BigHornRam

Well-known member

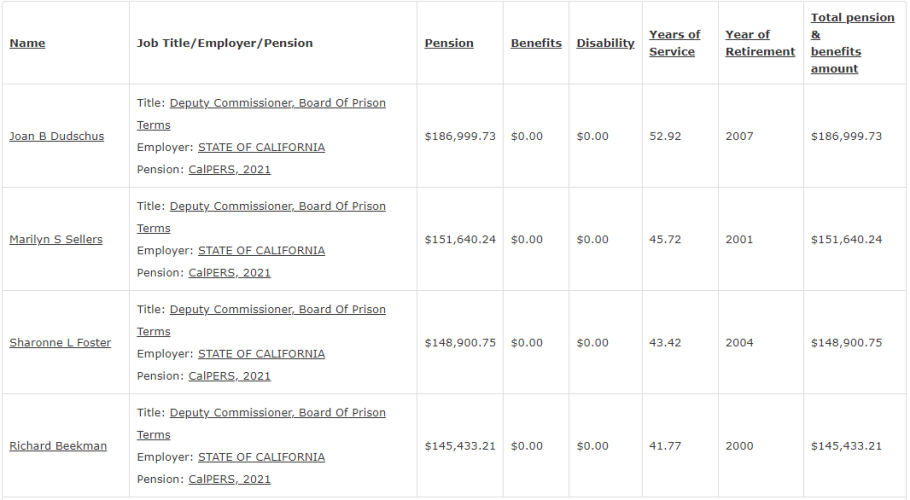

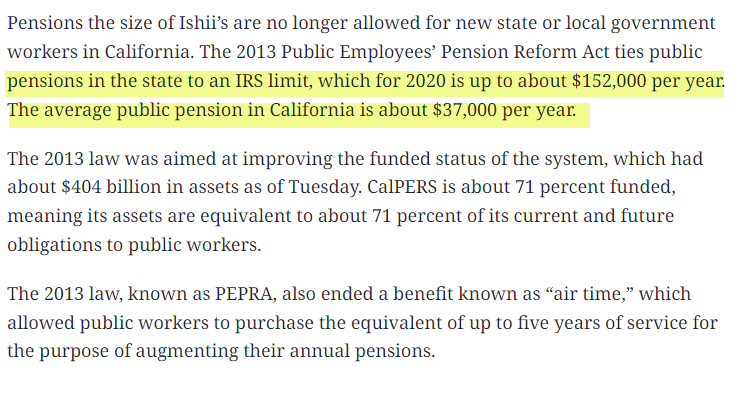

Show some data to back up your claim on 250k pensions. Not just hear say. I would like to see it.You are naive as hell. People really don't know the reall story on social security, medicare, and state & local govt retirement benefits. The retirement medical care is EXPENSIVE. A friend who was a fireman in Pittsburgh told me "You think I got good healthcare, the teachers NEVER pay a deductible or copay!!". Maybe not every prison guard in Calif, but how about an average pension of $200K??? Go do some searches on google. I recall seeing a woman that retired with 30 years in the prison system and got a pension of $300K.

People just cant conceptualize the cost of $300,000 pension. What is the present value of something like that??? Well here ya go. 30-year U.S Treasury yields are at 4.5% now. Take the iverse of that (1/.045) and that is 22.22 times. $300,000 times 22.22 = $6,666,666. So her pension is equivalent to you having $6.7 mil in your 401k!!!! Does it now hit ya? Duh! Add in another $500k-$1 mil for the healthcare. Remember, they have no mortality risk whatsoever with a pension. That is worth a considerable too. Mortality risk is "that you outlive your assets". Are you the world's smartest investment manager??? Pension (no mortality risk) or 401K (you take the mortality risk)???? Which would you take????

Now do you see? What is the pre-tax salary you need in aftertax takehome pay to accumulate $7-9 million for your pension over a 30 year period??? Where's the genius on here with the simplistic 30 year app to calculate that??? With not a volatile stock market!

Last edited: