Greybeard

Well-known member

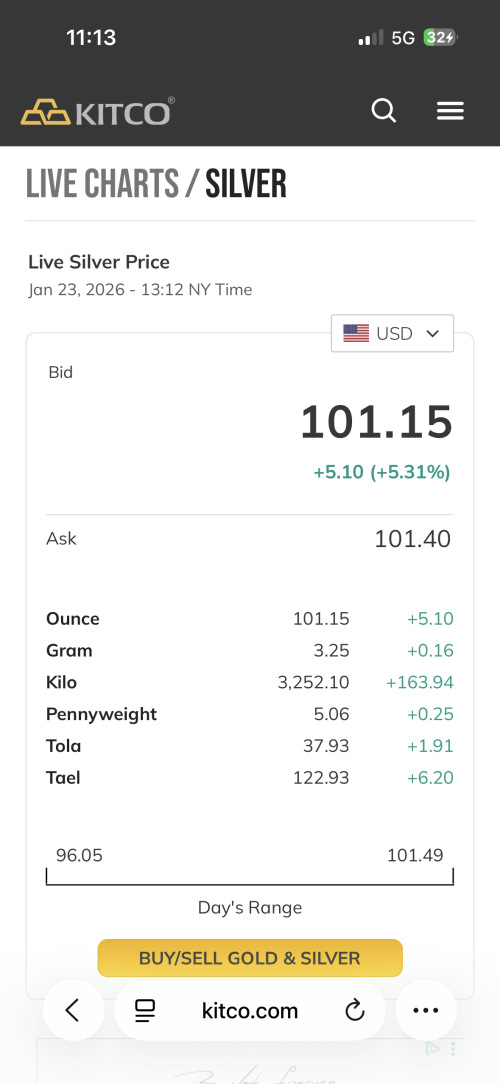

Good luck if you plan on selling to a coin shop. Most are paying $10-$20 back of spot if they are buying at all. The recyclers that they sell their excess to are paying the coin shops way back of spot because they are backed up from the inrush of silver coming in from sellers.I've got about 30 Oz im going to unload a little soon.

You might be better selling to an individual or just waiting until the market lines out.