D

Deleted member 16864

Guest

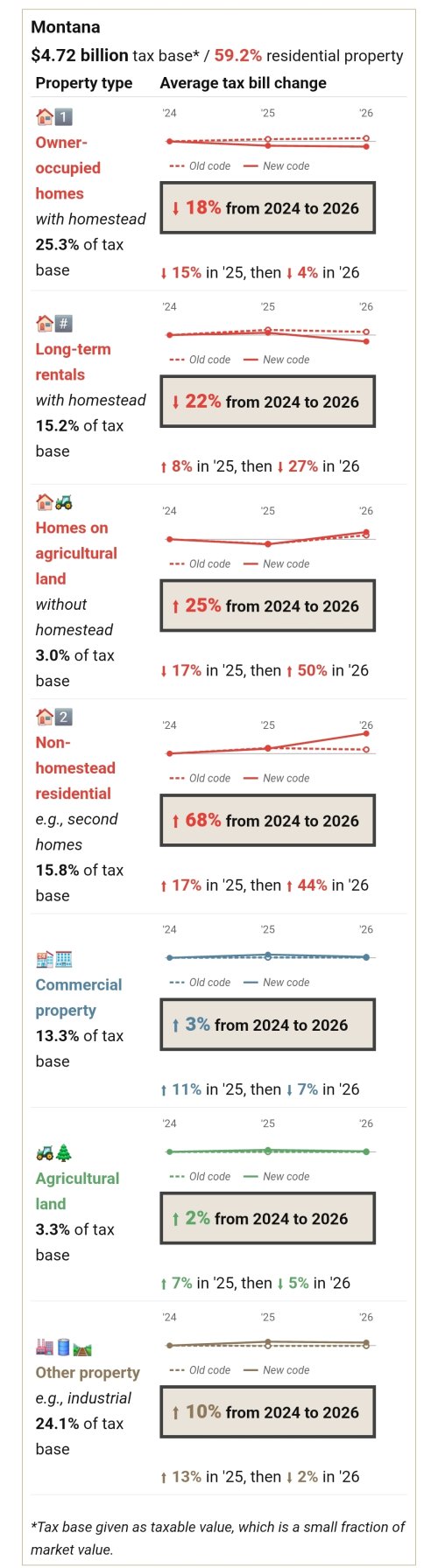

Revenue department says Montana property taxes could rise again

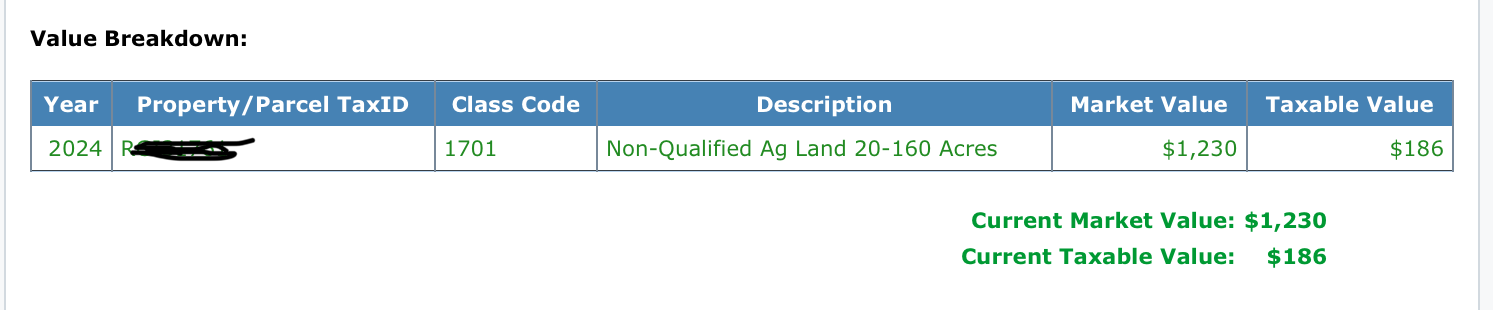

The department expects the market value of the average Montana residential property to be reappraised at 21% higher when it completes next year’s reappraisal cycle.