Handlebar

Well-known member

- Joined

- Jul 15, 2014

- Messages

- 380

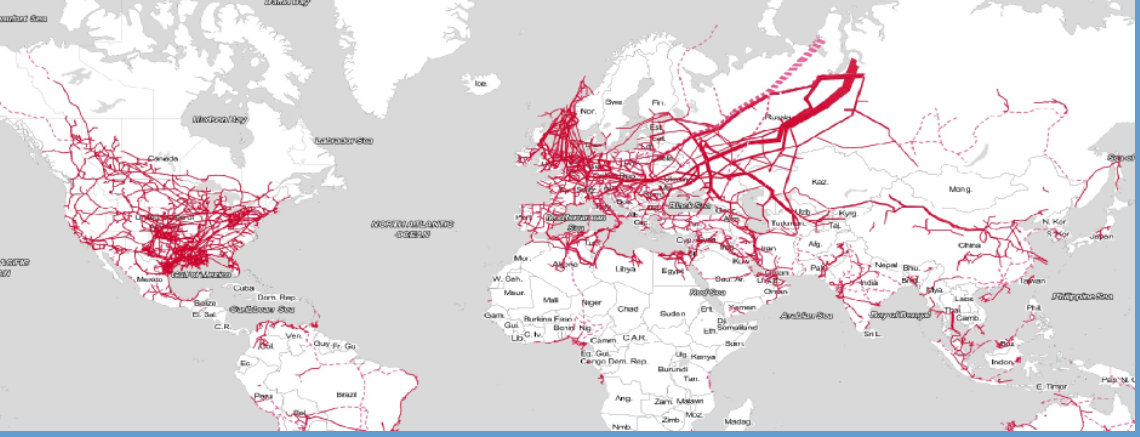

There are better O&G experts on this forum, but simplistically, when we say German buys gas from Russia - we really mean various German companies (including state entities) buy gas from various Russian companies (including state entities). The buying/selling between companies is done via fairly standardized contracts. The vast majority of O&G contracts are "settled" in dollars.

For example, if Bob agrees to buy three beanie babies from Sue for a certain number of bitcoins via a contract, Bob can't just unilaterally decide to pay Sue in Swiss Francs of equivalent value - it is up to Bob to bear the cost/risk of converting his Francs to bitcoin prior to payment.

But of course, we are now overlaying complex nation-state posturing (sanctions, war, etc) which often throw typical commercial behaviors to the wind.

In this specific scenario, Poland says its gas buyers have binding contracts with Russian gas sellers to settle all payments in $USD. Russia unilaterally changes its mind and says they will only take Rubles (to force Poland to buy Rubles with dollars/euros to prop up foreign demand for rubles) for payment. Poland offers payment in dollars, Russia refuses payment, Russia terminates supply for "non-payment" by Poland, Poland argues it complied with the contract payment terms and Russia is the one who breached the agreement. Poland is technically correct.

Russia wants to make it harder/more expensive for EU to buy gas, prop up the value of the Ruble, and remind western Europe how vulnerable they are to Russian demands.

Four European Gas Buyers Made Ruble Payments to Russia

Four European gas buyers have already paid for supplies in rubles as President Vladimir Putin demanded, according to a person close to Russian gas giant Gazprom PJSC.

Just saw this I have not read it