BigHornRam

Well-known member

Losing jobs and significant taxpayers. He should be reducing debt, not increasing it.His proposed spending raises their debt by 0.4% hardly a needle mover.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Losing jobs and significant taxpayers. He should be reducing debt, not increasing it.His proposed spending raises their debt by 0.4% hardly a needle mover.

I agree with that point - hence the AND.I don't disagree with that, but folks want to act like a state with 40 Million people can be run like Mayberry.

A city like LA can't exist with everyone having leach fields, there own private drives, no public transit, yada yada yada

Seems like 95% of the "liberal" policies people complain about are literally just the necessary features of a densely populated area.

2019 your most recent data?I don't think Montana can go bragging about its fiscal situation. Its funded status is middle of the pack. Every state has the same problem to varying degrees. The pensions are in the same situation as SS. The bigger problem remains healthcare cost. I also note that the author of the Hoover article didn't have any suggestions on solutions, just "no more debt". That always sounds so easy. I hope he doesn't tear a rotator cuff patting himself on the back.

View attachment 322187

I don't believe $250k to $350k pensions, but based on the houses they were buying pre covid, it is comfortable. People can move away from high tax states, that's human nature. Going to be a big problem going forward however. I've heard Kentucky is a fiscal train wreck. Plenty of other states are as well.

CA, MA, NY & MN send billions to MT, and yet MT claims individualistic success basis their bootstraps.I don't think Montana can go bragging about its fiscal situation. Its funded status is middle of the pack. Every state has the same problem to varying degrees. The pensions are in the same situation as SS. The bigger problem remains healthcare cost. I also note that the author of the Hoover article didn't have any suggestions on solutions, just "no more debt". That always sounds so easy. I hope he doesn't tear a rotator cuff patting himself on the back.

View attachment 322187

How about that BigHorn! The Penna & New York retirees move to Florida and condos to rent out, and pay not state income tax. But they still maintain a house for 5.5 mos up in their "favorite" state. They want Biden in for another 4 years so he can give a handout to these states to filter money to the union pension plans that are way underfunded. These illegal aliens will be voting, I guarantee you. And the republicans will do NOTHING.The Bitterroot is a popular place for retired California firemen with nice pensions. Interesting that most of them leave high tax states like California and New York once they retire, instead of continuing to pay taxes and support businesses in the state they earned a living in. That ponzi scheme won't end well either. California, Illinois, and New York are in serious financial trouble.

He should be finding a way to make working class housing affordable.Losing jobs and significant taxpayers. He should be reducing debt, not increasing it.

How about that BigHorn! The Penna & New York retirees move to Florida and condos to rent out, and pay not state income tax. But they still maintain a house for 5.5 mos up in their "favorite" state. They want Biden in for another 4 years so he can give a handout to these states to filter money to the union pension plans that are way underfunded. These illegal aliens will be voting, I guarantee you. And the republicans will do NOTHING.

A lot of them already had friends and family that moved here previously. They come to visit and it's an easy decision. Lower cost of living, less crowded, and less crime. With a good pension and empty nest, no need to worry about good paying jobs and schools.You or I can assume the reason why they moved from California to Montana. It might only be for tax reasons, or it might only be for outdoor recreation reasons. It might be some combination. It is speculation.

When I moved west many years ago, it came down to Wyoming or Montana. I chose Montana, and the state taxes weren't considered, at all. I preferred Montana for several other reasons.

Sorry, they only do it every 10yrs apparently.2019 your most recent data?

Losing jobs and significant taxpayers. He should be reducing debt, not increasing it.

A lot of them already had friends and family that moved here previously. They come to visit and it's an easy decision. Lower cost of living, less crowded, and less crime. With a good pension and empty nest, no need to worry about good paying jobs and schools.

He should be finding a way to make working class housing affordable.

Who’s Leaving California—and Who’s Moving In?

The primary driver of California's population loss over the past few years has been residents moving to other states. We examine the latest demographic data for those moving out of and into our state and discuss factors that underlie these decisions.www.ppic.org

My liberal parents changed their residency to Florida after retiring with state of Wisconsin pensions. Happens a lot.How about that BigHorn! The Penna & New York retirees move to Florida and condos to rent out, and pay not state income tax. But they still maintain a house for 5.5 mos up in their "favorite" state. They want Biden in for another 4 years so he can give a handout to these states to filter money to the union pension plans that are way underfunded. These illegal aliens will be voting, I guarantee you. And the republicans will do NOTHING.

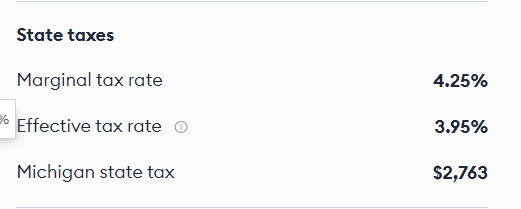

That's why I'm moving to WyomingI actually paid the highest income taxes while living in Montana, Montana chooses to place a much higher burden on lower income individuals... aka retirees than other states.

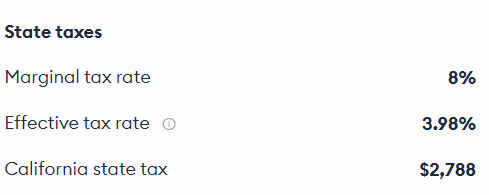

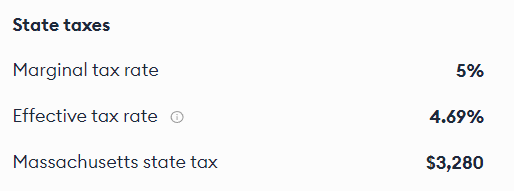

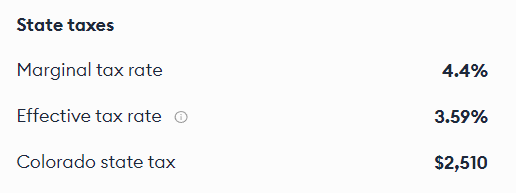

Eg. of someone making 70k

At the end of the day the delta is only ~$1000, state income taxes aren't a big factor for me when planning on where to live.

View attachment 322189

View attachment 322190

View attachment 322191

View attachment 322192

View attachment 322193

You are naive as hell. People really don't know the reall story on social security, medicare, and state & local govt retirement benefits. The retirement medical care is EXPENSIVE. A friend who was a fireman in Pittsburgh told me "You think I got good healthcare, the teachers NEVER pay a deductible or copay!!". Maybe not every prison guard in Calif, but how about an average pension of $200K??? Go do some searches on google. I recall seeing a woman that retired with 30 years in the prison system and got a pension of $300K.I don't believe $250k to $350k pensions, but based on the houses they were buying pre covid, it is comfortable. People can move away from high tax states, that's human nature. Going to be a big problem going forward however. I've heard Kentucky is a fiscal train wreck. Plenty of other states are as well.

Once the snowbirds get there, they quickly change their residency, however.I'd say the number one reason retirees move to Florida, or Arizona, is to escape winter. The other reasons are ancillary, imo.

You are full of it.I'd say the number one reason retirees move to Florida, or Arizona, is to escape winter. The other reasons are ancillary, imo.

You are full of it.