Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cheapest way to e-file ???

- Thread starter mikieb

- Start date

I had to drop $109.00

TaxSlayer® | File Taxes Online | E-File Tax Returns

TaxSlayer is the easiest way to file your federal and state taxes online. Learn about our tax preparation services and receive your maximum refund today.

www.taxslayer.com

www.taxslayer.com

D

Deleted member 28227

Guest

Basically with anything, if it gets too time consuming or frustrating I use a professional.All you DIYers are going to put Big Finn out of business! I use an accountant. He charges us 100 dollars and there is no question in my mind that we make money on that arrangement.

I use a CPA for Trust returns.

D

Deleted member 28227

Guest

I’ve found enough mistakes that I don’t use a CPA for personal returns, most likely the CPA isn’t doing your $100 return it’s some assistant and I’ve caught numerous errors. Whoever did ours one year in Bozeman (not Big Fin) didn’t know the difference between a deduction and a credit... apparently.I hear this prices and think it make my account fee seem like a bargain. I even get to sit down with him for the better part and hour or so and bullshit.

WyoDoug

Well-known member

I used Turbo Tax on line free and never had to buy the software. They keep trying to push the premium service on you but I ignore that and those the free option. turbotax.com

We haven't had 100 dollar returns since we got married 15 years ago. Our taxes and combined financial situation is a bit too complex an undertaking for me to not hire an account. Yes that cost is significantly more than 100 however it's still money well spent for us. This years meeting unfortunately is via zoom, however we will still meet with him, not an assistant, and run though any questions or changes we had.I’ve found enough mistakes that I don’t use a CPA for personal returns, most likely the CPA isn’t doing your $100 return it’s some assistant and I’ve caught numerous errors. Whoever did ours one year in Bozeman (not Big Fin) didn’t know the difference between a deduction and a credit... apparently.

When I considered the time saving for myself and my wife its money saver for sure.

westbranch

Well-known member

I’ve found enough mistakes that I don’t use a CPA for personal returns, most likely the CPA isn’t doing your $100 return it’s some assistant and I’ve caught numerous errors. Whoever did ours one year in Bozeman (not Big Fin) didn’t know the difference between a deduction and a credit... apparently.

Sitting in my office at 6:45 am and instead of reviewing tax returns I am adding some thoughts here. Some of the below comments are more general but when it comes to an assistant preparing the returns I would say its like any other business, the detail work is going to be done by some sort of less experienced staff and reviewed up the chain. But there should still be review process for quality control in place. I would be very hesitant to work by myself as a sole-prop CPA due the self-review issues. Long hours during tax season lead to input errors are caught by having someone else review. I see quite a few tax returns from sole-prop CPAs throughout the year that have glaring mistakes. Once I review and let a potential client know of potential issues, there are times I have estimated our fees 2-3+ times more than they have been paying. That usually applies to business owners or other more complex tax situations.

Our process is that tax documents come in and are reviewed by a CPA or other experienced staff who organizes and leaves comments, it is input into tax software by staff with 0-5 yrs of experience, reviewed by a CPA with review comments back to the staff, and back again to the CPA for for final review. I have some sort of conversation with every client regarding planning and changes. A lot more zoom, phone calls and email this year. And I do have a dozen+ clients with very simple individual returns I tell every year they should be doing a free-file option either online or AARP tax-aide if they qualify. But they want the signature block on the return to say CPA.

The vast majority of people with a couple W2s, brokerage statement and own a home are going to be fine preparing themselves. Usually when people come in with a tax notice from the IRS on a simple return its due to miskeying a digit or omitting a form.

Addicting

Well-known member

Join the military, it’s free!

