Marshian

Well-known member

In reference to the “Eve of Destruction” thread, what would be your preferred, primary way to change social security, if you want it changed at all? Feel free to comment why you voted how you did.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Exactly! Gov wasn’t there for me in the beginning of my life, not counting on them to be there for me in the end of it. Pay off your house and buy a nice life Insurance policy and hope to go by grizz or lightning strike early so the little woman is taken care of.Doesn't matter what I'd like it's not gonna be fixes anytime in my lifetime, act accordingly.

I'm taking the load data with me though. mtmuleyExactly! Gov wasn’t there for me in the beginning of my life, not counting on them to be there for me in the end of it. Pay off your house and buy a nice life Insurance policy and hope to go by grizz or lightning strike early so the little woman is taken care of.

I’d settle for I don’t get anything and you quit taking from meI’d take back what I have paid into it. I don’t even want interest. Just give me back my money and let me out of that racket.

I'd happily take what I paid into it and what my business paid into it on my behalf (which I owned) interest free.

Also, here is a novel idea. Stop robbing it. And instead of funding crap like monies paid to Ukrainian oligarchs, pay back to SS all the f'n money you stole. Problem solved.

Right. If it's on the internet and if the government tells us it's untrue, then it's gospel. Sorry, at this point in my life I don't believe shit. I will stick with my gut, which has rarely led me astray in my 57 years in this planet.

Did Congress Steal Trillions From Social Security? The Answer Might Surprise You | The Motley Fool

Did lawmakers really steal your hard-earned income?www.fool.com

It's funny you mention that. About 10 years ago, when I was about to retire, I ran through an exercise to see what rate of return I would have needed to receive over the 40+ years I paid into the system to get the payment I was promised. I counted my actual contributions and also my employer contributions over my 40+ work history. I believe I calculated that I would have needed a 13% rate of return over those 40 years to get a payment from 66 to my expected mortality. That's what amazed me. I think my employer & my contributions totaled around $300,000. I remember seeing something how the first woman that collected from social security only contributed $100 but because she lived pretty long had collected thousands of dollars in benefits, even accounting for the time value of money. Do we have any actuaries on here? I think most people are astonished. Benefits far outweigh contributions.I’d take back what I have paid into it. I don’t even want interest. Just give me back my money and let me out of that racket.

That article is total bullshit. The SS system reserves are in Treasury bonds!! Taking out of one pocket to put in the other pocket! THERE IS NO TRUST FUND. It's an accounting entry, cash in and cash out. And, I believe that when they calculate your benefit when you retire, you only get credit for the earnings you paid the FICA taxes on. So it is a myth that somehow rich people are getting a free benefit funded by "the common man". Top monthly benefits have a limit. Actuaries could confirm that, but I believe that is my understanding of how benefits are calculated. My actuary buddy died last June 24, RIP at 62. One of the problems is that there is a minimum benefit of close to $1000 a month. And, SSI has been taped by a bunch of homeless and drug addicts, all allowed by the politicians. There are so many falsities that the public believes.Right. If it's on the internet and if the government tells us it's untrue, then it's gospel. Sorry, at this point in my life I don't believe shit. I will stick with my gut, which has rarely led me astray in my 57 years in this planet.

Between you and your employer, 12.4% is put in SSI on your behalf.It's funny you mention that. About 10 years ago, when I was about to retire, I ran through an exercise to see what rate of return I would have needed to receive over the 40+ years I paid into the system to get the payment I was promised. I counted my actual contributions and also my employer contributions over my 40+ work history. I believe I calculated that I would have needed a 13% rate of return over those 40 years to get a payment from 66 to my expected mortality. That's what amazed me. I think my employer & my contributions totaled around $300,000. I remember seeing something how the first woman that collected from social security only contributed $100 but because she lived pretty long had collected thousands of dollars in benefits, even accounting for the time value of money. Do we have any actuaries on here? I think most people are astonished. Benefits far outweigh contributions.

