Irrelevant

Well-known member

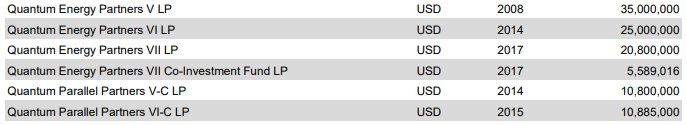

What's your take on AK buying some of them up?All about the $$$, funding has dried up for O&G in general, ANWR is just a terrible buy.

Drilling is super expensive, public market doesn't want to fund it, banks wont touch it...

You read article after article about Permian companies and it just boggles the mind why anyone would bid on those leases.