Pucky Freak

Well-known member

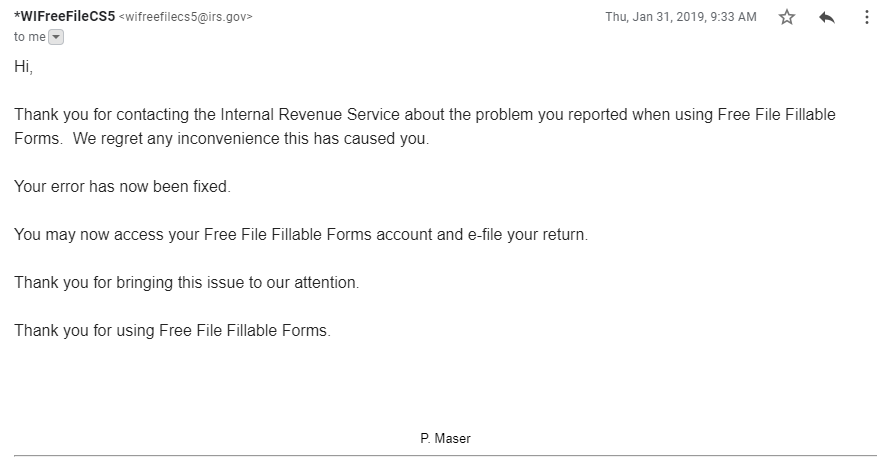

I’ve tried the fillable forms and I am not a fan. Some of the forms have entry field program errors, e.g. a grey type-in field to the left of a line where you can’t type anything at all, etc. Most years my taxes are complicated with numerous supplementary forms including necessary attachments that I have to type up.

D

Deleted member 28227

Guest

The program does feel like a beta version, but in part it is because they have to change it every year with our fickle tax policy.I’ve tried the fillable forms and I am not a fan. Some of the forms have entry field program errors, e.g. a grey type-in field to the left of a line where you can’t type anything at all, etc. Most years my taxes are complicated with numerous supplementary forms including necessary attachments that I have to type up.

In 2019 they had a field set to accept a string instead of a number and it was blowing up one of the schedules.

Fun fact the IRS won't contact you by email... unless you point out a coding error.

Gellar

Well-known member

Has anyone ever done a free version and then payed someone in the same year to compare the two? All of my coworkers take a day off work and meet with their tax person but I file mine myself. Every year I wonder if I’m making a mistake by filing myself and if I’d get a bigger return if I hired someone.

Dougfirtree

Well-known member

I say try it once. I know that for us, our returns got significantly bigger when we first used an accountant.Has anyone ever done a free version and then payed someone in the same year to compare the two? All of my coworkers take a day off work and meet with their tax person but I file mine myself. Every year I wonder if I’m making a mistake by filing myself and if I’d get a bigger return if I hired someone.

Pucky Freak

Well-known member

I average about 1 mistake a year between the federal return and the state return. About half the time the IRS or IA dept. of revenue catches the mistake, the other half of the time I catch the mistake when I look back over a previous year's return a year or two after I filed it, since I always compare my current return with the returns from the last 3 years when I'm working on one. When I catch the mistake I just file an amended return. About half the time I missed paying something I should have paid and the other half the time I missed a deduction or credit, so the net error amount is right around $0. All but one of the 20 or so error amounts was greater than $300, and I think only 3-4 were greater than $100, so these are small potatoes. I priced out my 2019 taxes if I had an accountant do them and it was around $500. That sounds like a lot, but that is them doing a ridiculous amount of legwork and calculating because my taxes were quite complicated that year. In reality, an accountant would ask I do nearly all this prep work myself and they'd crunch the numbers, prepare the return and charge somewhere in the neighborhood of $150-175. But if I'm going to do all that legwork, I am 85% of the way there and I can do the rest with a little more effort.Has anyone ever done a free version and then payed someone in the same year to compare the two? All of my coworkers take a day off work and meet with their tax person but I file mine myself. Every year I wonder if I’m making a mistake by filing myself and if I’d get a bigger return if I hired someone.

My point in saying all this is you have to deduct the cost of having someone prepare your return vs. what you might miss by doing it yourself, so you may or may not come ahead. There have been 2 years I've paid an accountant to do my taxes. One of those years I felt he kind of zipped through it and didn't ask me any questions to see where I might be saving some extra money. It was a complete waste of a fee IMO. I learned nothing, he did the bare minimum, and I could have done the same thing in my sleep. I wanted him to look for ways to save me more $ - I told him this up front and even had an appointment to meet and go over this info. The meeting lasted 2 minutes! He had me sign on the dotted line and couldn't kick me out of his office fast enough. Total BS - would not recommend him to my worst enemy. My other experience with an accountant was when I was 20. They failed to follow through and confirm that a supplementary document being received and processed by the IRS. Complicated story, but the bottom line was I spaced it out, the accountant never checked, and there was like $1000 that should have come to me and never did. I uncovered the error a few years later, fixed the issue and finally did get the money, but what am I paying you for if you're going to drop the ball like that...

TLDR, TLDR...Geller...if you want someone to take second look at your taxes I'd be happy to give them the once over for free. Otherwise, if you do go with a CPA make sure you get one that comes with MULTIPLE raving reviews from people you know personally. There are a lot of schmucks out there who aren't worth their weight in potato flour.

Gellar

Well-known member

Thank you for the generous offer. I’ve always hesitated for those same reasons. I’m fairly confident in my abilities to do our taxes and not sure if the extra cost of having someone do them for us would equal a greater return compared to the cost of the preparer.I average about 1 mistake a year between the federal return and the state return. About half the time the IRS or IA dept. of revenue catches the mistake, the other half of the time I catch the mistake when I look back over a previous year's return a year or two after I filed it, since I always compare my current return with the returns from the last 3 years when I'm working on one. When I catch the mistake I just file an amended return. About half the time I missed paying something I should have paid and the other half the time I missed a deduction or credit, so the net error amount is right around $0. All but one of the 20 or so error amounts was greater than $300, and I think only 3-4 were greater than $100, so these are small potatoes. I priced out my 2019 taxes if I had an accountant do them and it was around $500. That sounds like a lot, but that is them doing a ridiculous amount of legwork and calculating because my taxes were quite complicated that year. In reality, an accountant would ask I do nearly all this prep work myself and they'd crunch the numbers, prepare the return and charge somewhere in the neighborhood of $150-175. But if I'm going to do all that legwork, I am 85% of the way there and I can do the rest with a little more effort.

My point in saying all this is you have to deduct the cost of having someone prepare your return vs. what you might miss by doing it yourself, so you may or may not come ahead. There have been 2 years I've paid an accountant to do my taxes. One of those years I felt he kind of zipped through it and didn't ask me any questions to see where I might be saving some extra money. It was a complete waste of a fee IMO. I learned nothing, he did the bare minimum, and I could have done the same thing in my sleep. I wanted him to look for ways to save me more $ - I told him this up front and even had an appointment to meet and go over this info. The meeting lasted 2 minutes! He had me sign on the dotted line and couldn't kick me out of his office fast enough. Total BS - would not recommend him to my worst enemy. My other experience with an accountant was when I was 20. They failed to follow through and confirm that a supplementary document being received and processed by the IRS. Complicated story, but the bottom line was I spaced it out, the accountant never checked, and there was like $1000 that should have come to me and never did. I uncovered the error a few years later, fixed the issue and finally did get the money, but what am I paying you for if you're going to drop the ball like that...

TLDR, TLDR...Geller...if you want someone to take second look at your taxes I'd be happy to give them the once over for free. Otherwise, if you do go with a CPA make sure you get one that comes with MULTIPLE raving reviews from people you know personally. There are a lot of schmucks out there who aren't worth their weight in potato flour.

On a side note my wife and I always argue about our return. I believe at least one of us should be claiming at least 1 dependent so we get more in our checks each week. She likes having a return at tax time to pay off Christmas debt and if we have any other stuff on our credit cards.

On a side note don't let her know the states you apply in that "borrow" your money for applying. It is a forced savings so maybe agree to she gets half for Christmas debt and you get half for hunting. Win winOn a side note my wife and I always argue about our return. I believe at least one of us should be claiming at least 1 dependent so we get more in our checks each week. She likes having a return at tax time to pay off Christmas debt and if we have any other stuff on our credit cards.

Gellar

Well-known member

Ha, she got her Id stolen before we were married and now she checks our credit cards daily. It has caught a few things at times, but during app season I have to answer questions.On a side note don't let her know the states you apply in that "borrow" your money for applying. It is a forced savings so maybe agree to she gets half for Christmas debt and you get half for hunting. Win win

Blow_n_smoke

New member

- Joined

- Jun 17, 2016

- Messages

- 1

Give Dave Ramsey’s tax program a shot. Easy to do. Cost $74 for fed and state. Unlike most other tax programs, they won’t sell your information.

Gellar

Well-known member

My wife is on me that we need to amend our taxes! She received unemployment in 2020 and thanks to brother Biden’s stimulus package last week she says that unemployment is no taxable income. Is it going to be worth the time and cost to amend our taxes? She was working 32 hours a week and getting unemployment for the other 8 hours.

Similar threads

- Replies

- 35

- Views

- 2K

- Replies

- 11

- Views

- 1K

Latest posts

-

-

-

Western Mountaineering Terralite Sleeping Bag

- Latest: Timberlinehunter

-