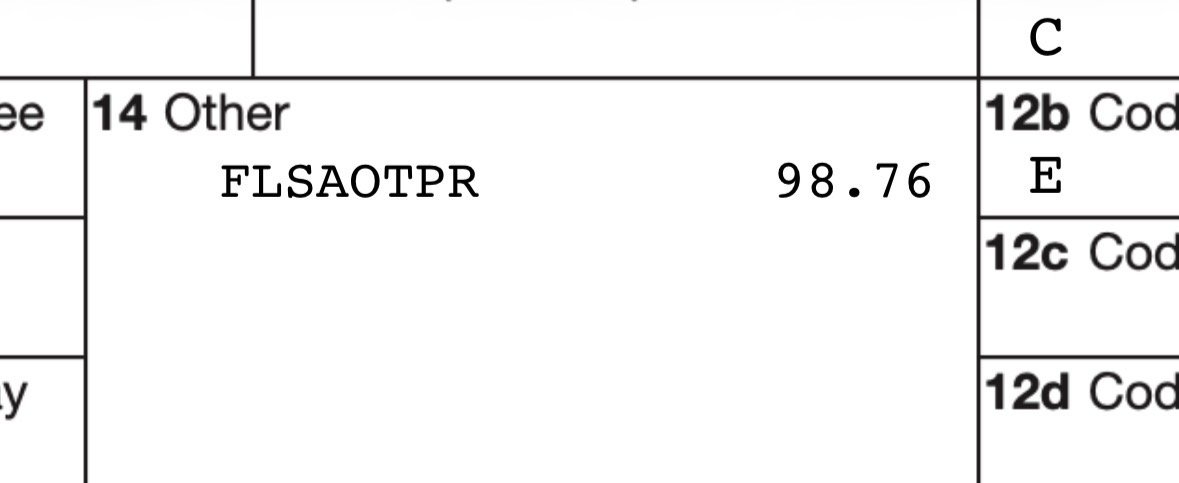

Well looking at my W2 and my employer didn't have a separate column for my overtime. So I went back through every pay check and wrote down my OT premium. My job pays the 1/2 or double time as separate hours.

Example I work 60 hours for the week I will get paid 60 hours straight time and 20 hours OT premium. My question is how do I break down what is 1/2 time and what is double time? For 9 months we were on a crazy schedule where we got 1.5 for the last 2 hours some days and double time for the last 2 hours others. (12) hour schedule. But also 6 days out of the month and all holidays were double time. I am well over the 25k limit on the OT just wondering how to figure it and if there are any tax guys on here that know

Example I work 60 hours for the week I will get paid 60 hours straight time and 20 hours OT premium. My question is how do I break down what is 1/2 time and what is double time? For 9 months we were on a crazy schedule where we got 1.5 for the last 2 hours some days and double time for the last 2 hours others. (12) hour schedule. But also 6 days out of the month and all holidays were double time. I am well over the 25k limit on the OT just wondering how to figure it and if there are any tax guys on here that know