation you need to include the discounted cash flow of the present value of their pensions, which generally are twofold for many: company defined benefit schemes (millennials very rarely get that luxury) and also SS (which for us will exist but only after substantial raises in taxation to account for the forthcoming demographic collapse based on too few workers supporting too many retirees (see prior post). These get under-counted for boomers if you just look at Roths, 401ks, 403bs, etc.

As for inflation: yes, it is and for a while will continue to be worse than our medium term 2-3% we have had for decades…the pre- but especially post- COVID growth in money supply relative to GDP is about to kick CPI into crazy mode. So being a millionaire ain't what it used to be.

As for what to do about it…this is a bit dated, but prescient. About the only thing to do is: 1) lower expectations (and potentially read Stoic literature) 2) increase one's savings rate (note that the highest level of economic anxiety was in Japan, which is effectively 20-30 years ahead of ‘the West’ when it comes to the ratio of retirees supported by the average worker…but we will close the gap unless we have a systemic change in our view towards immigration), 3) selectively spend money now on experiences because they are about to get more expensive and degraded (#pointcreep in life, if you will)

I need to go make some mint tea.

Young people are saving more for retirement than Boomers and Generation X — and this is why

Young people are saving more than previous generations, according to a study, flipping the historical trend that saw older savers put the most money aside towards retirement.www.cnbc.com

***And also, yes they are stupid if by stupid I can transliterate that to mean they are the up there as the most self-entitled and consumptive generation in US history. My provisional book title is titled, “Thanks for f***ing us over, Boomers.” It’s too multivariate for forums, but they were born with a geopolitical silver spoon up their ass and unique ability to exploit the natural world for their own consumption...

The difference between millennials and boomers is their great fear was MADD with a substantially weaker opponent (Soviets) but cool heads could prevail and nothing happened. Our MADD is with mother nature, and is in large part (substantial if not existential) already in motion, and will slowly make our next few decades heart-wrenching from a perspective of relative helplessness because the commons’ tragedy is already baked. I need to step off my soap box because it’s Friday.

Re: the instareels, well, yes…my favorite are the ones that tell you what the effects are on your retirement account for chopping out that Starbucks latte. I feel @ElkFever2 could help here or perhaps we’ll wait a minute for the realest Dave Ramsey leg humper to please stand up.

In short (in long?), the answer is that yes, saving money (PMT) consistently in a retirement account from even a starting point of zero (PV) at an assumed rate (the million $ question of how much it will be … INT or RATE) will grow to a tidy sum eventually (FV). You then must handicap it by the inflation rate over the time period (N) to get to your real return, ie., how much you were truly paid to take on the investment risk. The equation today has substantially changed for most savers, especially younger ones, because: 1) the world is awash in money, and markets are much more efficient (in HT terms, fewer #honeyholes)…so S&P’s PE ratio of 25 means you are ‘getting’ a 4% return (100/25) on your money in terms of overly simplified cash flow (forget Price / Cash flow vs Price / Earnings for the moment)…so assets are expensive. So we won’t be getting that >10% long term S&P index fund return (or else it will only be on the back of high inflation so not real return).

View attachment 212033

Unfortunately, in addition to expensive assets, and to your point, inflation is now popping to now >7%, which is because we are moving closer to Jimmy Carter era inflation than anytime in recent period.

View attachment 212034

As for why aren’t there more millionaires within the boomer population, the answer there is: boomers are relatively wealthy but reports of 401ks/etc underestimate their wealth--they just don’t count all of it ****

For example: within their household wealth calculation you need to include the discounted cash flow of the present value of their pensions, which generally are twofold for many: company defined benefit schemes (millennials very rarely get that luxury) and also SS (which for us will exist but only after substantial raises in taxation to account for the forthcoming demographic collapse based on too few workers supporting too many retirees (see prior post). These get under-counted for boomers if you just look at Roths, 401ks, 403bs, etc.

As for inflation: yes, it is and for a while will continue to be worse than our medium term 2-3% we have had for decades…the pre- but especially post- COVID growth in money supply relative to GDP is about to kick CPI into crazy mode. So being a millionaire ain't what it used to be.

As for what to do about it…this is a bit dated, but prescient. About the only thing to do is: 1) lower expectations (and potentially read Stoic literature) 2) increase one's savings rate (note that the highest level of economic anxiety was in Japan, which is effectively 20-30 years ahead of ‘the West’ when it comes to the ratio of retirees supported by the average worker…but we will close the gap unless we have a systemic change in our view towards immigration), 3) selectively spend money now on experiences because they are about to get more expensive and degraded (#pointcreep in life, if you will)

I need to go make some mint tea.

Young people are saving more for retirement than Boomers and Generation X — and this is why

Young people are saving more than previous generations, according to a study, flipping the historical trend that saw older savers put the most money aside towards retirement.www.cnbc.com

***And also, yes they are stupid if by stupid I can transliterate that to mean they are the up there as the most self-entitled and consumptive generation in US history. My provisional book title is titled, “Thanks for f***ing us over, Boomers.” It’s too multivariate for forums, but they were born with a geopolitical silver spoon up their ass and unique ability to exploit the natural world for their own consumption...

The difference between millennials and boomers is their great fear was MADD with a substantially weaker opponent (Soviets) but cool heads could prevail and nothing happened. Our MADD is with mother nature, and is in large part (substantial if not existential) already in motion, and will slowly make our next few decades heart-wrenching from a perspective of relative helplessness because the commons’ tragedy is already baked. I need to step off my soap box because it’s Friday.