I also ran through a basic calculation to see if it matter whether I retired at 62 or 66.5, my full retirement age. It doesn't, otherwise the system would be incredibly unstable, even more than it is because benefits are so outsized. The actuaries make sure that you are roughly economically indifferent. Benefits for the whole are outsized because it's another handout from Congress. They own us.

They've basically turned social security into another welfare program, just like Medicare. The middle class is in denial, but it is absolutely true. High income people get screwed royally.That article is total bullshit. The SS system reserves are in Treasury bonds!! Taking out of one pocket to put in the other pocket! THERE IS NO TRUST FUND. It's an accounting entry, cash in and cash out. And, I believe that when they calculate your benefit when you retire, you only get credit for the earnings you paid the FICA taxes on. So it is a myth that somehow rich people are getting a free benefit funded by "the common man". Top monthly benefits have a limit. Actuaries could confirm that, but I believe that is my understanding of how benefits are calculated. My actuary buddy died last June 24, RIP at 62. One of the problems is that there is a minimum benefit of close to $1000 a month. And, SSI has been taped by a bunch of homeless and drug addicts, all allowed by the politicians. There are so many falsities that the public believes.

You are not accounting for mortality. And that adds considerable complexity. Also wives get a survivor benefit. And drug addicts get SSI. And there is an inflation adjustment in the benefit. It is not so simplistic.Between you and your employer, 12.4% is put in SSI on your behalf.

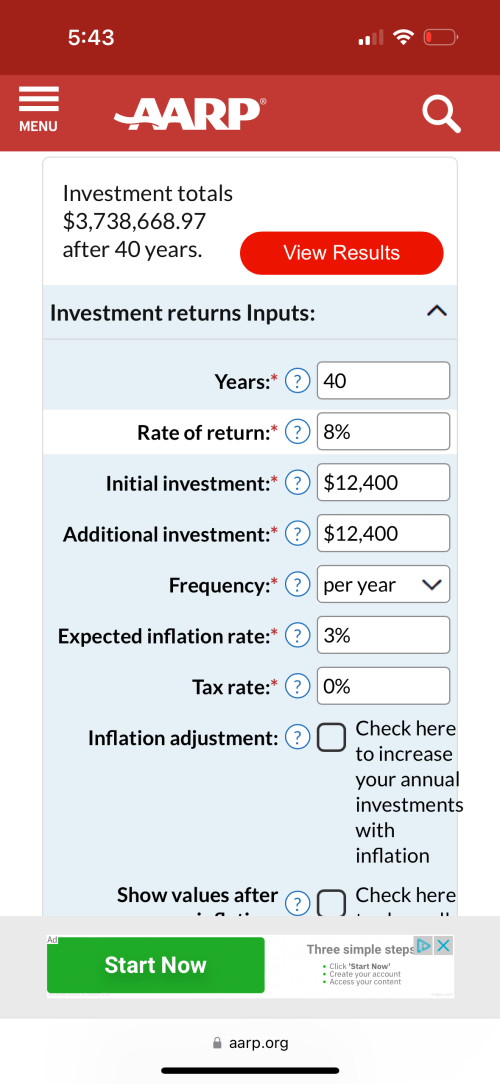

For easy numbers, let’s say you average $100k salary over 40 years.

That’s $12.4k/yr. If invested in Index Funds/ETFs we can say that it will grow 8% annually.

In a 40 year career, you’d have accumulated over $3.7 Million dollars in investments.

It’s considered safe to with draw 4% annually to avoid drawing down the principle.

This would allow you to draw $151k a year and die with that $3.7 million still in your account.

I haven’t checked the SSI calculator for the same $100k income, but it’s not paying you $151k/yr and leaving you with >$4 million to give to your kids.

View attachment 320141

And I can think of a 16 yr period where stocks didn't do shit. They were flat for 16 years while benefits get paid out. This is a huge drain. And SS is paid monthly, not annually.You are not accounting for mortality. And that adds considerable complexity. Also wives get a survivor benefit. And drug addicts get SSI. And there is an inflation adjustment in the benefit. It is not so simplistic.

They've basically turned social security into another welfare program, just like Medicare. The middle class is in denial, but it is absolutely true. High income people get screwed royally.