mevertsen

Well-known member

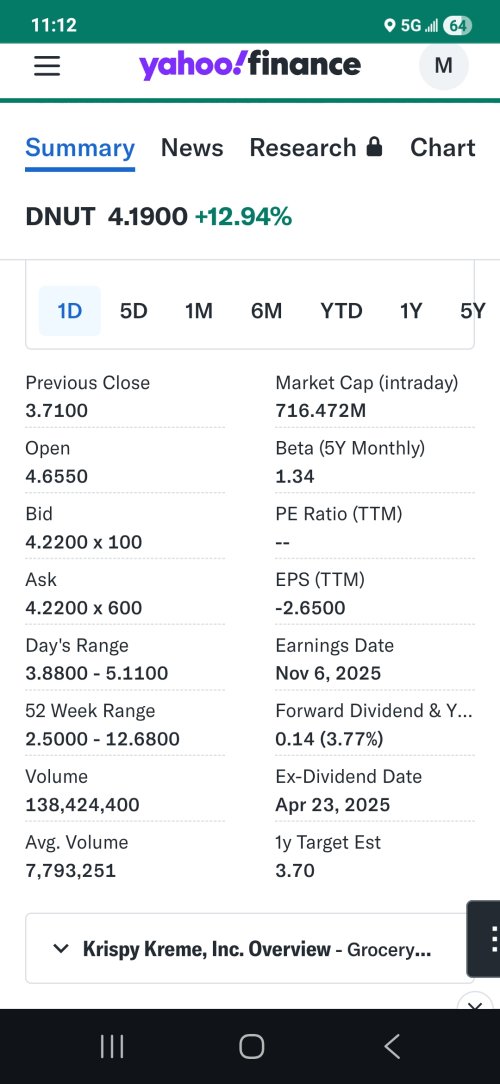

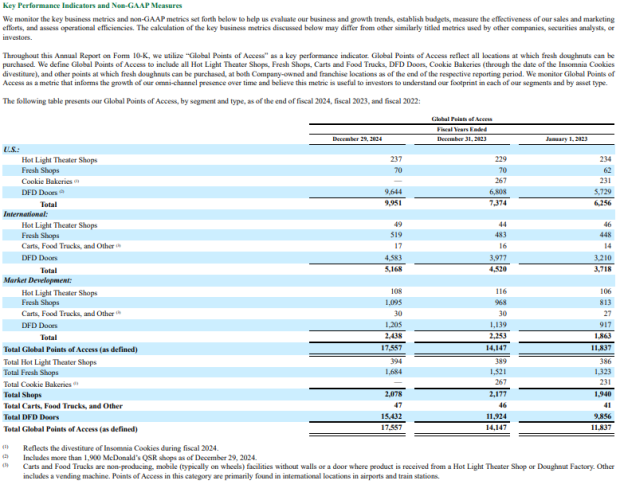

A thought just came to mind, and I don't know the answer, or the answer may just be in the stock details and I don't know what to look for.

I sell 1 million widgets for 5 dollars each. My net profit was .40 each, or $400,000 for that year.

Cost of my raw materials goes up, so I now have to charge 6.5 dollars for each widget.

As a result, fewer people buy the widget, so I sell 950,000 widgets. But, because of increased sale price, I actually net .50 cents for each widget and get $475,000.

Did my earnings actually go up?

Even though my units sold went down?

But my profit increased?

What data point am I looking for here?

Or, do earnings going up actually represent a healthy or growing economy? Or just fewer people buying more expensive things?

Reason I asked, is I read articles for the earnings season coming up, but I wonder if that is a true measure of what is going on.

Thanks

I sell 1 million widgets for 5 dollars each. My net profit was .40 each, or $400,000 for that year.

Cost of my raw materials goes up, so I now have to charge 6.5 dollars for each widget.

As a result, fewer people buy the widget, so I sell 950,000 widgets. But, because of increased sale price, I actually net .50 cents for each widget and get $475,000.

Did my earnings actually go up?

Even though my units sold went down?

But my profit increased?

What data point am I looking for here?

Or, do earnings going up actually represent a healthy or growing economy? Or just fewer people buying more expensive things?

Reason I asked, is I read articles for the earnings season coming up, but I wonder if that is a true measure of what is going on.

Thanks