Addicting

Well-known member

I’m averaging 225 with 2 kids and a wife working from home. Single guy, on a budget in an older home, should be close to the 150.I wish.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I’m averaging 225 with 2 kids and a wife working from home. Single guy, on a budget in an older home, should be close to the 150.I wish.

There is $628 left in the wallet for the month and we haven’t budgeted for any food yet.

It also doesn’t take into account how fortunate a mid 20’s person would have to be. 12,500 in the bank, $25 an hour, and reliable car that’s paid for, no other debt.In fairness though, that example doesn’t include a second income earner either.

Problem is same as point creep. Wages are not keeping up to the market.For sure, agree.

It sounds like we may be discussing a person that may not quite be in the position to be buying a house yet.

Is their $22 an hour really going to help?

Health (or lack thereof) was the single biggest issue when I was working. Trying to keep my sick leave up, then spending a week in a far away hospital, travel expenses, incidental, and then making too much to be able to itemize taxes and get any kind of a break.It also doesn’t take into account how fortunate a mid 20’s person would have to be. 12,500 in the bank, $25 an hour, and reliable car that’s paid for, no other debt.

Oh and healthy because they are not paying for healthcare.

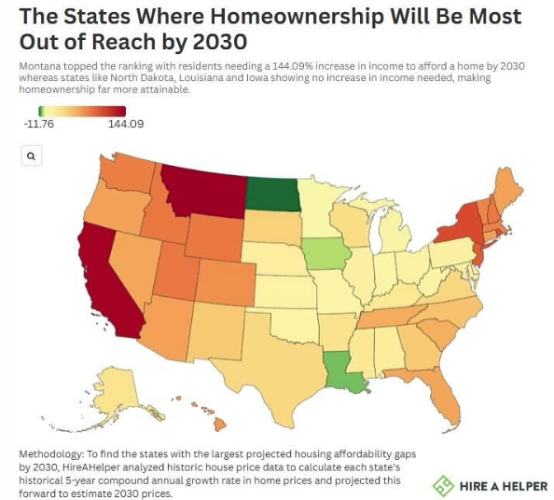

I think expecting every kid in their 20s to move to the midwest if they ever want to own a home is pretty damn ridiculous, and would make the intermountain west a lot shittier place for the boomers who got in when it was affordable.THIS is also part of the folks doing the "I will NEVER afford a house" issue.....not everyone can live in the inter-mountain west, on the beach, in a big city, etc. As was talked about above, as far as expectations, I am 56 and have kids in their 20s. I think my kids are pretty grounded but I can tell you that almost NONE of their friends or the younger folks I work with at Scheels are. I am fully aware that "things change" but it is also LARGELY about priorities. Younger folks spend tons of money on things that are in NO way necessities because they "feel" they are necessities and there is a huge sense of entitlement proportionally. Get a cheap ass cell phone, don't eat out or get stupid ass coffee everyday, clothes don't have to be expensive (or even new), cars can be really old and just good enough. Given the amount of those that can work remotely......live in a small town in almost anywhere in the middle of the country if you want a house. FFS, we just bought a house in IN for 250k that would be at LEAST 8-900k in CO. A LOT of the "we CAN'T do it" is perception and false reality.

His example was in Indiana. So for 250k there it means more rural than city. There just isn’t high paying jobs in rural areas.Where does this couple live?

(And they both need to have health insurance regardless of current state of health in my opinion).

Alternate question - could you afford to build it now? Even if the lot were free?Bought a 2.5 acre lot in 2012 for $38,000. Built our 3,600 sq ft house that year for $203,000. Did a lot of the work (wood floors, tiling, fireplace, etc) myself. Total of $241K. Refinanced in 2020 at 2.25% and added 60K to the mortgage to finish the basement and some surrounding concrete.

Lots alone in my subdivision now sell for north of $200K, and comparable listings in our neck of the woods would probably put our home at $700-800K.

If we were starting now as we did then, we would be looking further out, at something less, and probably trying to be creative (build a shop/house, and slowly grow it). I don't think an adventure like that would affect my life satisfaction, though.

No, I could not afford to buy my own house.

Alternate question - could you afford to build it now? Even if the lot were free?

For sure, agree.

It sounds like we may be discussing a person that may not quite be in the position to be buying a house yet.

THIS is also part of the folks doing the "I will NEVER afford a house" issue.....not everyone can live in the inter-mountain west, on the beach, in a big city, etc.

Where and will it qualify for a mortgage? Highly doubt it.There are still lots of sub $100k fixer upper homes available too.

It would be nice if HT members would post their locations in upper right hand corner. It gives posts much more context and clarity. Thanks in advance, HT members.Amen !

You can buy a whole farm with a house in the midwest or parts of the south for what some folks pay for a little home on a small property in high cost of living areas.

There are still lots of sub $100k fixer upper homes available too.

Just did a quick Zillow search in the nearest town to us, pop 18k and very quickly found a dozen available homes for under $100k.Where and will it qualify for a mortgage? Highly doubt it.